China's economic growth rate is likely to cool further this year, restrained by sluggish lending, a housing slump and weak global demand, a Reuters poll showed.China's economic growth rate is likely to cool further this year, restrained by sluggish lending, a housing slump and weak global demand, a Reuters poll showed.

China's economic growth rate is likely to cool further this year, restrained by sluggish lending, a housing slump and weak global demand, a Reuters poll showed.

The world's second-largest economy is predicted to grow 7 percent in 2015, and slow further to 6.8 percent next year, according to the median consensus of over 40 economists polled Jan. 15-19.

On Tuesday, data are likely to show China's economy expanded 7.2 percent in the final quarter of 2014, the weakest in 24 years.

Beijing is in the midst of its worst downturn in a generation, induced in part by government efforts to transform the economy away from a heavy reliance on investment and exports and towards consumption and services.

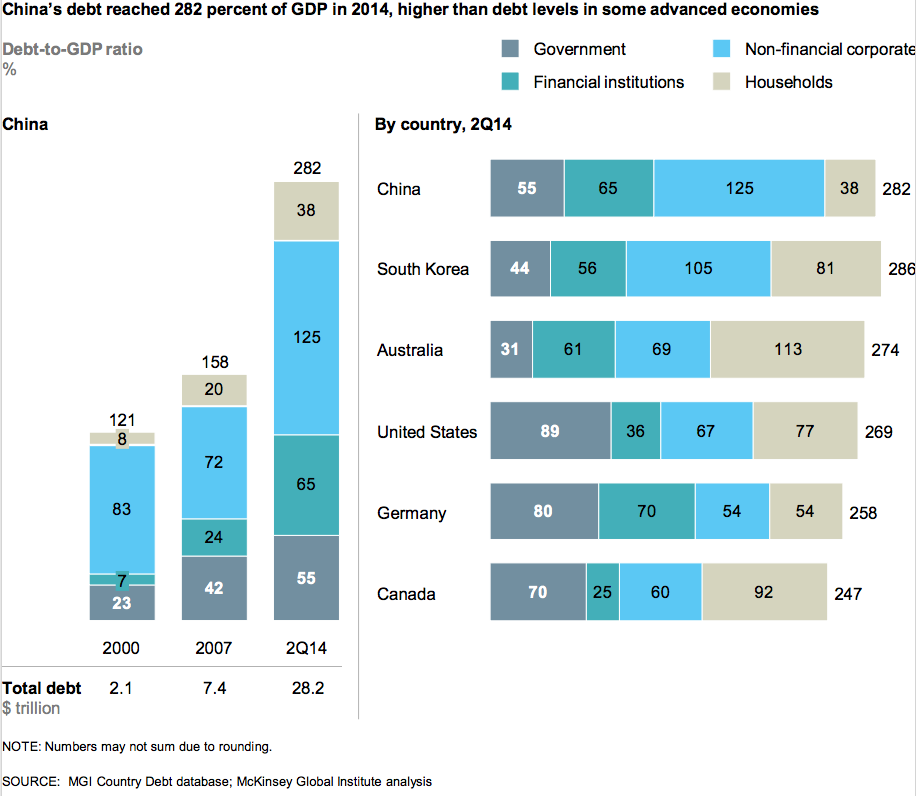

But a falling property market, brought on by oversupply and overinvestment fuelled by an unprecedented borrowing binge that helped China through the worst of the global crisis, was not planned.

If the Reuters consensus forecast for fourth-quarter growth is met, that would mean full-year growth for 2014 will have undershot the government's target of 7.5 percent and mark the weakest annual expansion in nearly a quarter century.

While only a matter of sums now that 2014 is over, that would increase the clamour for Beijing to ease policy even further.

Economists in the poll predicted the People's Bank of China will cut banks' reserve requirement ratio (RRR) by 50 basis points each quarter until October, to free up more cash for banks to lend.

That follows an interest rate cut to 5.6 percent late last year. Economists predict the benchmark lending rate will likely be lowered again to 5.4 percent in the second quarter.

A further slowdown in China could throw into risk chances of a revival in global growth in 2015, which right now is being led by what the World Bank calls the "single engine" of strong hiring and economic activity in the United States.

Indeed, economists in a Reuters poll last week said weaker growth than previously forecast in China and the euro zone were the biggest risk to the global economy this year.

"Even with continuing public sector investment and the significant benefits accruing to lower-priced oil imports, the softening in real estate activity alongside efforts to rein in lending highlight the risk of even slower growth," said Sacha Tihanyi, economist at ScotiaBank in Hong Kong.

Investment flows into China are an important gauge of the health of the global economy. They rose just 1.7 percent last year, sharply lower than the 5.3 percent growth in 2013.

Credit growth has also lagged expectations despite the surprise rate cut by the central bank in November as cautious banks remained reluctant to lend due to a spike in companies' debt levels and bad loans.

Beijing has traditionally relied on credit to fuel the economy but the broader slowdown has also diminished industries' appetite for fresh loans.

The central bank on Friday said it would lend 50 billion yuan ($8.1 billion) to banks for the purpose of lending the money on to farmers and small businesses, areas of the economy that are usually short of cash.

The protracted slowdown is also compounded by fears China's property market correction might turn into a crash that would ripple through the highly leveraged economy.

The housing sector makes up about 15 percent of the economy and cooling activity there has crimped demand in 40 sectors ranging from steel to cement and furniture, becoming the single biggest drag on domestic activity.

Since September, house prices in China's largest cities have on average been falling on a year-earlier basis and data on Sunday showed new home prices fell significantly last month.

Consumer price inflation is also likely to remain muted through the year, largely due to sluggish domestic demand and a slump in global energy and commodity prices.

The poll showed inflation will likely average 2 percent this year and 2.5 percent in 2016.

That mirrors a disinflation trend currently gripping the largest economies - prices have begun falling outright in the euro zone - and could pose a threat to economic activity, economists said.

What you are calling a Chinese Economy meltdown is all rubbish. It's an overdue correction. It is exceedingly rare to find an even remotely sane piece on the Chinese economy in the Western press - like for Russia, the upside is it allows those of us with a penchant for trading to profit from the credulity of our fellow man.

What you are calling a Chinese Economy meltdown is all rubbish. It's an overdue correction. It is exceedingly rare to find an even remotely sane piece on the Chinese economy in the Western press - like for Russia, the upside is it allows those of us with a penchant for trading to profit from the credulity of our fellow man.