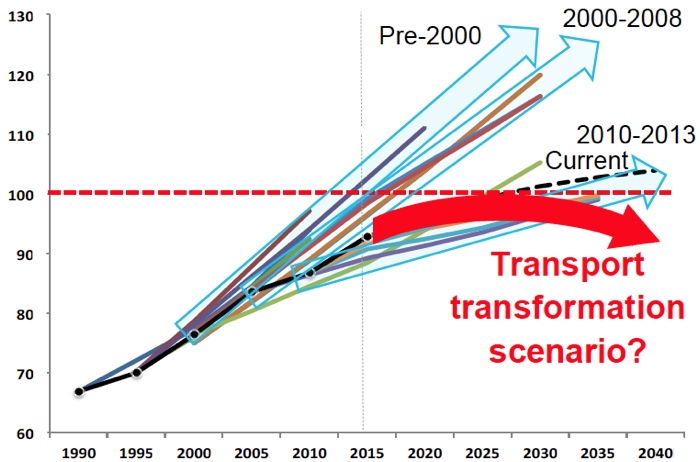

This graph from Chevron sums up what the world is facing in the next 15 years:

The problem is that the discoveries of new deposits have collapsed since the 1960s. There is no way that

new supplies will cover both demand increase and production decline form the existing oil fields.

http://www.ft.com/cms/s/0/def8d8f4-b532-11e4-b186-00144feab7de.html

The current oil price is due to a world economic recession and not to some mythical glut.

(the figure is from http://www.fool.com/investing/general/2015/12/05/crude-price-crash-could-drill-a-19-million-barrel.aspx)

The problem is that the discoveries of new deposits have collapsed since the 1960s. There is no way that

new supplies will cover both demand increase and production decline form the existing oil fields.

http://www.ft.com/cms/s/0/def8d8f4-b532-11e4-b186-00144feab7de.html

The current oil price is due to a world economic recession and not to some mythical glut.

(the figure is from http://www.fool.com/investing/general/2015/12/05/crude-price-crash-could-drill-a-19-million-barrel.aspx)