What happens to them if the price of oil goes back up?

Ohh... yeah... reduce taxes and print money.

Re: US Economy Thread

Re: US Economy Thread

102 Millions Americans Do Not Have Jobs

102 Millions Americans Do Not Have Jobs

Worst Jobs Report In Nearly 6 Years – 102 Million Working Age Americans Do Not Have Jobs

By Michael Snyder, on June 3rd, 2016

This is exactly what we have been expecting to happen. On Friday, the Bureau of Labor Statistics announced that the U.S. economy only added 38,000 jobs in May. This was way below the 158,000 jobs that analysts were projecting, and it is also way below what is needed just to keep up with population growth. In addition, the number of jobs created in April was revised down by 37,000 and the number of jobs created in March was revised down by 22,000. This was the worst jobs report in almost six years, and the consensus on Wall Street is that it was an unmitigated disaster.

The funny thing is that the Obama administration says that the unemployment rate actually went down last month. Almost every month since Obama has been in the White House, large numbers of Americans that have been unemployed for a very long time are shifted from the “unemployment” category to the “not in the labor force” category. This has resulted in a steadily falling “unemployment rate” even though the percentage of the population that is actually working has not changed very much at all since the depths of the last recession.

The Bureau of Labor Statistics claims that the number of Americans “not in the labor force” increased by 664,000 from April to May. If you believe that, I have a giant bridge on the west coast that I would like to sell you. The labor force participation rate is now down to 62.6, and it is hovering just above a 38 year low.

When you add the number of working age Americans that are “officially unemployed” (7.4 million) to the number of working age Americans that are considered to be “not in the labor force” (an all-time record high of 94.7 million), you get a grand total of 102.1 million working age Americans that do not have a job right now.

This is not a game.

So far in 2016, three members of my own extended family have lost their jobs.

According to Challenger, Gray & Christmas, layoffs at major firms are running 24 percent higher up to this point in 2016 than they were during the same time period in 2015.

It was only a matter of time before those layoffs started showing up in the official employment numbers, and I fully expect that this trend will accelerate in the months ahead.

And here are some other brand new numbers for you to consider…

-Since Barack Obama entered the White House, 14,179,000 Americans have “left the labor force” according to the Bureau of Labor Statistics.

-The quality of our jobs continues to deteriorate. In May, 59,000 full-time jobs were lost, but 118,000 part-time jobs were gained.

-Since September 2014, 207,000 mining jobs have been lost.

-We just learned that U.S. factory orders have declined once again. This marks the 18th month in a row that this has taken place, and we have never seen such an extended decline outside of a major recession.

-JPMorgan’s “recession indicators” have just soared to the highest level that we have seen since the last recession.

Needless to say, the financial community is pretty horrified by all of this news. They were expecting a much better jobs report, and many of them are not hiding their disappointment. Here is one example from the Wall Street Journal…

“This was an unqualified dud of a jobs report,” said Curt Long, chief economist at the National Association of Federal Credit Unions, noting “the unemployment rate fell, but for the wrong reason as labor force participation declined for the second consecutive month.”

And here is another example that comes from David Donabedian, the chief investment officer at Atlantic Trust Wealth Management…

“We can’t find a positive nugget in today’s job report. If we were looking for signs of strength in this report, there is nothing to hang onto here.”

But of course the mainstream media is doing their best to put a positive spin on these numbers. For instance, CNN just published a laughable article entitled “America’s economy is stronger than weak jobs report“.

And the White House insists that this new employment report really isn’t that big of a deal…

The White House doesn’t get “too disappointed” over the number of unemployed and underemployed Americans.

“I’ve been reacting to jobs numbers here at the White House for more than seven years, and what is true today has been true in the past, which is, we don’t get too excited when jobs numbers are better than expected and we don’t get too disappointed when jobs numbers one-month are lower than expected,” White House Press Secretary Josh Earnest told CNBC.

But of course the truth is that it is a really big deal. We just received major confirmation that the U.S. economy has slipped into recession mode.

For months, I have been writing about how virtually every other indicator has been screaming that a new economic crisis had already begun.

But the employment numbers had remained fairly decent up until now. Employment is typically considered to be a “lagging indicator”, which means that it isn’t one of the first places we would expect to see signs of a recession show up. However, it is inevitable that the official unemployment numbers will reflect an economic downturn eventually, and that is what we are starting to see now.

What this means is that you probably have even less time to get prepared for what is ahead than you may have originally thought.

The U.S. economy has already entered the early chapters of the next great economic crisis, and most of the population is going to be caught totally off guard and will suffer tremendously.

If our leaders had made better decisions since the last crisis, things could have turned out differently. But instead, they continued to conduct business as usual, and now we will reap what they have sown.

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread Re: US Economy Thread

Re: US Economy ThreadWalther von Oldenburg wrote:

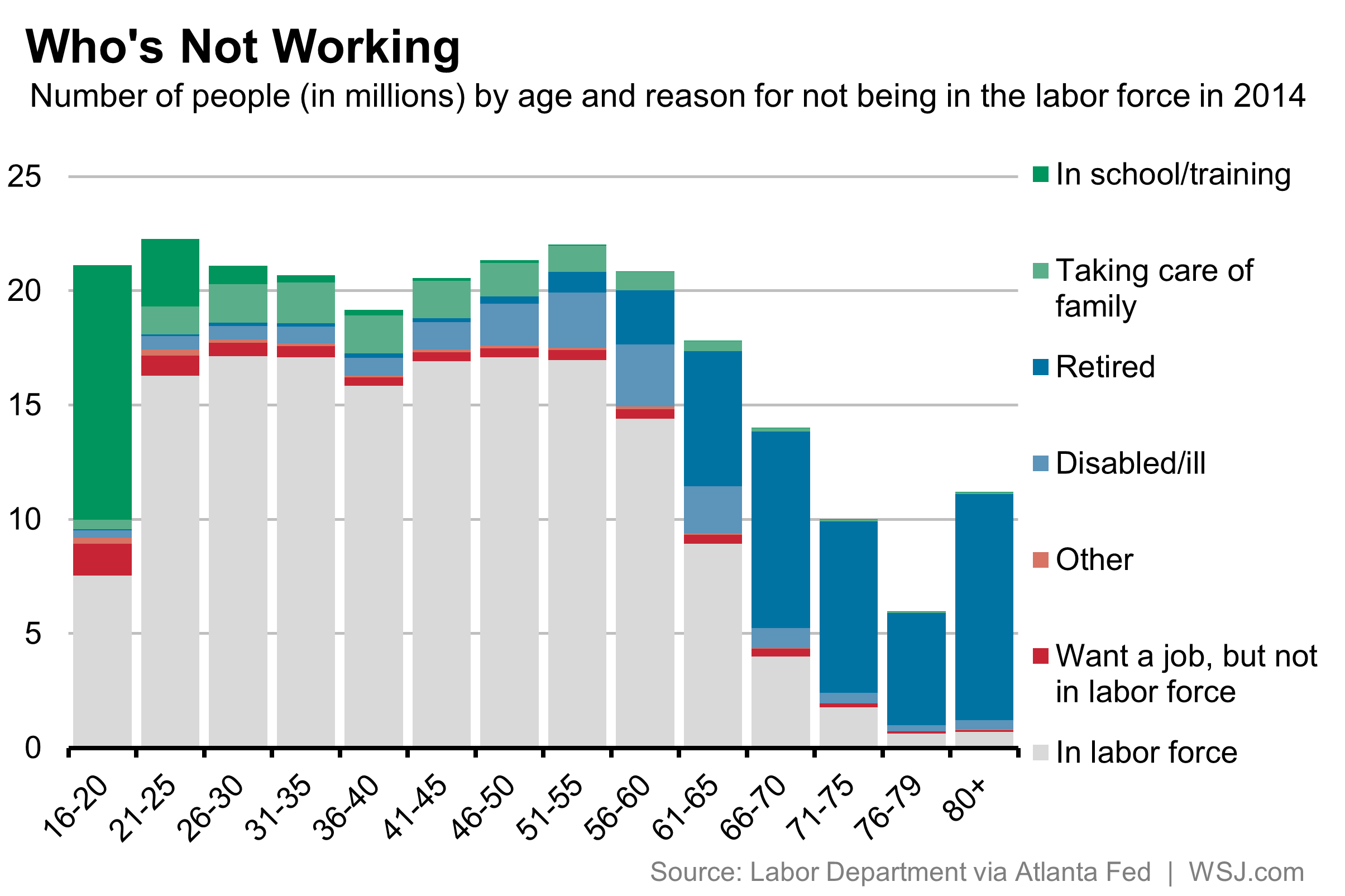

The label "not in the labor force" includes all people aged 16 and above. Out of 90+ milion "unemployed" 40 milion are retired, additional 15 milion are students and the rest are people who simply stay at home to take care of their families.

- the Walls Street Journal's claims. Wall Street Journal is simple piece of lies, and propaganda, it is the voice of the US oligarchy. This newspaper like many others like the economist, Financial times, etc... are all clearly anti popular orientations.

- the Walls Street Journal's claims. Wall Street Journal is simple piece of lies, and propaganda, it is the voice of the US oligarchy. This newspaper like many others like the economist, Financial times, etc... are all clearly anti popular orientations.

Downgrading The US Will Cost S&P $1.5 Billion

Remember when S&P forgot for a second that it lives in a world of pretend free speech, and where telling the truth would promptly result in a lawsuit by none other than the US government under false pretenses (and from which Buffett darling Moody's was excluded) after it downgraded the US from AAA to AA+ in the summer of 2011? A downgrade which as Bloomberg previously reported led to this exchange with then Treasury Secretary Tim Geithner: "S&P’s conduct would be looked at very carefully," Geithner told McGraw according to the filing. "Such behavior would not occur, he said, without a response from the government."

Well, S&P will never make the same mistake again, because according to Reuters, it will cost it $1.5 billion to settle with the government and put the whole "downgrade" episode in the past.

S&P SAID IN SETTLEMNT TALKS WITH WITH DOJ,STATES: RTRS

S&P SAID IN SETTLEMNT TALKS FOR $1.5B: REUTERS

SEC SAID TO BAN S&P FROM RATING PART OF CMBS MARKET FOR A YEAR

S&P SETTLEMENT WITH SEC SAID TO INCLUDE $60 MILLION FINE

S&P SETTLEMENT ON CMBS SAID TO BE ANNOUNCED AS SOON AS TOMORROW

And let that be a lesson to anyone else who thinks the First Amendment is anything but window dressing.

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Peter Schiff

Peter Schiff

Former Federal Reserve Chairman Alan Greenspan told CNBC on Thursday the political structure has been in chaos for years, and fixing the economy will take tough political judgments.

"I think we're in a period, because of fiscal reasons, for a sluggish economic growth rate for a while, but superimposed on that are very early signs of a pickup in inflation," Greenspan said on "Squawk Box." "My concern now is actually stagflation."

"That pickup in inflation is going to move profit margins up temporarily. But it's a false dawn," he said.

Greenspan's concerns were in sharp contrast to the views of billionaire investor Stanley Druckenmiller, who told "Squawk Box" in an earlier interview Thursday he's "quite, quite optimistic" about the U.S. economy following the election of Donald Trump.

Fiscal policy, which has been gridlocked for years in Washington, needs to be "one, two, and three" on the list of reforms to jump-start the economy, said Greenspan. The emphasis on the Fed's monetary policy should be fourth on the list, he added.The soaring costs of entitlement programs, including Social Security and Medicare, must be reined in, said Greenspan. "If we don't bring that under control, everything else we're doing is irrelevant."

Greenspan also said he'd "love to see Dodd-Frank disappear." He called the regulations that were designed to reduce banking risk in the wake of the 2008 financial crisis a "disastrous mistake."

The 90-year-old economist led the Federal Reserve for 19 years under four presidents, from Ronald Reagan through George W. Bush.

US Economy where we are right now

US Economy where we are right now Re: US Economy Thread

Re: US Economy ThreadAustin wrote:US Economy where we are right now

Am-TwMBOpx8

US Economy where we are right now

US Economy where we are right now

Re: US Economy Thread

Re: US Economy Thread Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Re: US Economy Thread

Jim Rickards

Jim Rickards Re: US Economy Thread

Re: US Economy Thread Re: US Economy Thread

Re: US Economy Thread Re: US Economy Thread

Re: US Economy Thread

|

|

|