+34

JohninMK

Begome

Aristide

SeigSoloyvov

Isos

slasher

AlfaT8

owais.usmani

flamming_python

TheArmenian

x_54_u43

ahmedfire

DerWolf

Azi

Hannibal Barca

franco

jhelb

GarryB

medo

Karl Haushofer

PhSt

Rodion_Romanovic

nero

Big_Gazza

Hole

calripson

PapaDragon

KoTeMoRe

Austin

George1

Cyberspec

Viktor

miketheterrible

magnumcromagnon

38 posters

Russian Oil and Gas Industry: News #2

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

Lol.

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

Finally!

https://www.nord-stream2.com/media-info/news-events/nord-stream-2-granted-a-construction-permit-by-denmark-139/

https://www.nord-stream2.com/media-info/news-events/nord-stream-2-granted-a-construction-permit-by-denmark-139/

Nord Stream 2 Granted a Construction Permit by Denmark

Approved 147-km route stretches south-east of Bornholm in Danish Exclusive Economic Zone

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

I think they should greatly reduce transit fees for that part of the pipeline to cover the extra costs created by their bullshit.

Actually I think they should delay the project and route the pipe around Danish waters.

Reduce gas transit through the Ukraine when the contract ends... if there is not enough capacity to europe then they can buy LNG to make up the difference at the extra cost of handling (liquifying, shipping, and distribution).

Russia has spent money increasing capacity and Europes ally has been trying to thwart them, clearly if there is anyone to blame you can make a list but Russia should not be on that list.

Actually I think they should delay the project and route the pipe around Danish waters.

Reduce gas transit through the Ukraine when the contract ends... if there is not enough capacity to europe then they can buy LNG to make up the difference at the extra cost of handling (liquifying, shipping, and distribution).

Russia has spent money increasing capacity and Europes ally has been trying to thwart them, clearly if there is anyone to blame you can make a list but Russia should not be on that list.

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

Russian Oil Giant Prepares Massive $157 Billion Arctic Oil Project

https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Giant-Prepares-Massive-157-Billion-Arctic-Oil-Project.html

https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Giant-Prepares-Massive-157-Billion-Arctic-Oil-Project.html

Rosneft is preparing to lead an Arctic oil field development project that will cost an estimated $157 billion (10 trillion rubles).

Reuters quoted Russia’s Deputy Energy Minister Pavel Sorokin as announcing the price tag of the Vostok Oil project to media last week, adding that the Kremlin had already agreed on a tax relief package that would help with the Artic oil and gas push.

The Vostok Oil project will include already producing fields as well as untapped ones, and Rosneft will develop them along with partner Independent Petroleum Company. The tax relief for this project alone could reach some $940 million (60 billion rubles) annually, the chief of the tax department of Russia’s Finance Ministry said.

The tax relief package for the energy industry has been the subject of heated debate in political circles because at the same time that the Kremlin is lending its generous support for oil and gas, it is hiking other taxes, on citizens, and extending the retirement age as part of a delayed and highly unpopular retirement system reform.

Yet the Vostok Oil project could add some 2 million bpd to Russia’s overall oil production, which although not the biggest contributor to federal GDP is still the biggest single contributor to export revenues, at 53.8 percent.

The government’s tax relief would certainly go a long way towards helping Rosneft and its partner develop the Arctic fields, but it will not be enough on its own. To bring the plans to fruition, Rosneft would need foreign partners as well. And it has already found them: Indian and Chinese investors have already agreed to invest in Vostok Oil in exchange for minority stakes in the fields that the project includes. Some of them had put forward as a condition for the investment the agreement of a government support package and now that this has been largely agreed, the project could move forward.

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

owais.usmani wrote:Finally!

https://www.nord-stream2.com/media-info/news-events/nord-stream-2-granted-a-construction-permit-by-denmark-139/

Nord Stream 2 Granted a Construction Permit by Denmark

Approved 147-km route stretches south-east of Bornholm in Danish Exclusive Economic Zone

The Winter is Coming somewhere between Romania, Poland and Russia. Jump on Maidan to keep warm guys.

JohninMK- Posts : 15617

Points : 15758

Join date : 2015-06-16

Location : England

KoTeMoRe wrote:owais.usmani wrote:Finally!

https://www.nord-stream2.com/media-info/news-events/nord-stream-2-granted-a-construction-permit-by-denmark-139/

Nord Stream 2 Granted a Construction Permit by Denmark

Approved 147-km route stretches south-east of Bornholm in Danish Exclusive Economic Zone

The Winter is Coming somewhere between Romania, Poland and Russia. Jump on Maidan to keep warm guys.

I think that this decision was related to the announcement this week that Norway and Denmark have agreed to extend their existing gas pipelines across the Baltic to Poland.

PapaDragon- Posts : 13467

Points : 13507

Join date : 2015-04-26

Location : Fort Evil, Serbia

JohninMK wrote:......

I think that this decision was related to the announcement this week that Norway and Denmark have agreed to extend their existing gas pipelines across the Baltic to Poland.

Could be but most important thing is that with Nord Stream 2 in play Russia will finally be able to fully detach from the Ukraine and have free hand there

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

JohninMK wrote:KoTeMoRe wrote:owais.usmani wrote:Finally!

https://www.nord-stream2.com/media-info/news-events/nord-stream-2-granted-a-construction-permit-by-denmark-139/

Nord Stream 2 Granted a Construction Permit by Denmark

Approved 147-km route stretches south-east of Bornholm in Danish Exclusive Economic Zone

The Winter is Coming somewhere between Romania, Poland and Russia. Jump on Maidan to keep warm guys.

I think that this decision was related to the announcement this week that Norway and Denmark have agreed to extend their existing gas pipelines across the Baltic to Poland.

Which again, is too small to cover Poland's demand YoY. So there's little benefit in this when it comes to the actual crisis.

It actually makes it worse for Ukraine, by ruining the Druzhba bargain chip.

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

Source: profitable for oil production in Russia will last for 33 years

https://tass.ru/ekonomika/7071576

https://tass.ru/ekonomika/7071576

MOSCOW, November 1. / TASS /. The Ministry of Natural Resources and Ecology sent a report to the Russian Ministry of Energy on the results of an inventory of hydrocarbon deposits whose reserves exceed 5 million tons. The document is being approved, TASS was told in the Ministry of Energy and the Ministry of Natural Resources.

“A report has been prepared to the Government of the Russian Federation“ On the results of an inventory of hydrocarbon reserves for fields of more than 5 million tons of crude oil. ”The draft report was sent for approval to the Ministry of Energy. The document is being approved,” the Ministry of Natural Resources said.

"Documents from the Ministry of Natural Resources were received, we are working closely with this ministry regarding the completion of the inventory process," the Ministry of Energy added.

A TASS source in one of the ministries noted that, according to the document, there are 609 large deposits in Russia (each with reserves above 5 million tons). Their total reserves amount to 17.4 billion tons of oil, of which 11 billion tons are profitable, that is 64% of the total. According to the interlocutor of the agency, these reserves, excluding their reproduction, will be enough for Russia for 33 years.

The highest margins for Russneft and Tatneft were 81%, the lowest for Gazprom (39%) and Surgutneftegaz (41%). Rosneft, the largest in Russia in terms of production, has a 69% profitability, Lukoil 63%, Gazprom Neft 62%.

In late October, Deputy Prime Minister Dmitry Kozak reported that the Ministry of Energy had prepared a draft roadmap for an inventory of oil fields in Russia to stimulate hard-to-recover oil reserves. The first step in this direction, according to him, should be the approval of a unified methodology together with the Ministry of Natural Resources. In the future, on the basis of the inventory, mechanisms of differentiated load and stimulation of oil producers should be worked out.

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

https://roscongress.org/en/sessions/iaf-2019-proizvodstvo-i-ispolzovanie-spg-v-arktike/discussion/

Enormous energy reserves are located in The Arctic

Enormous energy reserves are located in The Arctic

Natural gas reserves in the Russian Arctic amount to 53.4 trillion cubic meters. <...> Today, Russia produces 725 billion cubic metres, of which 83% is produced in the Arctic zone. That gas is competitive, despite the fact that it is produced in the Arctic, because of the low cost of production, very good quality of natural resources and their occurrence — Alexander Novak, Minister of Energy of the Russian Federation.

The resource base of the Yamal and Gydan Peninsulas is unlimited. <...> Our strategy involves active investment in exploration. <...> We audaciously project that the production capacity will be 70 million tons by 2030 — Lev Feodosyev, First Deputy Chairman of the Management Board, NOVATEK

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

Source: profitable for oil production in Russia will last for 33 years

But the thing is that when all that profitable oil is gone the price of oil will go up and then the remaining reserves will be worth extracting...

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

http://www.focus-fen.net/news/2019/11/05/442401/bloomberg-the-us-dithered-too-long-on-nord-stream-2.html

Bloomberg: The U.S. Dithered Too Long on Nord Stream 2

Washington. Nord Stream 2, the controversial Russian natural-gas pipeline project, has received the last permission it needs to close the distance between the Leningrad Region and the Baltic coast of Germany. It’s now probably too late for the U.S. to prevent Russia from finishing the project by the end of this year, writes Leonid Bershidsky in an article for Bloomberg.

Nord Stream 2 is part of Russian President Vladimir Putin’s plan to send natural gas to Europe without needing to go through Ukraine. The new pipeline will be able to carry 55 billion cubic meters of natural gas, more than half of what Russia now pumps through the Ukrainian system, and would mean for Ukraine a loss of $3 billion a year in gas transit revenues. The U.S. would like to prevent this, and also keep relatively cheap Russian gas from becoming an obstacle to increasing exports of U.S. liquefied natural gas to Europe. President Donald Trump has argued that Germany is too dependent on Russian gas, and has repeatedly threatened European companies involved in the project with sanctions.

Meanwhile, Russia has rushed to lay the pipe. On Oct. 1, Gazprom, the Russian gas export champion, said construction was 83% finished, with 2,042 kilometers (1,270 miles) laid across the bottom of the Baltic Sea. There had been a snag, though: For two years, Denmark put off granting permission for the section that was to pass through its territorial waters. On Wednesday, Denmark finally granted it, allowing the pipeline to take the shortest possible route, and Gazprom says that section can be built in five weeks.

This is a blow to Ukraine, albeit not a surprise. “We expected it this fall,” Andriy Kobolyev, chief executive officer of Naftogaz, the Ukrainian state company that runs the pipeline system, posted on Facebook. “Denmark’s principled position held back the project for some time, but geopolitical weapons cannot be stopped by means that regulate pure trade relations.”

It’s true that Denmark could not have held the fort forever while the U.S. dithered. The recent spat over Trump’s interest in buying Greenland did little to encourage the Danish government to keep dragging its feet.

Kobolyev called for Western sanctions as the next step. And in that, he’s supported by some American legislators. Republican Senator Ted Cruz promised to push his colleagues to pass the bill he has proposed with Democratic Senator Jeanne Shaheen, which would impose sanctions on vessels laying the pipeline.

That bill, however, is unlikely to delay the construction by much. Although Gazprom has used a Swiss-based contractor, Allseas Group SA, to lay the pipe, it can use its own vessel, the Akademik Cherskiy, for the final stretch.

So it’s too late for the U.S. to act. Sanctions against financing the pipeline could have been effective at the stage before European companies — Royal Dutch Shell, Engie, Uniper, OMV and Wintershall — provided what was needed. Sanctions against pipe-laying vehicles could have made a difference before the construction work began. In any case, they could have given Ukraine more time to renegotiate its gas-transit contract with Gazprom, which runs out at the end of this year.

A completed Nord Stream 2 will at least help Germany’s plans to stop using coal to generate power by 2038 — plans that cannot rely entirely on renewable energy, at least not until storage technology advances. (Most of the coal that will be replaced, by the way, is Russian coal.)

Now Ukraine, backed by the EU, wants a 10-year year contract to pump 40-60 billion cubic meters of natural gas. But Russia insists that any long-term agreement should resolve Ukraine’s billion-dollar legal claims on Gazprom, and for now is likely to agree only to a short-term, placeholder deal. Meanwhile it will keep working on bringing both Nord Stream 2 and the Turkish Stream project, meant to supply gas to southern Europe, to full capacity.

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

https://sdelanounas.ru/blogs/126600/

Amazing pictures of Russia's first LNG plant on Sakhalin island.

Amazing pictures of Russia's first LNG plant on Sakhalin island.

calripson- Posts : 753

Points : 808

Join date : 2013-10-26

- Post n°39

Russia Current LNG

Russia Current LNG

Operational Operator Source Date Capacity (mm t/year)

Sakhalin 2 Sakhalin Energy(Gazprom 50.1%) Lunskoye 2009 9.8

Yamal LNG Yamal LNG (Novatek 50.1%) South Tambei 2017 16.5

Vysotsk Novatek 51% Pipeline Gas 2019 1.7

Sakhalin 2 Sakhalin Energy(Gazprom 50.1%) Lunskoye 2009 9.8

Yamal LNG Yamal LNG (Novatek 50.1%) South Tambei 2017 16.5

Vysotsk Novatek 51% Pipeline Gas 2019 1.7

George1- Posts : 18514

Points : 19019

Join date : 2011-12-22

Location : Greece

Power of Siberia gas pipeline will be put into operation on December 2 — source

Initially, the launch of the pipeline was set for December 20

MOSCOW, November 5. /TASS/. Gazprom and China have set the date for the official launch of the Power of Siberia gas pipeline for December 2, a source familiar with the company's plans told TASS.

Gazprom CEO Alexei Miller said earlier that the construction is ahead of schedule and gas deliveries to China via the northern section of the pipeline (the Heihe-Changling section) will start earlier than planned — on December 1, 2019.

Initially, the launch of the pipeline was set for December 20.

The Power of Siberia gas pipeline will pump natural gas from the giant Chayanda oil and gas condensate deposit in Yakutia and the Kovykta gas condensate field in the Irkutsk Region in Eastern Siberia to deliver gas to the domestic market (via Khabarovsk to Vladivostok) and further on for exports to China. The so-called ‘eastern route’ stipulates the supply of 38 bln cubic meters of natural gas to China annually within 30 years. In May 2014, Gazprom and China National Petroleum Corporation (CNPC) signed a respective sales and purchase agreement.

On October 29, Gazprom announced that it had completed the filling of the Power of Siberia pipeline. Gas from the Chayanda field was brought to the border gas measuring station near the city of Blagoveshchensk. That means that the line part of the gas pipeline was prepared for the start of pipeline gas deliveries to China.

Besides that, in 2015 Gazprom and CNPC inked an agreement on the basic conditions for pipeline gas supplies from Western Siberian fields to China via the "western" route (through the Power of Siberia 2 gas pipeline) and a memorandum of understanding on the project for natural gas pipeline supplies to China from the Russian Far East.

https://tass.com/economy/1086956

Initially, the launch of the pipeline was set for December 20

MOSCOW, November 5. /TASS/. Gazprom and China have set the date for the official launch of the Power of Siberia gas pipeline for December 2, a source familiar with the company's plans told TASS.

Gazprom CEO Alexei Miller said earlier that the construction is ahead of schedule and gas deliveries to China via the northern section of the pipeline (the Heihe-Changling section) will start earlier than planned — on December 1, 2019.

Initially, the launch of the pipeline was set for December 20.

The Power of Siberia gas pipeline will pump natural gas from the giant Chayanda oil and gas condensate deposit in Yakutia and the Kovykta gas condensate field in the Irkutsk Region in Eastern Siberia to deliver gas to the domestic market (via Khabarovsk to Vladivostok) and further on for exports to China. The so-called ‘eastern route’ stipulates the supply of 38 bln cubic meters of natural gas to China annually within 30 years. In May 2014, Gazprom and China National Petroleum Corporation (CNPC) signed a respective sales and purchase agreement.

On October 29, Gazprom announced that it had completed the filling of the Power of Siberia pipeline. Gas from the Chayanda field was brought to the border gas measuring station near the city of Blagoveshchensk. That means that the line part of the gas pipeline was prepared for the start of pipeline gas deliveries to China.

Besides that, in 2015 Gazprom and CNPC inked an agreement on the basic conditions for pipeline gas supplies from Western Siberian fields to China via the "western" route (through the Power of Siberia 2 gas pipeline) and a memorandum of understanding on the project for natural gas pipeline supplies to China from the Russian Far East.

https://tass.com/economy/1086956

Viktor- Posts : 5796

Points : 6429

Join date : 2009-08-25

Age : 44

Location : Croatia

By the end of this year Russia will complete pipelines Turkish Stream = 31.5 bin m3/year + North Stream 2 = 55 bin m3/year + Power of Siberia = 38 bin m3/year

= 124,5 bin m3/year which with with todays price somewhat of 220$ per 1000m3 from 2020 on adds 27 bin $ to Russian economy annually.

prospect of Nord Stream 3 also is not weird and could happen

= 124,5 bin m3/year which with with todays price somewhat of 220$ per 1000m3 from 2020 on adds 27 bin $ to Russian economy annually.

prospect of Nord Stream 3 also is not weird and could happen

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

Viktor wrote:By the end of this year Russia will complete pipelines Turkish Stream = 31.5 bin m3/year + North Stream 2 = 55 bin m3/year + Power of Siberia = 38 bin m3/year

= 124,5 bin m3/year which with with todays price somewhat of 220$ per 1000m3 from 2020 on adds 27 bin $ to Russian economy annually.

prospect of Nord Stream 3 also is not weird and could happen

Not if EU-rope keeps being EU-tarded. The Power of Siberia is not the only pipeline project to China. So the chances are that instead

of Nord Stream III, there will be a pipe to China. EU-rope can go and eat yanqui LNG cake.

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

The irony is that if they had to go with LNG to make up any shortages... Russian LNG is cheaper than American LNG anyway...

As they have been saying for a while now... the future is Asia.... there are a lot of expanding economies there that use gas for energy... often used to heat water as you need it... it is much more efficient than having an enormous water tank that is heated electrically to keep a store of hot water available for if and when you need hot water.

Also lots of people I know prefer to use gas for cooking as well...

As they have been saying for a while now... the future is Asia.... there are a lot of expanding economies there that use gas for energy... often used to heat water as you need it... it is much more efficient than having an enormous water tank that is heated electrically to keep a store of hot water available for if and when you need hot water.

Also lots of people I know prefer to use gas for cooking as well...

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

So add in the LNG terminals too and that is a large hefty sum of money Russa will be accumulating over the years.

I heard that Russia really wants to gasify majority of its own regions though with many of them under developed. I wonder how that project is going? There is a lot of money involved and a lot of prospects for growth.

I heard that Russia really wants to gasify majority of its own regions though with many of them under developed. I wonder how that project is going? There is a lot of money involved and a lot of prospects for growth.

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

Well the benefit for Russia is that LNG can be shipped anywhere... so they could send it to Venezuela or Brazil or South Africa.

Personally, I doubt there will be a Nord Stream III... I rather suspect Turkey will see sense and expand South Stream... they can use it in their relations with the EU and fellow NATO members to give them even more leverage than they currently have... and to be honest feeding gas in to Germany gives them a lot of power and improves their economy with cheap energy supplies... good to sell the gas, but do they really want to make German industry more competitive?

Selling gas to China and other countries in Asia will increase too... I think selling more in that direction makes more sense for Russia... let europe have its freedom gas and throw away the shackles of cheap energy and become tied to another string the US can pull to make those europeans obey and conform.

Personally, I doubt there will be a Nord Stream III... I rather suspect Turkey will see sense and expand South Stream... they can use it in their relations with the EU and fellow NATO members to give them even more leverage than they currently have... and to be honest feeding gas in to Germany gives them a lot of power and improves their economy with cheap energy supplies... good to sell the gas, but do they really want to make German industry more competitive?

Selling gas to China and other countries in Asia will increase too... I think selling more in that direction makes more sense for Russia... let europe have its freedom gas and throw away the shackles of cheap energy and become tied to another string the US can pull to make those europeans obey and conform.

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

Russia’s Oil Reserves Now Worth $1.2 Trillion

https://oilprice.com/Energy/Crude-Oil/Russias-Oil-Reserves-Now-Worth-12-Trillion.html

The comment in this link is interesting

https://oilprice.com/Energy/Crude-Oil/Russias-Oil-Reserves-Now-Worth-12-Trillion.html

The comment in this link is interesting

Actually Russia’s proven oil reserves are currently worth $6.69 trillion based on a current oil price of $63 a barrel and proven reserves of 106.2 billion barrels (bb) according to the 2019 BP Statistical Review of World Energy. This is 59% bigger than Russia’s GDP of $4.213 trillion in 2018 based on purchasing power parity (PPP).

However, this valuation is a movable one. It varies from time to time according to oil price movement. Were oil prices to surge to $100 a barrel, the valuation of Russian reserves immediately goes up to $10.62 trillion. Vice versa, were prices to drop to $50, the valuation declines to $5.31 trillion.

Annual contribution of Russia’s oil exports to GDP amounted to $180 bn or 4.3% in 2018.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

These 15 countries, as home to largest reserves, control the world’s oil

https://www.usatoday.com/story/money/2019/05/22/largest-oil-reserves-in-world-15-countries-that-control-the-worlds-oil/39497945/

https://www.usatoday.com/story/money/2019/05/22/largest-oil-reserves-in-world-15-countries-that-control-the-worlds-oil/39497945/

Austin- Posts : 7617

Points : 8014

Join date : 2010-05-08

Location : India

Russia to set up oil deposits cluster to tap huge Arctic energy reserves

https://www.rt.com/business/461212-rosneft-arctic-deposits-china/

https://www.rt.com/business/461212-rosneft-arctic-deposits-china/

Russia’s oil major Rosneft said it will start developing a cluster of oil fields in the Arctic region, which is believed to hold some of the world’s largest remaining untapped oil and gas reserves.

According to the head of Rosneft Igor Sechin, preliminary estimates suggest that, starting from 2027 the deposits could annually produce up to 100 million tons of oil.

“The resources of the Russian Arctic (considering only from the above-ground part) are estimated at up to 10 billion tons of oil equivalent. We are embarking on their development,” Sechin said on Thursday at the St. Petersburg International Economic Forum (SPIEF).

He noted that oil reserves at the oilfields which will be developed by Rosneft are estimated at 2.6 billion tons. The Arctic cluster of fields should become the engine of development of the entire Arctic zone, Sechin forecast. He added that the future of energy and economy is linked to the wealth of the Arctic.

Sechin said that the most promising areas are located in the north of the Krasnoyarsk Territory, near the Northern Sea Route. It was confirmed that they have oil reserves which can be considered premium in terms of quality, the head of Rosneft said.

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

Austin wrote:Russia’s Oil Reserves Now Worth $1.2 Trillion

https://oilprice.com/Energy/Crude-Oil/Russias-Oil-Reserves-Now-Worth-12-Trillion.html

The comment in this link is interesting

Actually Russia’s proven oil reserves are currently worth $6.69 trillion based on a current oil price of $63 a barrel and proven reserves of 106.2 billion barrels (bb) according to the 2019 BP Statistical Review of World Energy. This is 59% bigger than Russia’s GDP of $4.213 trillion in 2018 based on purchasing power parity (PPP).

However, this valuation is a movable one. It varies from time to time according to oil price movement. Were oil prices to surge to $100 a barrel, the valuation of Russian reserves immediately goes up to $10.62 trillion. Vice versa, were prices to drop to $50, the valuation declines to $5.31 trillion.

Annual contribution of Russia’s oil exports to GDP amounted to $180 bn or 4.3% in 2018.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Seriously, what is this SHIT?

Oil accounted for 72 percent of Russia's gross domestic product last year.

No, oil and gas and their full associated footprint accounted for maybe 7.2% of Russia's gross domestic product (GDP) last year.

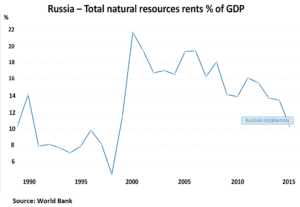

https://data.worldbank.org/indicator/NY.GDP.TOTL.RT.ZS

https://www.awaragroup.com/blog/russian-economy-2014-2016-the-years-of-sanctions-warfare/

Russia 2017 : 10.7% for all resource rents which includes minerals, metals (including gold), and forestry. A fair estimate of

the oil and gas part is about 7%. Note that there is a clear decline in the resource rent GDP percentage. Russia's GDP

is not growing due to resource rents.

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

the article actually said:

Which means that not the oil sales is 71.7% of GDP but that the reserves are that amount.

Which is also nonsense since that oil is far more valuable and there are significantly more reserves in the arctic portion of Russia.

Also add in, Russia is giving away its oil for paper. Its a rather bad scheme Russia got itself into. Instead, it should trade based upon assets and other material.

The value of oil reserves reached some 71.7 percent of Russia’s GDP in 2018.

Which means that not the oil sales is 71.7% of GDP but that the reserves are that amount.

Which is also nonsense since that oil is far more valuable and there are significantly more reserves in the arctic portion of Russia.

Also add in, Russia is giving away its oil for paper. Its a rather bad scheme Russia got itself into. Instead, it should trade based upon assets and other material.

owais.usmani

owais.usmani