Russian fossil energy (Oil and Gas and Coal) Industry: News #4

caveat emptor- Posts : 1835

Points : 1835

Join date : 2022-02-02

Location : Murrica

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

caveat emptor wrote:Prigorodnaya and De-Kastri.

Prigorodnaya is LNG export terminal of Sakhalin 2. I was asking about oil export terminals.

caveat emptor- Posts : 1835

Points : 1835

Join date : 2022-02-02

Location : Murrica

Prigorodnaya also has oil terminal. Vityaz light oil crude is exported from there.owais.usmani wrote:caveat emptor wrote:Prigorodnaya and De-Kastri.

Prigorodnaya is LNG export terminal of Sakhalin 2. I was asking about oil export terminals.

owais.usmani likes this post

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

caveat emptor wrote:Prigorodnaya also has oil terminal. Vityaz light oil crude is exported from there.owais.usmani wrote:caveat emptor wrote:Prigorodnaya and De-Kastri.

Prigorodnaya is LNG export terminal of Sakhalin 2. I was asking about oil export terminals.

Okay I didn't know that. Thanks.

caveat emptor likes this post

Sprut-B- Posts : 428

Points : 432

Join date : 2017-07-29

Age : 31

And the best part is that 98% of all the equipment used are domestically made in Russia including the turbine.

kvs, LMFS, Hole, owais.usmani, Kiko and Broski like this post

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

https://www.naturalgasintel.com/another-russian-lng-project-slated-for-2023-fid-as-more-output-targeted-for-china/

Another Russian LNG Project Slated for 2023 FID as More Output Targeted for China

Yakutia LNG, a 17.7 million metric ton/year (mmty) liquefaction project proposed for the Russian republic of Yakutia, is planned to start up in 2027 to deliver liquefied natural gas (LNG) from Russia’s Far Eastern coast to China.

If the Russian government gives permission for the Yakutia project to export LNG, it could help Russia towards reaching its ambitious LNG production target of 140 mmty by 2035, set by the government in 2021. It would also help buttress Russia’s growing role as a natural gas supplier to China, which has become the world’s leading LNG importer.

The relationship has expanded at a time when Europe’s dependency on Russian supplies has come under a microscope as war has broken out in Ukraine.

Russia’s annual LNG production capacity is currently about 28 mmty, although production surpassed 30 mmty in 2020 and 2021, according to data and analytics firm Kpler.

Along with Australia and the United States, Russia has driven global LNG supply additions in recent years. In 2020, Russia was the fourth largest global LNG exporter at 30.3 million tons (Mt), and the fifth largest LNG exporter to China at 4.46 Mt. Russia exported 30.1 Mt of LNG in 2021, of which 4.46 Mt was exported to China.

To achieve Russia’s 140 mmty production target, the majority of the production increase is likely to come from projects located in Siberia.

Russia holds the largest gas reserves in the world, with more than half of them located in Siberia, according to state-owned Gazprom PJSC. But Siberia’s long winter months, cold temperatures and unfavorable light conditions are a challenge for constructing LNG projects.

At least ten projects are planned for Northern and Eastern Siberia to start-up in the next decade, according to a 2021 report from the Oxford Institute for Energy Studies. Additional capacity is also planned from existing projects, including Yamal LNG in Russia’s Far North, and Sakhalin 2, located on Sakhalin Island in the Okhotsk Sea.

Moreover, PAO Novatek is building the Arctic LNG 2 project in the Far North, which would have the capacity to produce 19.8 mmty. More than half the facility is complete.

Yakutia LNG plans to reach a final investment decision (FID) in 2023. Globaltec is the operator and manager of the project. Natural gas and condensate producer Yatec JSC would supply the feed gas. Both companies are subsidiaries of Russian private company, A-Property, which is owned by Russian Oligarch Albert Avdolyan.

A-Property acquired Yatec, Yakutia’s largest gas producer in 2019. Yatec will manage the construction and operation of the 810-mile pipeline route to deliver gas from Kysyl-Syr in Yakutia to Ayan on the coast of the Sea of Okhotsk, for liquefaction and export.

Globaltec awarded the front-end engineering and design (FEED) contract last month to a consortium of Japan’s JGC Corp. and Norway’s Aker Solutions ASA. TechnipFMC plc completed the pre-FEED study in 2020.

A second agreement was concluded in January between Zhejiang Energy International, a subsidiary of Chinese importer Zhejiang Energy Group Co. Ltd., and Globaltec. Zhejiang Energy would take a 10% equity share in Yatec and Globaltec. Zhejiang Energy would supply LNG to China under an offtake agreement. .

Yatec is negotiating with Gazprom and the Russian Energy Ministry about the potential of LNG exports from the region, Yatec Executive Director Andrey Korobov reportedly said. According to news media reports, Korobov suggested that since Gazprom holds a license for a large block in Yakutia, there could be potential to share the proposed export pipeline and LNG plant, or to employ Gazprom as an intermediary for LNG exports.

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

Interesting, though unsurprising news that Russia's NOVATEK is apparently kicking off 'pre-project' work on a 5 mtpa LNG facility using entirely Russian-made equipment.

This is according to #Novatek's Head Leonid Mikhelson, who talked to reporters about the plan in Tyumen, West Siberia, on Wednesday 25th May.

“Now we are going to make a project (...) to place two trains on GBS (gravity-based structures), which we will produce in Murmansk [specifically, #Novatek's Belokamenka fabrication yard, where trains are under construction for the #ArcticLNG2 Project]. This production was for 5 million tons. Pre-project work has begun. This will all be done using Russian-made equipment,” Mikhelson said.

He noted that the company has already tested its own 'Arctic Cascade' liquefaction technology. “We made a pilot plant, a small one, a little less than 1 million tons of LNG production [i.e. #YamalLNG Train 4]. But we got a lot of headaches - for about a year, but it is now working, completely made using Russian equipment,” said Mikhelson.

This Interfax article makes logical reference to #Novatek's former #ObLNG Project located on the Yamal Peninsula, relatively close to Sabetta and #YamalLNG. Before being repurposed to produce blue ammonia and hydrogen (known as the #ObGasChemicalsComplex / #ObGCC Project), #ObLNG was to have been a 5 mtpa project, based on two 2.5 mtpa trains. Perhaps now that #Novatek will be unable to secure western technology for #ObGCC (related to new sanctions), the company may have reverted to its old 5 mtpa #ObLNG Project, using its own proprietary Arctic Cascade technology. The original #ObLNG Project was to have used Arctic Cascade too but for a number of reasons, including the challenges faced on the experimental #YamalLNG Train 4, #Novatek chose to reinvent it as #ObGCC.

#Novatek will have been hard at work to improve the performance of Arctic Cascade but now, with sanctions in place prohibiting the transfer of western LNG technology and equipment to Russia, this 'import substitution' effort will pick up momentum.

Finally, it's worth noting that just before the invasion of Ukraine, it came to light that #Novatek was considering building a single 6.6 mtpa LNG train to accompany #ObGCC. It would be a carbon-copy of one of the #ArcticLNG2 trains (same size, using western LNG tech). Perhaps that train will be replaced by the two new 2.5 mtpa trains.

GarryB, xeno, LMFS and Broski like this post

JohninMK- Posts : 15044

Points : 15183

Join date : 2015-06-16

Location : England

https://www.zerohedge.com/markets/sorry-diesel-prices-are-likely-climb-again-soon

LMFS likes this post

franco- Posts : 6769

Points : 6795

Join date : 2010-08-18

Characteristically, Russia and Iran account for more than 40% of proven gas fields, and recently Gazprom and NIOC signed a cooperation agreement on projects worth $40 billion.

https://twitter.com/TobiAyodele/status/1555812854519025665

NOTE: earlier it was reported that Russia has proven oil reserves to last for 39 years at present production and 80 years for gas.

LMFS likes this post

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

LNG from Yamal for India stuck in geopolitics: Germany found reasons not to supply

Am I reading this correctly that Germany basically stole the cargoes from Yamal LNG which were destined for India?

How can Russia and India allow this?

GarryB and LMFS like this post

sepheronx- Posts : 8650

Points : 8910

Join date : 2009-08-06

Age : 35

Location : Canada

owais.usmani wrote:https://eadaily.com/ru/news/2022/08/05/spg-s-yamala-dlya-indii-zastryal-v-geopolitike-germaniya-nashla-prichiny-ne-postavlyat

LNG from Yamal for India stuck in geopolitics: Germany found reasons not to supply

Am I reading this correctly that Germany basically stole the cargoes from Yamal LNG which were destined for India?

How can Russia and India allow this?

They didn't allow anything. I mean, India and Russia could bomb Germany to the stone age but over LNG?

It will now be up to India to force Germany to hand it over. Otherwise it's piracy and German assets in both countries can be stripped.

Germany will fold of course eventually.

GarryB, flamming_python, Werewolf, kvs, Hole, owais.usmani and Broski like this post

GarryB- Posts : 39516

Points : 40010

Join date : 2010-03-30

Location : New Zealand

How quickly the veneer of culture and morals and ethics rubs off... isn't there a Russian saying about when a stranger gives you some of his food during a famine... it is not a serious famine, or something along those lines...

If they refuse to hand it to its rightful owner then they are essentially no better than Kiev when they started stealing gas from customers further down the pipe chain....

owais.usmani likes this post

franco- Posts : 6769

Points : 6795

Join date : 2010-08-18

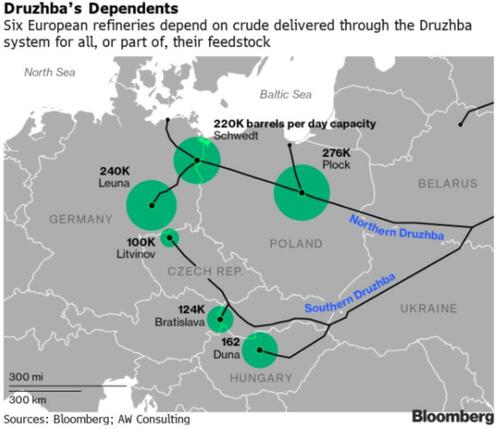

The Hungarian company MOL and the Slovak Slovnaft independently paid for the transit of Russian oil through the Druzhba pipeline through the territory of Ukraine. The press service of the Hungarian company noted that they expect the restoration of supplies in the near future.

“By taking over the payment, MOL was able to ensure a quick resolution of the issue: the Ukrainian side undertook to resume the transportation of crude oil within a few days, which was stopped a few days ago due to technical problems on the banking side,” Reuters quoted MOL as saying.

The transit of Russian oil through Ukraine to Hungary, Slovakia and the Czech Republic was stopped on August 4 due to the impossibility of making payments.

The day before, the situation was clarified at Transneft PJSC . They noted that the next Russian payment was returned due to the entry into force of a new EU regulation. According to this document, European banks have lost the ability to make payments on their own. ■

LMFS, owais.usmani and Broski like this post

JohninMK- Posts : 15044

Points : 15183

Join date : 2015-06-16

Location : England

This is a map not seen often as, whilst gas transit through Ukraine gets a lot of publicity, this pipeline seems to hide under the radar.

https://www.zerohedge.com/energy/oil-slides-ukraine-readies-resumption-russian-crude-flow-europe

franco, Werewolf, kvs, LMFS, owais.usmani and Broski like this post

franco- Posts : 6769

Points : 6795

Join date : 2010-08-18

JohninMK wrote:Hungary paid the transit fees so oil will flow again.

This is a map not seen often as, whilst gas transit through Ukraine gets a lot of publicity, this pipeline seems to hide under the radar.

https://www.zerohedge.com/energy/oil-slides-ukraine-readies-resumption-russian-crude-flow-europe

Just read that the Czechs are not part of this deal so no oil past Slovakia.

GarryB, flamming_python, kvs, JohninMK and lancelot like this post

GarryB- Posts : 39516

Points : 40010

Join date : 2010-03-30

Location : New Zealand

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

The second western echelon is derailed: the shares of the French and Norwegian companies in the Kharyaginskoye field will be withdrawn

In Russia, getting rid of unfriendly investors began with Sakhalin-2. Many experts then tensed in anticipation of Putin's next move. It seemed to some that the head of the Russian Federation simply decided to intimidate foreign partners and would not go any further. The latter predicted that this oil and gas project is only the beginning.

The continuation was not long in coming. After "Sakhalin" Japan, "Nenet" France and Norway also appeared. So why are companies from other countries so actively beginning to say goodbye to their shares in Russian business? They have quietly received millions of dollars over the past 20-30 years. Let's see.

The Russian government instructed TotalEnergies (France) and Equinor (Norway) to transfer their shares (20% and 30% respectively) to the Russian Zarubezhneft. We are talking about signing an addendum to a production sharing agreement (PSA) as part of a joint project at the Kharyaginskoye field in the Nenets Autonomous District.

After the transfer of blocks of shares, the domestic joint-stock company will be the owner of 90%. Another 10 are at the disposal of the Nenets Oil Company.

The French, after the introduction, including by their government, of anti-Russian measures in March 2022, announced their unwillingness to conclude new contracts for the purchase of oil from the Russian Federation. They also refused to renew the old agreements. At the same time, TotalEnergies did not want to invest more in local projects.

The Norwegians announced their withdrawal from the Russian project 4 days after the February events. And in mid-March, they decided not to trade Russian oil anymore. They also refused to transport hydrocarbons to other partners. The company's financial losses amounted to more than $1 billion.

The PSA with Total for the Kharyaginskoye oil field was signed back in 1995. The term of the agreements was initially 5 years. The agreement entered into force in 1999. In the process of work, the validity of the document was extended until 2031.

Total, according to the current agreement, received almost 100 thousand tons of oil per month for export. And until 2016, the company owned a 40 percent stake in the project. But in the same year, she sold half of Zarubezhneft, which joined the project only in 2010. At the start, the Russian organization received 20% of the shares.

Equinor started operations in Russia in 1996. She led the development of the field in the Timan-Pechora basin. Then she received 30% in the project for the development of the Kharyaginskoye field.

Last year, it produced more than 1.5 million tons of oil. For all the time, over 20 million tons of black gold have been raised from the bowels. And now this project will be implemented exclusively by domestic companies.

Foreign media wrote that TotalEnergies left Russia, but not completely. The company wants to keep shares in Novatek. And this is almost 20% of the shares. The French are participating in the Yamal LNG, Arctic LNG-2 and Terneftegaz projects.

Judging by what is happening with Western companies, one can draw a simple conclusion - the Russian budget, thanks to and despite the "EU packages", is in surplus. And this means that the country is able to invest in the development of various industries without the participation of invited investors.

Whether this will be a new impetus for domestic companies, time will tell. I wonder what will happen to other Russian projects that are being carried out jointly with partners from unfriendly states? History is silent for now, but probably their fate will be decided very soon.

kvs, LMFS, Hole, Kiko and Broski like this post

lancelot- Posts : 2808

Points : 2806

Join date : 2020-10-18

The Indian's lower oil price reflects the extra transportation costs vs Middle Eastern oil plus some benefit to India so they can adjust the refineries to process Russian Urals oil.

You don't mess with mr. Market. I think the US is chancing getting into a Carter era like depression or worse. Nixon like shock and disengagement of the Saudi-US oil deal over next two decades is not impossible.

Kiko likes this post

lancelot- Posts : 2808

Points : 2806

Join date : 2020-10-18

Ghawar has been using water injection for years. Decades at this point. There is enough oil, like in Canada, Iran, and what not for next decades but the huge investments necessary for this haven't been made and cannot happen at the flick of a wrist.kvs wrote:The Saudis have no non-conventional oil like the US and are coasting on their super field called Ghawar. This

field is decades old and not growing in size. It is fast approaching the transition point where the water being

injected to maintain reservoir pressure will start to come out of the wells. This typically happens at just above

50% of the original oil remaining. This is when instead of oil flowing through the sedimentary porous rock you

have the formation of an emulsion and water flow with the oil staying trapped in the rock.

kvs- Posts : 15358

Points : 15495

Join date : 2014-09-11

Location : Turdope's Kanada

lancelot wrote:Ghawar has been using water injection for years. Decades at this point. There is enough oil, like in Canada, Iran, and what not for next decades but the huge investments necessary for this haven't been made and cannot happen at the flick of a wrist.kvs wrote:The Saudis have no non-conventional oil like the US and are coasting on their super field called Ghawar. This

field is decades old and not growing in size. It is fast approaching the transition point where the water being

injected to maintain reservoir pressure will start to come out of the wells. This typically happens at just above

50% of the original oil remaining. This is when instead of oil flowing through the sedimentary porous rock you

have the formation of an emulsion and water flow with the oil staying trapped in the rock.

So your argument is that because it is old that therefore it will last decades more. This is not grounded in any

reality but wishful thinking. The Yibal field in Oman is a reference for Ghawar. The world will not be pulling

just enough oil out of the ground to keep itself going because cornucopians wish for it.

If there was all this oil available, then the discovery history that I posted more than once would not be on an asymptote to

zero. The peak discovery was in the 1960s and most large fields have a 40 year life. So we have the North Sea now

a spent nothing. Russian major fields in west Siberia are on their last legs as well. The only reason that they have not

been abandoned is because the Soviets did not exploit them to the max and in the late 1990s and early 2000s there

was a "reworking" of these fields with maximal contact drilling.

Ghawar is the only field of its size. There are no other Ghawars waiting to be found. Enough of the planet has been

geologically characterized to know this. In particular, the expectation that the global ocean seabed is full of oil is

moronic.

Saudi Arabia will disappear as leading producer overnight. Just like Oman. But has some other fields, mostly high

viscosity and high sulfur, that will allow it to keep going for while as some Nth rank producer.

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

Chinese yard ready to ship Arctic LNG 2 modules to Russia but sanctions uncertainty persists

Chinese yard Bomesc Offshore Engineering is ready to ship the modules it has completed for the Novatek-led Arctic LNG 2 project in Russia, but the shipping schedule remains uncertain due to the impact of Western sanctions imposed following Russia’s invasion of Ukraine in February.

Well-placed industry sources told Upstream that Bomesc has loaded two non-processing modules it has built for Train 2 of the $21.3 billion project onto the Cosco-owned vessel Xin Guang Hua.

However, an air of uncertainty still hangs over transporting the equipment to Murmansk, the location of the three-train project, they said.

In 2020, Dutch heavy lift and transportation company Mammoet signed a contract with a joint venture of Technip Energies, Saipem and Russia’s Nipigas, committing to unload and install a total of 42 large modules onto three concrete gravity-based structure (GBS) platforms in Murmansk.

Mammoet said soon after the deal was signed that it “will provide unloading, lifting, jacking and skidding services at the purpose-built shipyard near Murmansk, ensuring a continuous installation of the modules on top of the GBS”.

Western exodus

In recent months, European contractors including Technip Energies, Saipem, Linde and Royal Boskalis Westminster have all withdrawn commitments to the project, following European Union sanctions barring the supply of goods, technology and services for the liquefaction of natural gas in Russia.

It is not yet clear if Mammoet has cancelled the 2020 contract.

Mammoet has not respond to Upstream’s requestes for commenty at the time of publishing.

“In the case that the contract is cancelled, Mammoet will not be able to offload the modules upon arrival,” said one China-based industry official.

Cosco Shipping Heavy Transport — one of the shipping companies with an agreement from Technip Energies to transport Arctic LNG modules from China to Russia — is keen to send the two modules before its deal with Technip Energies expires.

“We understand that the shipping contract will soon expire and Cosco wants to make the last shipment before the contract (expires),” said another source familiar with the situation.

European heavy-lift shipping companies including Royal Boskalis Westminster have walked away from their Arctic LNG 2 contracts with Technip Energies amid EU sanctions.

Cosco’s last shipment of Arctic LNG modules was in made in December last year using the 2016-built heavy lift semi-submersible vessel Xin Guang Hua.

Other Chinese yards, including Cosco Shipping Heavy Industry, Penglai Jutal Offshore Engineering (PJOE), Wison Offshore & Marine, Qingdao McDermott Wuchuan Offshore Engineering and Jiangsu China Nuclear Industry Libert have committed to delivering Arctic LNG modules.

However, most have either mothballed the modules they have completed or suspended the fabrication as advised by Technip Energies after it terminated the contract with Russian gas producer Novatek, in accordance with EU sanctions.

The Arctic LNG 2 project will include three, 6.6 million tonnes per annum trains for a total LNG capacity of 19.8 million tpa. Each train consists of 14 modules.

The first train of Arctic LNG 2 was scheduled to enter into operation in 2023, but sanctions have put that timeline in doubt, especially after contracting giants Saipem, Technip Energies, Linde, Baker Hughes and transporter Boskalis pulled the plug on their existing obligations.

Gygaz, a joint venture between Technip Energies and Saipem, is lead engineering, procurement and construction contractor for Arctic LNG 2, while Linde was awarded the contract to supply the natural gas liquefaction process equipment.

Within the Gygaz joint venture, Saipem is involved in the construction of the project’s concrete gravity-based foundations and LNG topsides at the Belokamenka yard.

Neither Cosco nor Bomesc had replied to Upstream’s requests for comment at the time of publishing.

Among the main stakeholders in the Arctic LNG 2 project, French supermajor TotalEnergies withdrew when EU sanctions were extended to technology and financing underpinning the project, announcing a $4.1 billion impairment in its first quarter accounts.

The other stakeholders in Arctic LNG 2 project are operator Novatek with 60%, China National Petroleum Corporation on 10%, China National Offshore Oil Corporation on 10%, and Japan Arctic LNG, a pairing of Japan’s Mitsui and Jogmec, also on 10%.

GarryB, LMFS and Broski like this post

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

Russia is ramping up its #LNG equipment import substitution efforts.......

Russian PM Mikhail Mishustin has announced that the Government of the Russian Federation will allocate 1 billion rubles to compensate domestic LNG equipment developers and manufacturers for the costs of conducting research and development.

Mishustin noted:

- The Government will support the developers and will allocate 1 billion rubles to compensate for the costs that arise when conducting research and development work using modern technologies;

- These funds will ensure the launch and partial financing in 2022 of four projects to create LNG equipment for medium and large-scale production;

- One of the main directions for the development of domestic energy is the diversification of exports;

- It will be possible to expand the geography of deliveries, including via a breakthrough to promising LNG markets;

- At the same time, it is important not only to look for new buyers, but also to develop our own production of critical equipment, its list has been compiled jointly with key customers and includes 18 priority areas;

- Developing our own capabilities in this area will help solve a number of problems, support a relatively new market for the Russian energy sector, launch industrial sites, create jobs and continue moving towards the national development goals set by the president.

Commenting on this news, Russian Minister of Energy Nikolay Shul'ginov said in his Ministry's Telegram channel that the subsidies will enable the creation of prototypes by 2030.

Shul'ginov added:

- The federal program "Breakthrough to the LNG Markets" will ensure Russia's leadership position in global LNG markets;

- Thanks to the approved funding, prototypes of various domestic LNG equipment will be manufactured by 2030, dozens of scientific and technical works will be carried out annually;

- As a result, over 500 high-tech jobs will be created throughout Russia, with more than 30 billion rubles playing a leading role in this process, also involving private investments;

- Thus, Russia will be able to develop its own competencies and serial technologies for medium- and large-scale gas liquefaction, which will make it possible to achieve the goals of increasing LNG production in Russia to 80-120 million tons per annum by 2035.

The article reminds us that during the St. Petersburg International Economic Forum (#SPIEF) on June 17, 2022, the head of NOVATEK, Leonid Mikhelson, spoke about the need to create domestic liquefaction technology, which would require a full-fledged localization program supported by the State in full. According to #NOVATEK, the enterprises with which the company is working will need about 24 billion rubles for R&D.

GarryB and LMFS like this post

owais.usmani- Posts : 1794

Points : 1790

Join date : 2019-03-27

Age : 38

COMMENT: Can Russia pivot its European gas sales to Asia?

Russian gas has been remarkably popular in Europe over the past decade, with its share of demand rising as high as 39% (including sales of both pipeline gas and LNG). However, it has been clear to the Kremlin for some time that this would be unsustainable over the long term due to the impact of the Energy Transition, with the EU leading the world in announcing aggressive decarbonisation objectives, as seen most recently in its “Fit for 55” package. Although gas demand is expected to remain fairly robust to 2030 in Europe, beyond that time it must go into sharp decline if the region’s net zero target is to be met. With this in mind, the Kremlin and Gazprom had already been thinking about how to diversify to new markets, with the growing economies in Asia the obvious target not just because of their expanding need for energy but also because gas offers a cleaner alternative to the huge amount of coal that is burnt in many countries in the region.

Some historical context is useful in understanding how this strategy has evolved and could evolve further in light of the impact of the war in Ukraine. A gas export pipeline to China was first conceived in the Soviet era and was discussed on a regular basis through the 1990s by state gas company Gazprom as well as by private companies such as TNK-BP through the 2000s. However, China didn’t need the gas at that point and so nothing happened. It was not until 2006 that China’s gas import needs started to rise significantly and the prospects for Russian exports improved. However, it took another 8 years before a major export deal could be signed, and interestingly it happened shortly after sanctions had been imposed on Russia following the annexation of Crimea. Not surprisingly, the Chinese parties negotiated from a position of strength and got a very good deal on the price.

Moving forward to 2022 and the situation in Europe with regards to Russian gas has deteriorated dramatically for obvious reasons. Although it is unclear how rapidly Europe can fully diversify away from buying gas from Gazprom, and indeed if imports from Russia will ever actually reach zero given the different attitudes to it across the European continent, nevertheless it is obvious that Russian gas export volumes will decline sharply over the next few years – indeed they are likely to be down by around 45% in 2022. Having sold 150bcm to the EU in the form of pipeline gas and LNG in 2021, current projections see this figure falling to around 80bcm in 2022, with the 35bcm sold to other European countries also likely to decline sharply.

In revenue terms this decline in sales volumes has been more than compensated for by the ten-fold increase in gas prices in Europe, and Gazprom will make record export revenues in 2022. Nevertheless, the search for alternative markets is being stepped up to secure the long-term future of the Russian gas industry. Asia remains the obvious target, with China to the fore, but the process will not be instantaneous. Whereas oil can be loaded onto tankers and transported anywhere in the world, the vast majority of Russian gas is transported by pipeline and for historical and geographic reasons these are mainly pointed towards the west. Indeed, in terms of available capacity, Russia’s export pipelines to Europe could be carrying well over 250bcm per annum if fully utilised.

As mentioned above, Gazprom has struck one deal with China already as in 2014 a long-term contract was signed with CNPC to supply up to 38bcm per annum through the newly constructed Power of Siberia pipeline running from East Siberia to NE China. The political nature of the deal was underlined by the fact that President Putin’s presence in Beijing was required to finalise the agreement, but with his help a contract was signed and pipeline construction began in 2014. It was completed 5 years later in 2019, when gas started flowing, and volumes are currently being ramped up towards their plateau level, which is expected to be reached in 2024 or 2025. Current volumes are around 16bcm per annum.

Gazprom had been making plans to expand its sales to China prior to 2022, and these have now been accelerated. The first option is relatively simple and involves the expansion of the existing contract from 38bcm to 44bcm per annum via Power of Siberia. Gazprom CEO Alexei Miller has already discussed this with his Chinese counterparts and it looks likely to be agreed, with the volumes being added in the second half of this decade.

A second option is to use an existing pipeline in the Far East of Russia, which runs from the island of Sakhalin to Vladivostok, to create a spur line into NE China for exports of gas from new fields offshore Sakhalin. The potential is for volumes to reach up to 10bcm per annum to China (adding to volumes already being used domestically in Russia), and President Putin announced that an agreement had been reached with China in February 2022. However, sanctions have hindered the development of the gas fields that will be needed to fulfil any future contract and as a result progress has stalled and timing is somewhat uncertain.

The largest, and most interesting project for Gazprom involves bringing gas from West Siberia that would otherwise have gone to Europe and re-directing it towards China. Originally called Power of Siberia 2, this line was conceived as flowing gas from Russia into western China at the border between the Amur region of Russia and Xinjiang in China. However, this would have put it into direct competition with gas from Central Asia and would have necessitated significant upgrading of pipeline infrastructure inside China, and as a result negotiations have never reached a conclusion on the proposed 30bcm per annum contract.

Instead, a larger 50bcm per annum deal has been proposed by Gazprom which would essentially involve the re-direction of Power of Siberia 2 to the Mongolian border, from where a new transit pipeline named Soyuz-Vostok would take the gas across Mongolia and into Northern China. Gazprom has apparently agreed the terms of a transit contract with the Mongolian authorities, but it remains unclear what the Chinese reaction is to this new route and the volumes of gas involved. In theory the gas, if priced competitively, should be welcome in an expanding Chinese gas market by the end of this decade, but as yet there has been no official word from the Chinese authorities. With that in mind and considering the length of negotiations over Power of Siberia, it seems unlikely that gas could flow before 2027 at the earliest, with the end of the decade a more likely start date.

Russia also had major plans for growing its LNG business prior to February 2022, and although these are still theoretically in place it is likely that the impact of sanctions will delay progress as much of the liquefaction technology comes from the West. Two main projects, Sakhalin 2 and Yamal LNG, are currently in operation with a combined capacity of 35bcm. Around two thirds of this is already being sold in Asia, but the remaining 14bcm that was sold in Europe in 2021 could easily be re-directed. However, plans for a new project (Arctic LNG-2) have been somewhat stalled, as although the first train is almost complete and is likely to start up in 2023/24, the remaining two trains have been delayed. As a result, another 9bcm could be sold to Asia by 2025, but beyond that it remains unclear whether further expansion will be possible. Novatek has developed its own Arctic Cascade liquefaction process, which can work at smaller scale, but plans for 100bcm of export capacity by 2030 are unlikely to be reached, with 60-70bcm perhaps a more attainable goal.

To conclude, can Russia replace lost European sales in Asia? In the short-term this is unlikely, although it depends how fast and how far exports to Europe fall. If they decline to, say, 50bcm in the next couple of years (a decline of 100bcm from 2021 levels) then this will not be replaceable on a similar timescale as the only real options will be the redirection of current LNG flows and the addition of Arctic LNG 2 train 1 – in total 23bcm – plus the continued ramp up of Power of Siberia flows to 38bcm (22bcm higher than today). However, by the late 2020s the current Power of Siberia contract could have expanded by 6bcm and we could see the Far East pipeline onstream with a further 10bcm, and if contracts can be signed quickly for Power if Siberia 2 / Soyuz-Vostok then initial sales from a 50bcm contract could also have started. Extra LNG projects could also have started, albeit more slowly than hoped, adding another possible 15-25bcm, meaning that by the early 2030 Russia could be sending an extra 116-126bcm of gas to non-European markets. If some gas is still flowing to Europe at that stage, then a re-balancing could have occurred, after a likely dip in export volumes in the 2020s.

kvs- Posts : 15358

Points : 15495

Join date : 2014-09-11

Location : Turdope's Kanada

LMFS, Hole and Broski like this post

JohninMK- Posts : 15044

Points : 15183

Join date : 2015-06-16

Location : England

Also

Tom Marzec-Manser

@tmarzecmanser

·

Aug 15

Russia now supplying Hungary with an extra 2.6mcm/d via TurkStream. But this is not net extra #natgas to Europe as TK->BG flows are unchanged. Rather I’d say Serbia has filled storage so #Gazprom now able to deliver similar spare volume to another customer.

kvs, LMFS, owais.usmani and Broski like this post

franco

franco