Great analysis regarding weak grain exports this year and potential risk of running out of storage:

https://zerno.ru/node/20831

Since the beginning of the agricultural year, the Russian Federation has reduced grain exports by 13% and expects a record harvest - Russian Grain Union

Since the beginning of the current agricultural year (started in July), the Russian Federation has reduced grain exports by 13%, to 16.8 million tons, Arkady Zlochevsky, president of the Russian Grain Union (RGU), said, Finmarket writes .

"In total, from the beginning of the season, from July 1 to October 15, 16.8 million tons were shipped - this is almost 13% less than a year earlier, 2.3 million tons less than a year ago. A serious backlog, and at the same time resources such a huge amount has formed on the territory of the country that the need for export is quite obvious, at a much higher rate," Zlochevsky said at a press conference on Monday.

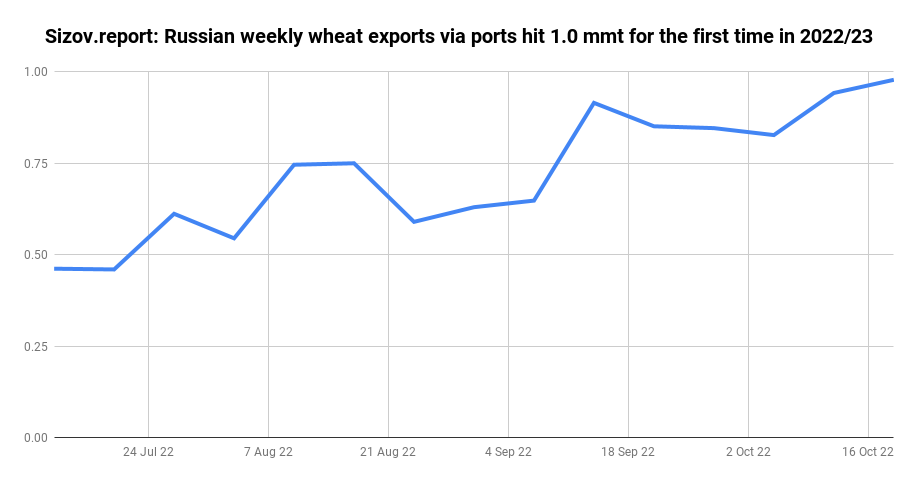

According to him, the pace of exports began to accelerate in October: 2.45 million tons were shipped in the first half of the month. "This gives hope that in the region of 5 million tons in October we will pull out, but we need to load 6 million tons every month," the head of the RGU said.

Further, according to him, there will come a difficult time for shipments from the point of view of the weather: traditionally, the weather deteriorates in December-January, there are traffic jams in ports, and low water freezes. So, in October, shipments "from the depths of the water" by river-sea vessels "rather intensified", "but further rivers will freeze, and this will be impossible," the expert noted.

"Based on the amount of resources - we have high carry-over stocks this season and plus a record harvest - we actually need to export at least 60 million tons in a good way. At such a pace, of course, such indicators are unattainable. And this ultimately leads to a fortune market to very low domestic prices - now the prices for wheat of the fourth class in the Volga region, in the Urals, I'm not talking about Siberia, are falling below the cost, and it is about 10 thousand rubles per ton, "said the head of the union.

He added that this economic condition is already affecting the pace of winter sowing, and it is lagging behind 2021. According to him, a similar picture is emerging in the oilseeds industry, which also experienced a decrease in value. "The economic situation does not look optimistic. It is a matter of time when this will affect and backfire on our production potential and crops," he said.

He also said that this season the number of countries where the Russian Federation supplies grain has decreased to 39 from 70 a year earlier. Deliveries to Nigeria, Cameroon, and Congo have completely "dropped out". Deliveries to Turkey decreased by 1.5 million tons due to switching its demand to Ukrainian suppliers. At the same time, there was a positive trend in deliveries to Saudi Arabia, Algeria, and Pakistan, Zlochevsky noted.

According to him, the Russian Federation this season is "catastrophically lucky with the weather," and a record grain harvest awaits it - even taking into account possible "additions" of 7-8 million tons, the harvest will exceed 140 million tons.

He recalled that the forecasts for the grain harvest in Russia in 2022 are about 150 million tons in weight after completion, including 100 million tons of wheat. The barley harvest, he said, could reach 24 million tons.

Zlochevsky also said that the amount of grain storage capacity in Russia is about 150 million tons. "Of these, only a third are long-term storage elevators that ensure the safety of more than a year. The rest of the temporary storage tanks, up to six months, they ensure the safety in quantity, but not always in quality," he added.

In addition, the so-called polyethylene sleeves, which are special areas for short-term storage on the side of the field, can store about 30 million tons of grain. According to Zlochevsky, thus, the total capacity of 180 million tons corresponds to the level of resources, taking into account carry-over reserves.

“But if there shouldn’t be a problem with crop storage on a macro scale, it arises because the distribution of containers is uneven across the territory, and in some regions there is a shortage. Previously, these containers were built in places of consumption, and not in places of production. And in regions where there are records in terms of production - especially the Rostov region, Kuban, Stavropol Territory - there is not enough, although the proximity to the export gate helps," the head of the Russian Grain Union concluded.

Grain purchases for the intervention fund

The Russian Grain Union estimates the potential for grain purchases to the state intervention fund in Russia in 2022 at 1 million tons.

"Based on the amount of money - more than six billion (roubles) for these purchases - it is quite obvious that they will not be enough to fulfill this season. There was a discussion about buying 3 million tons - this money is simply not enough, for this it is necessary more additional funds. It will be enough for 1 million tons. I think the state will buy 1 million tons this season, this is normal," Zlochevsky said.

According to Zlochevsky, the placement of 1 million tons in the warehouses of the intervention fund should not cause problems either. "The main thing is to support the market. Now the mechanism of purchases to the intervention fund is not actively removing surpluses from the market in order to support the market situation and somehow influence the price situation, and the mechanism itself was conceived and used precisely for this purpose. It is necessary to intensify, to support the market," he said.

The Ministry of Agriculture of the Russian Federation previously announced plans to purchase up to 3 million tons of grain to the state intervention fund.

"Grain Deal"

Russian grain exporters are still experiencing difficulties with freight, payments and insurance, so in order to extend the "grain deal" it is necessary to make sure that all participants fulfill their obligations, Arkady Zlochevsky believes.

"De facto, the second side of the transaction does not work exactly. We still have difficulties with freight, with payments, with insurance for our shipments, as a result, this all greatly undermines our competitiveness. It seems to me that the fulfillment of the second side of the transaction should be set as the main condition for renewal. If it is not fulfilled, it is not necessary to renew it. Why do we create advantages for competitors with our own hands and harm ourselves?" - he said.

According to Zlochevsky, the implementation of the "grain deal" has significantly lowered world prices. “And the threat to its extension will automatically raise these prices. This number is a psychological factor: not because something will not be enough somewhere, but simply because the market works this way,” the head of the union emphasized.

On the whole, in his opinion, the "grain deal" did not bode well for Russian suppliers. "For example, Turkey has moved its purchases to Ukraine. But still, Ukraine does not have eternal opportunities for the supply of Russian grains to the world market, and, now actively exporting, it is "eating up" its capabilities. Therefore, it is only a matter of time. Inevitably, demand will return to Russia, it's only a matter of time - when," Zlochevsky is sure.