http://southfront.org/russian-problem/

+45

GarryB

max steel

OminousSpudd

kvs

fragmachine

Vann7

A Different Voice

TheArmenian

magnumcromagnon

Austin

higurashihougi

Rmf

Hannibal Barca

Godric

AlfaT8

Kimppis

Walther von Oldenburg

mutantsushi

Nikander

Book.

NationalRus

KomissarBojanchev

Cowboy's daughter

PapaDragon

Dforce

George1

Firebird

Regular

bmtppk

zg18

Maximmmm

Karl Haushofer

victor1985

medo

KoTeMoRe

franco

Viktor

Werewolf

Project Canada

Prince Darling

Svyatoslavich

flamming_python

par far

Neutrality

JohninMK

49 posters

Russian Economy General News: #5

franco- Posts : 7207

Points : 7233

Join date : 2010-08-18

- Post n°76

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

A graph of the World Debt;

http://southfront.org/russian-problem/

http://southfront.org/russian-problem/

sepheronx- Posts : 9069

Points : 9329

Join date : 2009-08-06

Age : 35

Location : Canada

- Post n°77

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Going Global: Russian Currency Authorized for Circulation in Chinese City

Altai motor plant adapts the engine for tractor "Agromash-Ruslan"

In the Istra district of the Moscow region opened a dairy farm

And who says that Russia has to import all equipment to make different types of goods?

The People’s Bank of China (PBC) has officially authorized the Russian ruble to be used alongside the yuan in the north-eastern city of Suifenhe City on the China-Russia border.

Altai motor plant adapts the engine for tractor "Agromash-Ruslan"

Altai motor plant on the program of import substitution continues to adapt its diesel engines for installation on tractors, harvesters and other machinery. The engines have already been successfully put to the tractors "Kirovets", tested the harvesters "Altai-Palesse" with the Altai engines.

The Altai territory industry and energy notes that the constructors of Altai motor plant will adapt the engine for tractor "Agromash-Ruslan", which has no analogues in Russia. It features a contemporary design, high energy saturation, a high level of working and transport speeds, maneuverability and easy operation. A triangular caterpillar contour provides optimum centre of gravity and allows you to work with heavy attachments and towed agricultural implements without additional ballast weights. And allows the tractor to go on the field for six to eight days earlier in the spring under conditions of high soil moisture and in two or three weeks later in the autumn in comparison with wheeled tractors.

In the Istra district of the Moscow region opened a dairy farm

And who says that Russia has to import all equipment to make different types of goods?

August 7, opened a cheese factory in the village of Dubrova of the Istra district of Moscow region. In the dairy plan to do Russian and Parmesan cheese.

According to the owner of the dairy farmer Oleg Orphans, all the equipment was made by Russian manufacturer at the Moscow plant "Misconnect".

PapaDragon- Posts : 13669

Points : 13709

Join date : 2015-04-26

Location : Fort Evil, Serbia

- Post n°78

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

In the meantime sdelanounas.ru is so loaded with pictures of cows, it looks like Playboy for bulls.

''European Dairy Industry in Crisis Due to Russian Food Embargo

European dairy farmers are facing their most serious economic crisis in decades, largely as a result of the ongoing sanctions war between EU member countries and Russia.''

http://sputniknews.com/business/20150810/1025581375.html

At this rate we will need cow emoticon pretty soon...

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

- Post n°79

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

PapaDragon wrote:

In the meantime sdelanounas.ru is so loaded with pictures of cows, it looks like Playboy for bulls.

''European Dairy Industry in Crisis Due to Russian Food Embargo

European dairy farmers are facing their most serious economic crisis in decades, largely as a result of the ongoing sanctions war between EU member countries and Russia.''

http://sputniknews.com/business/20150810/1025581375.html

At this rate we will need cow emoticon pretty soon...

It's a bit disingenous to claim this is ONLY due to Russia. Russia is the drop that tipped the scales, but the Dairy and cattle industry have been making own goals for two decades now. Especially since they abolished all barriers for milk from Eastern Europe, which forced the big boys (France, Germany) to go on a price war backed by Euro-subsidies.

Now that there's no more place for that spilled milk, the main players are turning on eachother, since Germans are litterally destroying the French Diary chain, which in return affects the Belgian and Netherlands chain. Russia started this chain-reaction now, but I don't know how this will end. Having 10 to 20% of French Diary industry go bust, is about as desirable as having one of the German big 3 car manufacturers go down. Wait, scratch that, fuck them.

Neutrality- Posts : 888

Points : 906

Join date : 2015-05-02

- Post n°80

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

I'll tell you how this will end:

1) Massive amounts of jobs lost

2) State treasury loses tax income

3) Social welfare funds, which are already under heavy pressure, will be pressured once more due to people being laid off

4) Increase in prices

One of the most respected newspapers in Belgium already reports that potatoe price might increase 3 times.

Moscow did its job once again. Someone out there analyzed the European agriculture business and its situation very thoroughly and chose the most effective response.

1) Massive amounts of jobs lost

2) State treasury loses tax income

3) Social welfare funds, which are already under heavy pressure, will be pressured once more due to people being laid off

4) Increase in prices

One of the most respected newspapers in Belgium already reports that potatoe price might increase 3 times.

Moscow did its job once again. Someone out there analyzed the European agriculture business and its situation very thoroughly and chose the most effective response.

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

- Post n°81

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Neutrality wrote:I'll tell you how this will end:

1) Massive amounts of jobs lost

2) State treasury loses tax income

3) Social welfare funds, which are already under heavy pressure, will be pressured once more due to people being laid off

4) Increase in prices

One of the most respected newspapers already reports that potatoe price might increase 3 times.

Moscow did its job once again. Someone out there analyzed the European agriculture business and its situation very thoroughly and chose the most effective response.

Actually there lies the rub, those jobs were aleady fat...most of them can't be "productive" even if the current brake even price per litre was at 65 euro-cents (about twice what it is today). Most of them were subsidized at 80 to 120% (according to who you listen). So State treasuries will not "lose" in the strict sense of revenue since the internal market won't drop. What is about to happen though is that cheaper price will remain (probably) without the same level of subsidies. This is what generally starts a "consolidation" process". IE major players buying off smaller, less profitable players. THIS is what needs to be checked in Europe. "Hostile takeovers", especially in such sensitive sectors are tricky.

As for welfare, usually the arable land will be taken over and the consolidation will incorporate the former farmers at some degree, so while revenue will be lower for the former owners, the cost will be passed out of the French economy and up to the German one, since the fresh cash would come from Djörmanie. This is my greatest issue, having a consolidation accross the board will lower cost, streamline output, kill about anything that made Europe, but also maybe offer more revenue locally. Slightly. In the long term.

So While Russia surely has done its homework, the finale might be that it also has helped create a real CAP tool which will make it even worse for trade for most of the lower revenue countries, that have already an hard time to compete with European output.

This is a circle and one I don't like.

Edit: The potato issues with the lowlands are normal, since they overgrow certain varieties that are far less robust than other varities. Notably for fries and tranformed, deep frozen products. In 2013 the price per ton went ballistic at 350 euros, this year it is expected to hover around 80/100. Last year, it went as low at 25 for conservation varities in september and that was Russia doeing its magic indeed.

Neutrality- Posts : 888

Points : 906

Join date : 2015-05-02

- Post n°82

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

No matter how you sugarcoat it, someone is going to get hit hard due to the embargo. I'm betting Spain and Portugal will be demanding some kind of support from France, Germany and UK in order to survive.

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

- Post n°83

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Sugarcoat what?Neutrality wrote:No matter how you sugarcoat it, someone is going to get hit hard due to the embargo. I'm betting Spain and Portugal will be demanding some kind of support from France, Germany and UK in order to survive.

Neutrality- Posts : 888

Points : 906

Join date : 2015-05-02

- Post n°84

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

KoTeMoRe wrote:Sugarcoat what?Neutrality wrote:No matter how you sugarcoat it, someone is going to get hit hard due to the embargo. I'm betting Spain and Portugal will be demanding some kind of support from France, Germany and UK in order to survive.

You were talking about state treasuries not losing from the embargo at all and a couple of other nuances.

medo- Posts : 4342

Points : 4422

Join date : 2010-10-24

Location : Slovenia

- Post n°85

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Neutrality wrote:No matter how you sugarcoat it, someone is going to get hit hard due to the embargo. I'm betting Spain and Portugal will be demanding some kind of support from France, Germany and UK in order to survive.

The main problem from Russian embargo will come to EU in the future. It is not only, that Russia stop imports from EU and that EU farmers and food industry lost their share in Russian market, but bigger problem will be in fact, that Russia invest a lot in agronomy and food production, not only to cover 100% domestic needs, but also for exports. Russia is already one of the biggest food exporters, but not in everything. In few years Russia will export everything, grain, meet, milk, vegetables, fruits and food products. When comparing to EU, Russia have lower taxes, low debt to pay and all needed energy and resources at home, so nothing to import, what mean that in international market Russian food and food products will be far cheaper than from EU and with the same quality, not to say, that Russia already forbid the use of GMOs. EU will soon face extremely powerful concurent in food and industrial products as they will not be able to produce with such low price because of high taxes, high debts and importing of energy and resources.

PapaDragon- Posts : 13669

Points : 13709

Join date : 2015-04-26

Location : Fort Evil, Serbia

- Post n°86

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

medo wrote:Neutrality wrote:No matter how you sugarcoat it, someone is going to get hit hard due to the embargo. I'm betting Spain and Portugal will be demanding some kind of support from France, Germany and UK in order to survive.

The main problem from Russian embargo will come to EU in the future. It is not only, that Russia stop imports from EU and that EU farmers and food industry lost their share in Russian market, but bigger problem will be in fact, that Russia invest a lot in agronomy and food production, not only to cover 100% domestic needs, but also for exports. Russia is already one of the biggest food exporters, but not in everything. In few years Russia will export everything, grain, meet, milk, vegetables, fruits and food products. When comparing to EU, Russia have lower taxes, low debt to pay and all needed energy and resources at home, so nothing to import, what mean that in international market Russian food and food products will be far cheaper than from EU and with the same quality, not to say, that Russia already forbid the use of GMOs. EU will soon face extremely powerful concurent in food and industrial products as they will not be able to produce with such low price because of high taxes, high debts and importing of energy and resources.

I have been saying this for weeks...

Losing marked is bad. Creating competition that will end you is cataclysmic.

ExBeobachter1987- Posts : 441

Points : 437

Join date : 2014-11-26

Age : 37

Location : Western Eurasia

- Post n°87

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Explain this.

Russia’s economy shrank the most since 2009 after a currency crisis jolted consumer demand, while a selloff in oil threatens to drag the country into a deeper recession.

Gross domestic product contracted 4.6 percent in the second quarter from a year earlier after a 2.2 percent decline in the previous three months, the Federal Statistics Service in Moscow said on Monday, citing preliminary data. That was worse than the median forecast for a 4.5 percent slump in a Bloomberg survey of 18 analysts. The Economy Ministry had projected that output shrank 4.4 percent in the period, calling it “the lowest point” for Russia.

The rout on commodities markets has overshadowed the first signs of stabilization in Russia by hammering the ruble and shaking a country that relies on oil and gas for about half of its budget revenue. The world’s biggest energy exporter is enduring its first recession in six years after the nation’s biggest currency crisis since 1998 and a surge in inflation eroded consumer buying power as sanctions over Ukraine choked access to capital markets.

“While second-quarter growth surprised on the downside, perhaps far more importantly is the fact that the outlook for the Russian economy has deteriorated so far in the third quarter,” Piotr Matys, a London-based foreign-exchange strategist at Rabobank, said by e-mail. “The central bank may have to pause the monetary policy easing cycle at a time when local banks are still cut off from external sources of funding.”

Forward-rate agreements are signaling 23 basis points of increases in borrowing costs during the next three months. The Bank of Russia has lowered its key interest rate by a cumulative six percentage points to 11 percent in five steps this year.

Rate Pause?

A renewed slide in commodity prices may put the central bank in a bind if it destabilizes the ruble and reignites inflation. Consumer prices rose 15.6 percent in July from a year ago, down from a 13-year high of 16.9 percent in March. The central bank forecasts inflation at 10.8 percent by year-end and says its 4 percent target will be reached in 2017.

Urals, Russia’s export blend of crude, averaged $57 in the first half, down almost 47 percent from the same period a year earlier, according to the Economy Ministry. The ruble has depreciated more than 43 percent against the dollar in the past 12 months, the worst performance globally, according to data compiled by Bloomberg. It traded little changed at 63.97 versus the dollar as of 5:17 p.m. in Moscow.

“Faltering oil prices have increased the risks for the expected economic improvement in the second half,” UralSib Capital analyst Alexey Devyatov said in a report before the data release. “Sharp swings in the ruble rate have hit consumer demand and capital investment.”

max steel- Posts : 2929

Points : 2954

Join date : 2015-02-12

Location : South Pole

- Post n°88

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

ExBeobachter1987 wrote:Explain this.

Russia’s economy shrank the most since 2009 after a currency crisis jolted consumer demand, while a selloff in oil threatens to drag the country into a deeper recession.

Gross domestic product contracted 4.6 percent in the second quarter from a year earlier after a 2.2 percent decline in the previous three months, the Federal Statistics Service in Moscow said on Monday, citing preliminary data. That was worse than the median forecast for a 4.5 percent slump in a Bloomberg survey of 18 analysts. The Economy Ministry had projected that output shrank 4.4 percent in the period, calling it “the lowest point” for Russia.

The rout on commodities markets has overshadowed the first signs of stabilization in Russia by hammering the ruble and shaking a country that relies on oil and gas for about half of its budget revenue. The world’s biggest energy exporter is enduring its first recession in six years after the nation’s biggest currency crisis since 1998 and a surge in inflation eroded consumer buying power as sanctions over Ukraine choked access to capital markets.

“While second-quarter growth surprised on the downside, perhaps far more importantly is the fact that the outlook for the Russian economy has deteriorated so far in the third quarter,” Piotr Matys, a London-based foreign-exchange strategist at Rabobank, said by e-mail. “The central bank may have to pause the monetary policy easing cycle at a time when local banks are still cut off from external sources of funding.”

Forward-rate agreements are signaling 23 basis points of increases in borrowing costs during the next three months. The Bank of Russia has lowered its key interest rate by a cumulative six percentage points to 11 percent in five steps this year.

Rate Pause?

A renewed slide in commodity prices may put the central bank in a bind if it destabilizes the ruble and reignites inflation. Consumer prices rose 15.6 percent in July from a year ago, down from a 13-year high of 16.9 percent in March. The central bank forecasts inflation at 10.8 percent by year-end and says its 4 percent target will be reached in 2017.

Urals, Russia’s export blend of crude, averaged $57 in the first half, down almost 47 percent from the same period a year earlier, according to the Economy Ministry. The ruble has depreciated more than 43 percent against the dollar in the past 12 months, the worst performance globally, according to data compiled by Bloomberg. It traded little changed at 63.97 versus the dollar as of 5:17 p.m. in Moscow.

“Faltering oil prices have increased the risks for the expected economic improvement in the second half,” UralSib Capital analyst Alexey Devyatov said in a report before the data release. “Sharp swings in the ruble rate have hit consumer demand and capital investment.”

Depending on western analysts to predict situation of russian economy ( always gloomy) is pretty comical.

Russia Says GDP Grew in July First Time This Year Amid Oil Risks

By Olga Tanas and Andrey Biryukov

(Bloomberg) -- Russia’s gross domestic product probably grew in July for the first time this year on a monthly basis, according to the Economy Ministry, even as a rout in oil threatens to drag the country into a deeper recession.

Preliminary data “encourage optimism,” the ministry’s press office said by e-mail in response to Bloomberg questions. “We have increasing confidence that the economy grew in July” when adjusted for seasonal factors, while “the situation on the oil market remains uncertain.”

The uptick would mark a turnaround for the economy after it succumbed to its first recession in six years amid a slump in oil prices and sanctions over Ukraine. The government has said that an estimated 4.4 percent annual plunge last quarter marked “the lowest point” for Russia and growth will resume late this year or at the start of 2016.

^^ This is from Bloomberg Professional

sepheronx- Posts : 9069

Points : 9329

Join date : 2009-08-06

Age : 35

Location : Canada

- Post n°89

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

They seem to concentrate more on the value of the currency than actual business activity. Inflation is an issue but easily solvable more so than currency value, with plus and minuses for both sides. In this case, its consumer demand. Higher costs means less purchases. But, it all depends on the goods. Many enterprises are experiencing profit gains, abroad and back at home. So it all depends.

In this case, which form of GDP? Nominal or PPP? Cause Nominal GDP for Russia dropped, mainly thanks to currency value. But PPP dropped less but that was due to industrial production of various goods (more like assembly plants).

They are conveying a story, but not giving us the whole picture.

What I find interesting though, is that with this drop, it is showing that Russian economy is more resilliant than in 2008/9. On average, Russian GDP dropped by 9% in 2009, and that was only due to oil prices. Russia, even after 2nd quarter results sees a total of around 2.8 - 3% gdp drop, with both sanctions and oil glut, and rouble value decline, isnt so bad. But this definately means Russia has to reorientate its economy. Which will be hard of course.

I am going to suggest something people hate. But I think for Russias caliber, an Autarky is a good structure. Not complete autarky but one that is simply reliant on itself but still sells and invests outside of the country. An autarky, if done right, would be far stronger (not richer, maybe poorer on paper) and more resilliant. As long as the peoples aim is for a better living standard set by the people and aimed for by everyone, then these gdp stuff becomes useless.

Lets face it. Many countries in the west with a growing gdp, the people do not really see it. Some do, but most dont. I dont as an example. I see my life as getting worst actually. And I think that is the same for many Russians, because they are concentrating too much on superficial concepts and not on their own people. Just food for thought.

In this case, which form of GDP? Nominal or PPP? Cause Nominal GDP for Russia dropped, mainly thanks to currency value. But PPP dropped less but that was due to industrial production of various goods (more like assembly plants).

They are conveying a story, but not giving us the whole picture.

What I find interesting though, is that with this drop, it is showing that Russian economy is more resilliant than in 2008/9. On average, Russian GDP dropped by 9% in 2009, and that was only due to oil prices. Russia, even after 2nd quarter results sees a total of around 2.8 - 3% gdp drop, with both sanctions and oil glut, and rouble value decline, isnt so bad. But this definately means Russia has to reorientate its economy. Which will be hard of course.

I am going to suggest something people hate. But I think for Russias caliber, an Autarky is a good structure. Not complete autarky but one that is simply reliant on itself but still sells and invests outside of the country. An autarky, if done right, would be far stronger (not richer, maybe poorer on paper) and more resilliant. As long as the peoples aim is for a better living standard set by the people and aimed for by everyone, then these gdp stuff becomes useless.

Lets face it. Many countries in the west with a growing gdp, the people do not really see it. Some do, but most dont. I dont as an example. I see my life as getting worst actually. And I think that is the same for many Russians, because they are concentrating too much on superficial concepts and not on their own people. Just food for thought.

JohninMK- Posts : 15990

Points : 16133

Join date : 2015-06-16

Location : England

- Post n°90

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Just as in the rest of the world I suspect that Russia's figures are also 'optimised' for whatever their strategic objective is. I somehow doubt that the objective is to make things look good. Much better to let everyone think the sanctions etc are hurting bad. In many ways the weaker the rouble the better.

sepheronx- Posts : 9069

Points : 9329

Join date : 2009-08-06

Age : 35

Location : Canada

- Post n°91

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

JohninMK wrote:Just as in the rest of the world I suspect that Russia's figures are also 'optimised' for whatever their strategic objective is. I somehow doubt that the objective is to make things look good. Much better to let everyone think the sanctions etc are hurting bad. In many ways the weaker the rouble the better.

The weaker rouble means more exports which are helping various companies but ones that are relying on domestic consumers are getting hit. If there is a way to greatly lower inflation or reduce overall prices for domestic consumption, to spur a growth in consumers, then Russia would be laughing. But how will they do that? Subsidies cost money. And local producers are greedy. So what can they do? Only thing they can do is increase average wages to increase spending money. Maybe try to make utilities cheaper and other basic needs so that leaves more consumers with disposable income.

There is all this talk of "moving to asia" or "moving east". Instead, it should be "moving inwards". Increase infrastructure like roads, railways, powerplants, etc to make overall costs cheaper in long run for businesses that rely on such infrastructure. As well, I would lower interest rates and just let the rouble tank. It will adjust later on anyway and with cheaper internal credit, it allows businesses to borrow what is needed for further development.

Relying on others is a dead ends game.

medo- Posts : 4342

Points : 4422

Join date : 2010-10-24

Location : Slovenia

- Post n°92

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

ExBeobachter1987 wrote:Explain this.

Russia’s economy shrank the most since 2009 after a currency crisis jolted consumer demand, while a selloff in oil threatens to drag the country into a deeper recession.

Gross domestic product contracted 4.6 percent in the second quarter from a year earlier after a 2.2 percent decline in the previous three months, the Federal Statistics Service in Moscow said on Monday, citing preliminary data. That was worse than the median forecast for a 4.5 percent slump in a Bloomberg survey of 18 analysts. The Economy Ministry had projected that output shrank 4.4 percent in the period, calling it “the lowest point” for Russia.

The rout on commodities markets has overshadowed the first signs of stabilization in Russia by hammering the ruble and shaking a country that relies on oil and gas for about half of its budget revenue. The world’s biggest energy exporter is enduring its first recession in six years after the nation’s biggest currency crisis since 1998 and a surge in inflation eroded consumer buying power as sanctions over Ukraine choked access to capital markets.

“While second-quarter growth surprised on the downside, perhaps far more importantly is the fact that the outlook for the Russian economy has deteriorated so far in the third quarter,” Piotr Matys, a London-based foreign-exchange strategist at Rabobank, said by e-mail. “The central bank may have to pause the monetary policy easing cycle at a time when local banks are still cut off from external sources of funding.”

Forward-rate agreements are signaling 23 basis points of increases in borrowing costs during the next three months. The Bank of Russia has lowered its key interest rate by a cumulative six percentage points to 11 percent in five steps this year.

Rate Pause?

A renewed slide in commodity prices may put the central bank in a bind if it destabilizes the ruble and reignites inflation. Consumer prices rose 15.6 percent in July from a year ago, down from a 13-year high of 16.9 percent in March. The central bank forecasts inflation at 10.8 percent by year-end and says its 4 percent target will be reached in 2017.

Urals, Russia’s export blend of crude, averaged $57 in the first half, down almost 47 percent from the same period a year earlier, according to the Economy Ministry. The ruble has depreciated more than 43 percent against the dollar in the past 12 months, the worst performance globally, according to data compiled by Bloomberg. It traded little changed at 63.97 versus the dollar as of 5:17 p.m. in Moscow.

“Faltering oil prices have increased the risks for the expected economic improvement in the second half,” UralSib Capital analyst Alexey Devyatov said in a report before the data release. “Sharp swings in the ruble rate have hit consumer demand and capital investment.”

Imports are also part of BDP. Replacing expensive western imports with cheaper domestic products immediately show lower BDP and cheaper export also. On the other hand, real economy is growing. Don't read to much western propaganda. They don't see the effects for tomorrow, not to say for next year.

victor1985- Posts : 632

Points : 659

Join date : 2015-01-02

- Post n°93

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

economy is like wheels of a motor. one moves another. problem is that politicians just "talk" nonsenses like on facebook because taking some measures make them loosing votes. the discusion in politics should be lot of economy technic

victor1985- Posts : 632

Points : 659

Join date : 2015-01-02

- Post n°94

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

point rich eople like to scream a lot and deviate from those "to the topic " discussions. lot of money to rich people not always bring well to people and this can be explained in economy terms.

if i were putin i would use technic speech kept relatively simple but sure ... and i would bring some logic in speeches and economy talks

if i were putin i would use technic speech kept relatively simple but sure ... and i would bring some logic in speeches and economy talks

kvs- Posts : 16107

Points : 16242

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°95

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

ExBeobachter1987 wrote:

Russia’s economy shrank the most since 2009 after a currency crisis jolted consumer demand, while a selloff in oil threatens to drag the country into a deeper recession.

Gross domestic product contracted 4.6 percent in the second quarter from a year earlier after a 2.2 percent decline in the previous three months, the Federal Statistics Service in Moscow said on Monday, citing preliminary data. That was worse than the median forecast for a 4.5 percent slump in a Bloomberg survey of 18 analysts. The Economy Ministry had projected that output shrank 4.4 percent in the period, calling it “the lowest point” for Russia.

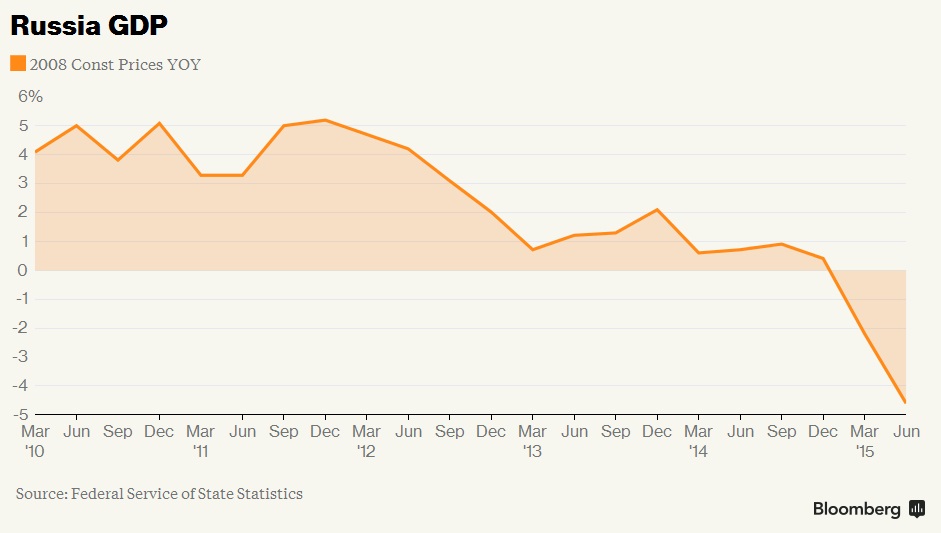

The above graph is fraudulent. GKS only has quarterly GDP figures for the first quarter of 2015. There are no figures for June of 2015.

The graph is a splice of the GKS figures and the -5% forecast from Moody's.

http://www.gks.ru/free_doc/new_site/vvp/tab6a.xls

If you look around on the GKS site you will see industrial production took a hit in the second quarter but has bounced back. So the GDP

ramp you see in the above graph is not consistent. Inflation was high in the first quarter but the inflation spike from last year fizzled out

by the end of March. So the GDP drop should have been larger in the first quarter as the shock was still significant. Given the production

figures I will wait until the end of the year before buying into the -5% GDP drop claim.

sepheronx- Posts : 9069

Points : 9329

Join date : 2009-08-06

Age : 35

Location : Canada

- Post n°96

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Well, that is just the quarterly. It pretty much falls in line with what the Rus government was saying that the worst could be over as they mentioned in June/July. If what Max posted is true, then growth already seen in July is good. Inflation wont go much higher as now domestic productions are ongoing and as well, imports from other countries started not much long after first quarter/second quarter.

If it drops even by 3 - 5%, far better than 2009 at around 8 - 9% But still not good. Like I said, reorienting the economy towards the internal consumption market and aiming for further domestic development and increasing living quality is what will really drive a real economy in Russia. Instead of aiming for simple numbers and %'s like the world is doing now. South Africa was able to achieve great results, I imagine Russia can too with heavy sanctions against it (Many south Africans stated that during the sanctions against them and their move to Autarky system, much development and larger increase in quality of life happened).

If it drops even by 3 - 5%, far better than 2009 at around 8 - 9% But still not good. Like I said, reorienting the economy towards the internal consumption market and aiming for further domestic development and increasing living quality is what will really drive a real economy in Russia. Instead of aiming for simple numbers and %'s like the world is doing now. South Africa was able to achieve great results, I imagine Russia can too with heavy sanctions against it (Many south Africans stated that during the sanctions against them and their move to Autarky system, much development and larger increase in quality of life happened).

sepheronx- Posts : 9069

Points : 9329

Join date : 2009-08-06

Age : 35

Location : Canada

- Post n°97

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Komsomolsk refinery has switched to production of fuels standard "Euro-5"

Another petrol plant switching to Euro 5 standard.

Another petrol plant switching to Euro 5 standard.

higurashihougi- Posts : 3592

Points : 3679

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

- Post n°98

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

PapaDragon wrote:

In the meantime sdelanounas.ru is so loaded with pictures of cows, it looks like Playboy for bulls.

''European Dairy Industry in Crisis Due to Russian Food Embargo

European dairy farmers are facing their most serious economic crisis in decades, largely as a result of the ongoing sanctions war between EU member countries and Russia.''

http://sputniknews.com/business/20150810/1025581375.html

At this rate we will need cow emoticon pretty soon...

Now they began to beg Russia for mercy

http://www.thenews.pl/1/10/Artykul/216457,Agriculture-Minister-calls-on-Russia-to-halt-food-burning

KoTeMoRe- Posts : 4212

Points : 4227

Join date : 2015-04-21

Location : Krankhaus Central.

- Post n°99

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Echehehhehehe. YOu can't post links yet, Trollo. And I have this dream you won't make it to 7 days, yo.American Eagle wrote:Russian economy contracts by 4%

ft.com/cms/s/3/8e640b2e-3f71-11e5-b98b-87c7270955cf.html

On a more specific note, people stop trying to find excuses. The Dip in oil prices couldn't be enough offset by the counter-trade in RUB. We have enough evidence that a bad management of the RUB floating and outright sharking from mid-level and up asset holders against the RUB were the cause of the Black Winter last year. The necessary reset of the Russian Economy is going to be tough and I found the CBR/RCB predictions pretty much on spot. a 4.5% drop YOY for the 2nd trimester, if that's to be the bottom isn't that bad. we're on track for that 3.6 GDP recession. My whole issue so far has been that Russia hasn't been taking seriously the lack of scope for the current cuts. Gazprom makes a killing, by stopping investment and being paid in Euros for ~40% of its exports. That's huge. But that means GP is tied to that Euromarket for a while.

Guest- Guest

- Post n°100

Re: Russian Economy General News: #5

Re: Russian Economy General News: #5

Kinda obvious why you are here. Don't worry, Russia's recession will end in the next two quarters.American Eagle wrote:Russian economy contracts by 4%

ft.com/cms/s/3/8e640b2e-3f71-11e5-b98b-87c7270955cf.html

Mods please take him out.

PapaDragon

PapaDragon