Sanctions-hit Russian manufacturers struggle to advance country’s LNG ambitions

Challenges mount as domestic contractors struggle to up their game as suppliers to Novatek’s Russian LNG projects

21 June 2022

...

With Europe in May enacting legislation to halt the supply of equipment and know-how to Russian LNG projects, deliveries of contracted equipment from the West and China have ground to a halt.

Before the start of the war in Ukraine, Novatek repeatedly claimed it would be able to deliver more than 55 million tpa of LNG to international markets by 2030 from its Yamal LNG, Arctic LNG 1 and Arctic LNG 2 projects.

There is growing evidence that sanctions are severely affecting the pace and possibly even the viability of the Novatek-led Arctic LNG 2 project, currently the largest of its kind in the country.

Arctic LNG 2 comprises three 6.6 million tonne per annum trains to be installed on concrete gravity based structures (GBS) now under construction at the Novatek-managed Belokamenka yard, near the port of Murmansk.

While channel dredging and other preparations have been continuing in Belokamenka for the towed transportation of the first train to the Gydan Peninsula later this summer, the ability of Russian contractors to design and manufacture missing elements for the project remains in doubt.

Power supply

Contracting arrangements in place before Moscow launched its war on Ukraine included a major role for the compact LM9000 gas powered turbines manufactured by US services giant Baker Hughes.

Moscow-based newspaper Kommersant last week reported that Baker Hughes had refused to deliver the turbines for the almost-complete first Arctic LNG 2 train to comply with sanctions against Russia.

Alexander Konyukhov, executive director of Russian turbo machinery supplier Power Machines, told the St Petersburg gathering that, following “weekly meetings” with Novatek, the company is able to commit to delivering between nine and 12 turbines, known as GTE-170, to the Arctic LNG project, located on the Gydan Peninsula.

Konyukhov said his company completed the manufacture of a pilot version of the GTE-170 turbine earlier this year.

But Novatek will have to wait until 2025 for its first delivery as Power Machines has agreed committed to deliver several power generation sets to at two other customers in Russia, he acknowledged.

Before Russia invaded Ukraine in February, Novatek had repeatedly said that Arctic LNG 2's first train would come into operation in 2023, and Mikhelson has been sticking to this plan even as Western sanctions were progressively tightened.

Most wanted list

According to Mikhelson, Russian manufacturers will have to supply 18 categories of essential equipment for the company’s LNG projects, including large heat exchangers, cryogenic pumps, turbo expanders to chill natural gas, compressors of various types and loading jetties.

While some progress has been seen in the development of Russian pumps and compressors, crucial R&D efforts relating to 11 categories of essential equipment have not yet started despite calls and efforts by the gas producer, Mikhelson said.

He added that he sees just the Russian government as the source of financing for such R&D efforts, as companies are unwilling to invest their own funds at this stage.

An initial need for short-term financing of 24 billion rubles (US$400 million) has been identified, he said.

“If any of [the] required 18 types of equipment are not available for order in Russia, the commissioning of new LNG trains will be impossible,” Mikhelson said.

He added that Russia has “no time to waste” because high energy prices will accelerate the final investment decisions on other competing LNG supply projects across the globe, and Novatek will have to “fight for a market share”.

Mikhelson said that in a best case scenario, R&D efforts on the "missing" LNG-related equipment would take between 18 months and two years, and the gas producer will have to wait several years more before commercially produced units become available for its LNG projects.

Price worries

Another key factor is the price of Russian manufactured equipment, he acknowledged.

Mikhelson said that replacement submersible cryogenic pumps, recently designed and manufactured by Russia's state-controlled contractor Atomenergomash, had been offered to Novatek at almost double the price of a similar pump manufactured in Japan.

Meanwhile, Russian LNG projects in the Arctic have to remain competitive on investment and operating costs on their upstream side, as they carry additional transportation costs because they require ice-breaking support.

...

https://www.upstreamonline.com/politics/sanctions-hit-russian-manufacturers-struggle-to-advance-country-s-lng-ambitions/2-1-1242028

Russian hydrocarbon (Oil and Gas and Coal) Industry: News #4

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

Arkanghelsk- Posts : 3980

Points : 3984

Join date : 2021-12-08

lancelot wrote:

Building huge LNG liquefaction capability in the Baltic is a mistake. The West is already talking about blockading Russia's access to the Baltic.

Existing liquefaction capability is more than enough for Kaliningrad.

There is also the issue that building LNG liquefaction facilities requires huge compressors. In Arctic LNG these are supposed to be done with Western imported gas turbine engines. There aren't any Russian gas turbines of the required size and power yet. There is a project to make huge LNG liquefaction facilities near Murmansk using electricity from nuclear power to move the compressors. I think this is way more viable than making LNG facilities in the Baltic. If you place the facilities in Murmansk then you can move the LNG either to Europe or Asia as you want to without risk of blockade.

There is also the issue that Russia doesn't have enough LNG tankers and they were using French technology to make the LNG tanks in the tankers they were building at Zvezda shipyard. Further orders to build LNG tanker ships in South Korea, the main world builder of such ships right now, was also cancelled just in case they also decide to sanction those. With the Western embargo on sales of such technology to Russia, they will have to make their own technology to build such ships, and switch orders to Chinese shipyards.

While I think Russia's LNG export capacity will increase, I think most liquefaction capability will be built in ports in Northern Russia, and a massive effort to import substitute technologies must happen first.

The government has plans for the baltics, and involved Portovaya LNG as well as Baltic LNG

Portovaya LNG essentially is tapping the gas from Gryazovets-Vyborg pipeline, and then loading it on ships to send to Kaliningrad

Sure it seems foolish

But then again so is preventing Russian ships from transiting , when you have a new military district on your border

Before the baltics only had to worry about 2 motorized rifle brigades

Now they have a full military force of half a million men, more then 4 fighter regiments, reinforced fleet with submarines, corvettes, and missile ships - and they have fully exposed themselves to the Russian world as being worse than Ukrainians with their russophobia

There is more at play then just business here, it is the foundation of a new security policy towards Finland and the Baltics

GarryB and owais.usmani like this post

kvs- Posts : 16107

Points : 16242

Join date : 2014-09-10

Location : Turdope's Kanada

struggle

LOL. At worst there are delays. In the medium and long term there is a boost from import substitution.

So much cope from western retards. Russia was supposed collapse economically in the summer of 2022. Now we have "Russian companies

are struggling" to achieve "ambitions". Meanwhile it is EU-tardia that is losing its manufacturing because it cannot get affordable natural gas.

GTFO.

sepheronx, GarryB, LMFS, Hole and lancelot like this post

GarryB- Posts : 41148

Points : 41650

Join date : 2010-03-30

Location : New Zealand

More importantly it means they can look to exporting their products too so countries that are joining BRICS will have a BRICS alternative to western options which I am sure most will appreciate.

In the end western companies have been screwed by their governments because they have broken or lost contracts that were earning them good money.

They weren't operating in Russia for charity... they were making good money and that has ended now.

Also with the withdrawal of western technology there is the potential for introducing new ideals, including gravity based compression of gas and also cryogenic compression of gas.

There will be bottlenecks of course like technology but also shipping capacity too but they will sort through those things because there are enormous sums of money involved and the potential to make very good money is there for those Russians wanting to step up.

Last edited by GarryB on Mon Jan 15, 2024 6:07 pm; edited 1 time in total

sepheronx, kvs, Hole and lancelot like this post

sepheronx- Posts : 9069

Points : 9329

Join date : 2009-08-05

Age : 35

Location : Canada

GarryB, xeno and kvs like this post

Hole- Posts : 11254

Points : 11232

Join date : 2018-03-24

Age : 48

Location : Scholzistan

Delays are mostly from the fact that those LNG companies had contracts with suppliersAt worst there are delays.

and had to go through the whole contract process again with new, now russian ones.

GarryB, kvs and owais.usmani like this post

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

Yes. I put the article up because it has a lot of details on the issues and how they were trying to solve them.sepheronx wrote:The article was from 2022, mid 2022. Lots have changed since.

Afterwards there was talk about using Chinese gas turbines. A mistake IMHO even if it is likely a lot of the LNG will end up in China.

Instead using the Russian GTE-170, as discussed in the article, looks a lot more viable to me. Power Machines just recently delivered the first one to a client.

https://tass.ru/ekonomika/19630205

GarryB and kvs like this post

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

LUKOIL is experiencing cracking

Refinery in Nizhny Novgorod may halve gasoline production

As Kommersant learned, LUKOIL became the first major victim of Western sanctions in oil refining. Its Nizhny Novgorod refinery, one of the largest in the Russian Federation, completely shut down one of the two catalytic cracking units, key for the production of gasoline, due to the accident. The second catalytic cracker broke down at the end of December but has since been restarted. LUKOIL will now have to look for a replacement for failed Western equipment. The oil company stopped selling AI-95 gasoline on the stock exchange last week, but so far the impact on stock prices has been insignificant due to low demand for fuel in winter.

In January, LUKOIL’s catalytic cracking unit at the Nizhny Novgorod Refinery, which allows the production of high-octane gasoline, failed, several Kommersant interlocutors told. According to them, the reason for its shutdown on January 4 was the breakdown of foreign compressor equipment, which cannot be replaced in the near future due to Western sanctions. Kommersant's interlocutors claim that LUKOIL will strive to complete repairs at this installation by spring.

LUKOIL, in response to a request from Kommersant, called the accident an “incident at a process unit,” confirming its shutdown.

The company promised to satisfy “the needs of the domestic market in coordination with its other participants using all available resources.”

In total, the Nizhny Novgorod Refinery has two catalytic cracking units, commissioned in 2010 and 2015, respectively. The older installation has now been taken out of service. At the same time, on December 26, 2023, as Kommersant’s interlocutors clarified, a breakdown also occurred at the catalytic cracking unit commissioned in 2015, but since then it has been able to be launched at a lower power. In addition, on December 21, 2023, LUKOIL itself reported a fire at one of its installations. According to Kommersant, in 2022 the Nizhny Novgorod Oil Refinery processed about 15 million tons of oil, which is approximately 5% of total refining in Russia.

Western sanctions in oil refining have so far mainly led to an increase in scheduled repairs at refineries or a slowdown in the modernization process. The most striking example is the protracted repair of Gazprom's Astrakhan gas processing plant, which last year did not produce gasoline for several months.

The accident at the Nizhny Novgorod refinery was the first known case where a shortage of equipment due to sanctions could lead to the loss of production of a significant volume of high-octane fuel.

The Nizhny Novgorod refinery is important for supplying the Moscow region, which accounts for about 30% of gasoline consumption in the country. Thus, gasoline was delivered to Moscow from the Nizhny Novgorod refinery via pipeline. Compensation shipments from other refineries will most likely have to be transported by rail, which will lead to a significant increase in logistics costs and increased delivery times.

Kommersant's sources note that LUKOIL stopped sales of AI-95 on the stock exchange on January 10, and as a result, the price of fuel on the stock exchange went up. According to two Kommersant sources, this tactics of the oil company is explained by the desire to provide fuel to its own gas stations. However, this provokes market participants to stock up on fuel, which does not yet pose a big problem due to the seasonal decline in demand. Since the beginning of the year, AI-95 and AI-92 at SPbMTSB in the European part of the Russian Federation have risen in price by 2.5% and 3.2%, to 43.4 thousand and 40.6 thousand rubles. per ton respectively.

Nizhegorodnefteorgsintez, one of the largest gasoline producers in Russia, produced an average of 410 thousand tons per month in 2023, and 4.6 million tons in 11 months, notes Alexandra Zubacheva from Petromarket.

According to her, in recent months the entire volume of gasoline has been directed to the domestic market. The two cat cracking units are core to the production of gasoline components at the refinery and were fully operational in 2023. According to Ms. Zubacheva, the failure of one of the catalytic cracking units will initially lead to a situation where the plant will produce half of the usual volume of gasoline, but over time it will be able to increase output. “The loss of 200 thousand tons per month is a lot, of course, but the Russian market can easily find such volumes, and besides, now is not the season of the highest demand for gasoline,” the analyst concludes.

https://www.kommersant.ru/doc/6453337

GarryB and franco like this post

kvs- Posts : 16107

Points : 16242

Join date : 2014-09-10

Location : Turdope's Kanada

preciously western. Lukoil's management needs to be shot. This is the same 5th column BS as with Aeroflot and its fetish for

NATO jets.

Rodion_Romanovic likes this post

Hole- Posts : 11254

Points : 11232

Join date : 2018-03-24

Age : 48

Location : Scholzistan

Or the management of the refinery is searching for excuses.

The article sounds like in a matter of months all russian refinerys will malfunction and break down.

GarryB, kvs, Rodion_Romanovic and Kiko like this post

GarryB- Posts : 41148

Points : 41650

Join date : 2010-03-30

Location : New Zealand

Now they aren't buying crude or gas from Russia not only is Europe suffering in terms of energy prices, but its petrochemical industry lacks the raw materials to make its own processed fuels and chemicals so that part of their industry will be dying too.

kvs, lancelot and Kiko like this post

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

That is right. The chemical industry used to be the backbone of German industry. But it is all moving to the USA and China.GarryB wrote:Now they aren't buying crude or gas from Russia not only is Europe suffering in terms of energy prices, but its petrochemical industry lacks the raw materials to make its own processed fuels and chemicals so that part of their industry will be dying too.

The steel industry in Europe in contrast seems to be packing up and moving to Brazil.

Europe will end up only doing screwdriver assembly. Of course for some people in Europe like the Greens this is great news. They don't like people doing anything anywhere.

GarryB, Firebird and owais.usmani like this post

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

Sources admit a ban on the export of gasoline from Russia after the incident at NORSI

Moscow. January 15. INTERFAX.RU - The government is considering the possibility of introducing a ban on the export of gasoline after the shutdown of one of the units at the LUKOIL refinery, several sources familiar with the situation told Interfax.

As the Ministry of Energy announced on January 15, due to unscheduled repairs of one of the catalytic cracking units of LUKOIL-Nizhegorodnefteorgsintez (NORSI), there was a decrease in the production of motor gasoline, and with the participation of oil companies, measures were developed to continue the uninterrupted supply of fuel to the domestic market during the repair period of the enterprise.

“The headquarters participants emphasized that the needs of the domestic market will be met by reducing export supplies and reorienting the existing resources of other market participants,” the ministry said.

According to Interfax sources, LUKOIL asked the Ministry of Energy to adjust the company’s production schedule for petroleum products, as well as the volume of exchange sales.

LUKOIL asked other oil companies to help with supplies of up to 200 thousand tons of AI-95 in January and February. At the same time, LUKOIL itself has already stopped exporting gasoline in order to direct volumes to the domestic market, sources say.

In addition, the agency’s interlocutors say that the option of temporarily banning the export of gasoline is being discussed again. According to sources, the Ministry of Energy notes that this possibility remains and can be used if necessary. One of the sources says that a regulatory act is already being prepared to introduce a ban on the export of gasoline. Another source clarifies that the tools to prevent gasoline shortages on the domestic market are still being discussed.

The Ministry of Energy has not yet been able to obtain a comment on this issue. The office of Deputy Prime Minister Alexander Novak and LUKOIL do not comment on the information.

According to one of the traders, the average daily export of motor gasoline for January 1-10 amounted to 20.4 thousand tons/day. versus 16.6 thousand tons/day. for December 1-27, and 7.8 thousand tons/day. In November. The average daily shipment of motor gasoline to the domestic market for January 1-10 amounted to 97.6 thousand tons/day. versus 110 thousand tons/day. for December 1-27, and 112.9 thousand tons/day. In November.

Back in the middle of last week, amid rumors of an accident at NORSI, stock prices for gasoline began to rise moderately. LUKOIL confirmed the shutdown of one of the installations only on January 12, without specifying what kind of installation it was or how long it had been out of operation. According to data as of January 15, compared to January 10, when prices started to rise, AI-92 at SPbMTSB rose in price by 4.7% - to 42,374 rubles per ton, AI-95 - by 3.7%, to 45,562 rubles / t (data are given based on the national index reflecting the prices of all Russian refineries).

https://www.interfax.ru/business/940314

The Ministry of Industry and Trade is confident in the ability to produce the equipment necessary for NORSI

Moscow. January 16. INTERFAX.RU - Russian machine-building enterprises are able to manufacture equipment similar to that which failed at the Nizhny Novgorod refinery of LUKOIL, the Ministry of Industry and Trade is confident.

“Already today, the Russian engineering industry has proven its readiness to offer solutions that are not inferior to imported analogues,” the department’s press service told Interfax.

“In particular, similar equipment that failed at the facility of PJSC LUKOIL is manufactured by Russian machine-building enterprises (for example, the Lenin Nevsky Plant (St. Petersburg)) and is actively used by other companies at the same technological installations,” the Ministry of Industry and Trade clarified.

“This once again proves that priority should be given to domestic manufacturers, who guarantee, among other things, after-sales service and maintenance,” the ministry emphasized.

The press service also recalled that in order to increase the efficiency of interaction between all participants in the oil and gas market - oil and gas producing companies, equipment manufacturers and federal ministries - a collegial body was created under the leadership of two vice-premiers - the Coordination Council for Import Substitution of Oil and Gas Equipment, formed within the framework of the government commission on import substitution. The Corsovet determines priority technological areas and executors responsible for their further implementation, and ensures the attraction of public and private funds for the implementation of import substitution projects. According to a decision made at one of the council meetings, the Ministry of Industry and Trade, together with the Ministry of Energy and oil and gas companies, is currently drawing up a list of needs for spare parts and components for fuel and energy complex facilities for the purpose of further selecting analogues and forming a schedule for the development of appropriate spare parts.

The “parallel import” mechanism approved by the Russian government is being used as a temporary measure to allow operating organizations of oil and gas companies to form the necessary stock of spare parts and components, the ministry added. “Despite this, the need to develop domestic solutions is obvious, and therefore, in 2022, a mechanism for supporting reverse engineering projects was created, which will allow, with government support, to ensure the rapid replacement of critical imported components,” the Ministry of Industry and Trade continued. In parallel, the departments, together with oil and gas companies, are exploring the possibility of harmonizing legislation in order to ensure regulatory legal reinforcement of the conditions under which it will be possible to use non-original spare parts, provided they pass the incoming control of the operating organization and there are restrictions established by the manufacturers’ manuals (instructions), the ministry reported.

LUKOIL reported on January 12 that due to an incident at the technological installation of LLC LUKOIL-Nizhegorodnefteorgsintez, its work was temporarily stopped. However, the company did not say what kind of installation we are talking about, the reasons for its decommissioning, when it was stopped and for how long.

At the end of December, the company notified that a fire had been extinguished at one of the process units at the same refinery, but emphasized that this incident, the causes of which were not specified, did not have an impact on production activities.

LUKOIL-Nizhegorodnefteorgsintez (formerly NORSI) is one of the largest oil refining enterprises in Russia, producing more than 50 types of commercial petroleum products: automobile, aviation and diesel fuel, petroleum bitumen, paraffins and other products. The installed processing capacity is 17 million tons per year.

https://www.interfax.ru/russia/940374

GarryB, kvs, LMFS and owais.usmani like this post

GarryB- Posts : 41148

Points : 41650

Join date : 2010-03-30

Location : New Zealand

kvs likes this post

kvs- Posts : 16107

Points : 16242

Join date : 2014-09-10

Location : Turdope's Kanada

which comes from attributing conventional gas deposit characteristics to tight gas deposits. This is utter nonsense. By definition, tight

gas has less volume than conventional gas since it is trapped in smaller porosity rock. You can see this from the production curves of

fracked wells. They have a much faster attenuation than conventional wells. Fracking more wells is not a compensation for this since

there is no free lunch. In fact, it is yet another indication of what a desperate play this is. The extraction costs scale with the number

of wells but the total production is still constrained over the life of those wells (i.e. the total natural gas extracted does not scale with the

number of wells when compared to conventional gas plays).

People can Google "Art Berman" for his analysis for more details. His evaluations are being confirmed by the observed facts over time.

He is not just another stock shill.

GarryB, Hole and lancelot like this post

owais.usmani- Posts : 1852

Points : 1848

Join date : 2019-03-27

Age : 38

Undeterred by Sanctions Novatek Begins Production at Arctic LNG 2

In spite of mounting international sanctions Russian gas producer Novatek has begun production at Arctic LNG 2 and the first shipment of liquefied natural gas is likely just weeks away. The company managed to successfully redesign its facility to replace Western technology with Chinese imports and a number of Arc7 LNG carriers will enter into service in 2024.

After five years of construction Novatek’s Arctic LNG 2 facility has begun producing liquefied natural gas (LNG) and the first shipments are just weeks away.

Despite the departure of Western companies and a number of rounds of US and EU sanctions, Novatek appears poised to complete all three trains of its Arctic LNG 2 project in the coming two years.

The first production line, or train, assembled on a floating platform near Murmansk and towed to the Utrenny terminal in summer 2023, began liquefaction of natural gas on 21 Dec 2023, confirms Mehdy Touil, a LNG Operations Specialist, who in the past worked as a senior operator for Novatek’s Yamal project.

Touil detailed the technical modifications Novatek undertook to complete the first train in the face of sanctions.

Challenged by sanctions

A key challenge was the lack of LM9000 gas turbines by supplier Baker Hughes. The American company delivered four out of seven turbines before sanctions kicked in.

As a result Novatek was forced to modify the configuration of train 1, while it awaits and installs replacement turbines by Chinese supplier Harbin Guanghan.

Originally train 1 was designed to use seven LM9000s, with three LM9000s for power generation and four more for refrigeration.

All-electric

However, with only four turbines available Novatek reconfigured the first production line to run at lower capacity using two turbines each for power generation and refrigeration. Train 1 began operation with this setup three weeks ago achieving around 50 percent capacity.

Graphic showing the original and current modified design of train 1. (Author’s own work with turbine drawings courtesy of VBR)

Once Novatek receives Harbin Guanghan’s CGT30s turbines it will revert train 1 to its final full capacity configuration: Four LM9000s for refrigeration and five CGT30s for power generation.

Train 2 will not rely on Baker Hughes turbines at all, instead they will be an all-electric configuration. The refrigeration compressors can be driven by turbines as they will be in train 1 or by electric motors in train 2.

No major challenges

“T2 will not be provided with turbines, it will be an all-electric configuration with a pool of CGT30s onshore. T3 is waiting for the operational feedback from the Chinese machinery to decide on the final configuration, but again it should be an all-electric configuration,” details Touil.

The onshore pool of CGT30s could encompass up to 20 units for up to 500 MW for train 2.

Graphic showing the final modified design of train 1 and planned modified design of train 2. (Author’s own work with turbine drawings courtesy of VBR)

Touil does not foresee any additional major challenges for Novatek to complete Train 2 and 3.

“All the Western machinery for T1, 2, and 3 was delivered. I do not see any other impact from the sanctions unless it is on the shipping of the remaining modules from the Chinese yards.”

Rapid progress

A number of remaining modules are currently en route from China to the construction yard outside Murmansk.

While experts, including Touil, expected train 1 to run at 50 percent capacity for most of 2024 until Novatek could install the Chinese turbines, it appears that the company has been able to make rapid progress in integrating the CGT30s.

Touil confirms that “the turbines have been successfully received and installed onshore, serving as a cornerstone for power generation within the project infrastructure for the 1st train.”

As a result Novatek may be able to achieve 100 percent capacity for train 1 in the coming weeks and months ahead of schedule. Each train has a nameplate capacity of around 6.6 million tons of LNG per year.

“However, a significant source of logistical uncertainties looms large,” Touil concluded.

How many carriers will be ready?

The limiting factor will likely be the availability of transport capacity, explains Viktor Katona, senior analyst at Kpler, a data and analytics firm for commodity markets.

“The first train might need to run at lower utilization rates so as not to hit tank tops, producing quicker than the LNG carriers can take it off, and the capacity ramp-up would be reflective of tanker availability,” Katona points out.

Western sanctions have slowed down the construction of the second generation of fifteen ice-capable Arc7 LNG carriers vital to Arctic LNG 2’s operation.

Pulled out

At Zvezda, a Russian shipyard in the Far East, a batch of five 2nd generation Arc7 LNG carriers are under construction. The yard may be able to place into service the first two or three vessels in 2024, explains Ben Seligman, a project specialist for Arctic oil and gas development.

As for the Zvezda’s ability to complete the remaining two or three vessels of the initial batch of five ships, questions remain surrounding the readiness of the membrane of the LNG storage system and the azipod propulsion system.

French company GTT and American General Electric, providers of the equipment, pulled out of Russia in 2023.

Chinese help

Zvezda had originally been contracted to complete an additional ten vessels in cooperation with Samsung Heavy Industries (SHI), which provided the main hull blocks for final assembly at the Russian shipyard.

SHI has stopped construction of the hulls, though it has not formally withdrawn from the partnership.

“Zvezda will be looking to China for help here,” explains Seligman.

Carriers from South Korea

A second batch of carriers is being readied at a South Korean shipyard. Here the news is somewhat more positive for Novatek.

Hanwha Ocean (formerly DSME) had originally been contracted to build six 2nd generation Arc7, three for Russian operator Sovcomflot and three for Japan’s Mitsui OSK Line (MOL).

Western sanctions rendered Sovcomflot unable to provide payment resulting in Hanwha canceling the order. The company, however, completed them at its own expense.

Graphic showing the status of Zvezda and Hanwha Arc7 LNG carriers. (Source: Author’s own work)

“It intends to sell them to another operator. It isunclear how far along Hanwha is in securing the new operator,” Seligman continues.

The three former Sovcomflot vessels have been completed and are currently undergoing sea and gas trials, Seligman confirms. Similarly, the first MOL carrier is conducting sea trials, with the 2nd and 3rd vessel a bit further behind.

“In theory, four of the six are pretty much ready to go. But three of them don't yet have a vessel operator/ owner,” Seligman concludes.

Ship-to-Ship transfers remain key

When Novatek begins deliveries from Arctic LNG 2 in the coming weeks, it will likely rely on the ship-to-ship (STS) transfer to optimize the use of its existing fifteen Arc7 carriers from the Yamal LNG project.

Originally it had planned to use its newly deployed floating storage units (FSU) off the coast of Murmansk and southern Kamchatka, but both vessels have been sanctioned by the US since November and have thus far remained unused.

“Given sanctions, it is not clear to me when Novatek might be able to commence operations at the Saam and Koryak FSUs,” emphasizes Seligman.

Novatek has already returned to STS operations for Yamal LNG transferring LNG from Arc7 carriers to conventional carriers off Kildin island. Five such transfers have already taken place in recent weeks.

“I could see Novatek using some of the Yamal LNG Arc7s to shuttle LNG from Arctic LNG 2 train 1 to Kildin for STS transfer to non ice-class LNGCs,” Seligman speculates.

Winter NSR voyages to Asia

Novatek also aims to follow through on its claim of year-round eastbound shipments along the NSR. In 2023 the company announced it would start mid-winter shipments in January 2024. Such experimental winter-time shipments are now in the works.

“These will apparently include one-off shipments in February, March, and April, which has not happened before. These are likely also aimed at allowing Novatek to claim that it has commenced year-round eastbound shipments of LNG to Asia via the Northern Sea Route,” explains Seligman.

Apart from challenges related to transportation, questions arise how the latest round of US sanctions will affect Novatek’s ability to sell its LNG.

Force majeure declarations

Just days after Arctic LNG 2 began production, the project’s minority stakeholders in France, China, and Japan declared force majeure as a result of US sanctions targeting the project.

France’s TotalEnergies, China’s state-owned oil major CNOOC and China National Petroleum Corp (CNPC), and Japan’s Mitsui each hold a 10 percent stake. Novatek controls the remaining 60 percent.

“The bigger complication is likely to be the force majeure declaration, combined with the US sanctions on the project,” explains Jason Feer, global head of business intelligence at Poten & Partners, a global broker for international oil, gas and shipping markets.

Waivers from the US

Novatek’s international partners have offtake agreements for millions of tons of LNG per year based on the size of their minority stakes in the Arctic LNG 2 project.

While Novatek’s equity partners have requested waivers from the US in order to lift those cargoes, there is no guarantee they will succeed. If its partners are unable to secure waivers, Novatek will have to find new buyers, likely on the spot market.

However, as a number of new LNG projects around the world come online in 2024 there may be little appetite for Novatek’s product.

“Chinese imports of LNG in particular have softened over the past year, at the same time new term contracts have kicked in. This means that the Chinese may not need a great deal of additional LNG from Russia,” explains Feer of Poten & Partners.

“It appears that European governments, as well as the US government, are increasingly taking the view that there is enough LNG supply globally, and therefore the Russian volumes are not needed and can be sanctioned without affecting global prices. So then the question will be which countries are willing to violate sanctions on Russia,” asks Feer.

Further impact

Thus far, sanctions have affected the completion of Arctic LNG 2, construction of the 2nd generation of Arc7 vessels, and the use of the two floating storage units (FSU).

Additional rounds of sanctions may further impact Novtek’s ability to secure the needed transport capacity or sell its LNG. The EU has been in talks for much of 2023 to restrict the inflow of Russian LNG into the block.

In contrast to Russian crude oil shipments, where the country has successfully developed a “shadow fleet” of oil tankers, no such opportunity exists for Russian LNG flows.

“For Novatek, it will be difficult to obfuscate the origin of its cargoes and it will be similarly difficult to buy shadow LNG carriers off of the second-hand market because for liquefied gas carriers that market is fairly shallow, if non-existent,” explains Katona, the analyst at Kpler.

Sanctioned cargoes

Jason Feer at Poten & Partners echoes that sentiment.

“First, there are only about 600 or so LNG carriers in the world and I would be surprised if many (or any) of the owners of these vessels are willing to allow them to be used to carry sanctioned cargoes.”

In contrast, the oil market, which encompasses many thousands vessels, is home to owners willing to use their vessels in violation of sanctions. In part because owners know that there will be sufficient trade to keep these vessels employed in the ghost market in the long run.

“LNG carriers are much more expensive and I would be surprised if any owners are willing to risk not being able to return to legitimate trade after being used to violate sanctions,” Feer concludes.

Novatek’s Arctic roads to China

It remains to be seen if and to what degree the Western sanction regime can further impact Novatek’s operation at Arctic LNG 2. While the US’ outspoken goal is to “kill the project”, Novatek appears to have the means to see the project through.

Especially as long as it pulls in the profits generated by its neighboring project, Yamal LNG.

“Right now Yamal LNG is the cash cow, and all efforts are spent by Novatek to keep it that way,” explains LNG expert Touil.

EU countries alone send in excess of $1bn to Novatek every month for LNG from Yamal.

China as the easiest option

“Novatek has the finances and background to carry Arctic LNG 2 to completion alone, if required. Ultimately, the less sanctions exemptions there might be, the bigger the probability that the project will become dominated by Chinese buying,” highlights Katona.

The increased flow of Russian crude oil to China, including via the NSR in 2023, indicates that increasing its partnership with China will likely be Russia’s preferred path.

“Dealing with China is the easiest option for Russian entities under sanctions, both for reasons of business convenience and financing,” concludes Katona.

GarryB, franco, kvs, lyle6 and lancelot like this post

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

I think Novatek is basically stepping on the same rake again. They should just use Russian gas turbines. The UEC Saturn GTD-110M (115 MW) and Power Machines GTE-170 (170 MW) would have likely been available in a year. They would have been better off waiting for that instead of buying CGT30 (32 MW) Chinese gas turbines.

The original design was supposed to use 7x LM9000 (73 MW) gas turbines. It seems like this can be replaced with 20x CGT30 (32 MW) gas turbines. So it looks like they need like 511-640 MW of power to get a train to work.

I am fairly sure they will be able to use Chinese shipyards to build the ships. There are Chinese companies with membrane technology. Eventually Russia should be able to make its own membrane technology, and I don't know what is the big deal with the azipods. The Project 22220 icebreakers use Russian made azipods just fine. There is some kind of slavish mentality with regards to imports which needs to stop.

I would like to know why US sanctions don't allow the FSUs to work. I see no good reason why this is the case. Novatek owned ships in Russian waters. So what is the big deal. Are G7 nation ships refusing to dock? Just use Russian or Chinese ships.

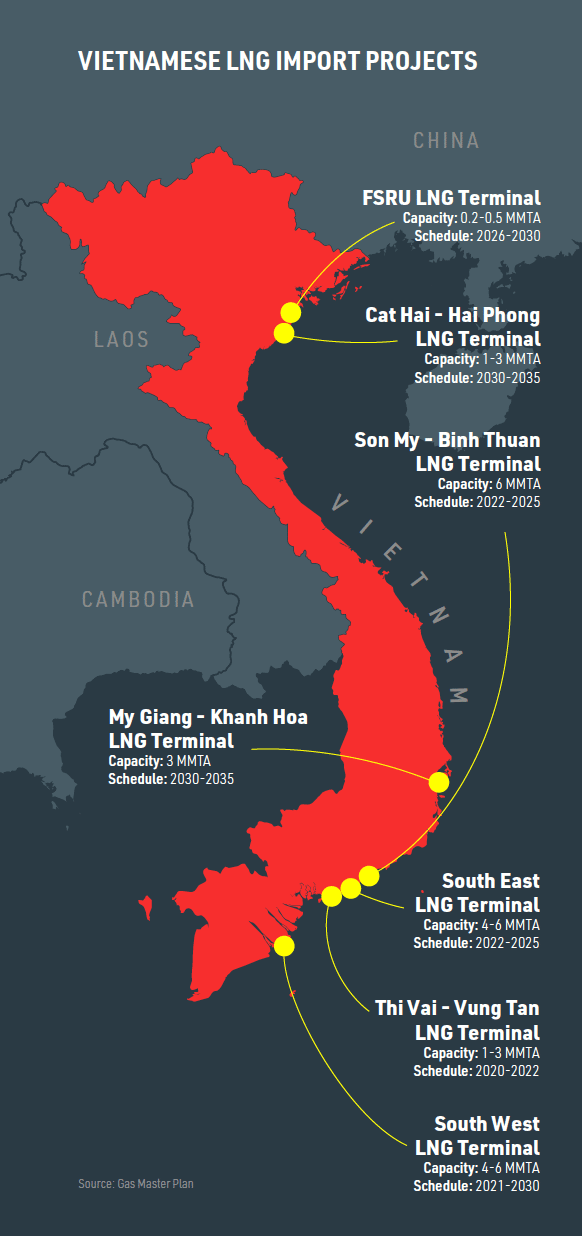

If Japan and the French leave the Arctic LNG 2 project I am certain that Russia will find other customers. For example Vietnam and Turkey.

sepheronx, GarryB and owais.usmani like this post

GarryB- Posts : 41148

Points : 41650

Join date : 2010-03-30

Location : New Zealand

If Japan and the French leave the Arctic LNG 2 project I am certain that Russia will find other customers. For example Vietnam and Turkey.

France and Japan were not in it to help Russia with any charity... they were there to make money and ensure a supply of gas in the case of Japan.

They shouldn't have problems finding investors.

owais.usmani- Posts : 1852

Points : 1848

Join date : 2019-03-27

Age : 38

GarryB likes this post

owais.usmani- Posts : 1852

Points : 1848

Join date : 2019-03-27

Age : 38

ALNG2: Mothballing next?

As I wrote three weeks ago Eikland Energy expected the long-winded commissioning of the GBS1 plant of the heavily sanctioned Arctic LNG 2 project to complete in January. This important milestone seems to have taken place last week as the staggering amount of flaring tailed off. Since mid-November the natural gas equivalent of at least two full cargoes of LNG has been burned. Arctic LNG 2 therefore not only ranks high in terms of media interest, but also as one of the most wasteful LNG plant startups in recent years.

The 'proof of the pudding' of a successful commissioning is in a ship picking up a cargo. There were rumors early this week about the Christophe de Margerie receiving that honor, but it instead sailed off with a Yamal cargo to Zeebrugge. None of the custom-built ships for Arctic LNG 2 are available or near, and sanctions have frozen the Saam and Koryak FSUs. The only solution is a ship/slot-swap with Yamal. But then there is ice in the Northern Shipping Route and Houthi missiles in the Red Sea!

As reported, TotalEnergies this week finally also served notice of Force Majeure as an owner/LNG equity buyer from Arctic LNG 2. Given the US November 3 sanctions on the project and the 31 January deadline for disposition compliance, this was essentially an expected legal technicality (ref. my December analysis). The entire project is now effectively frozen as a Novatek pure-play. It does not make it easier for Novatek, though.

In the complex strategic, logistical and market picture of the day Novatek will have difficulty prioritizing choosing a ship to sail past Yamal LNG to Arctic LNG 2 at Utrenniye. There the ship will be stuck for up to a couple of weeks in commissioning port handling, including ice, loading operations, flow line testing, metering and the like. The opportunity cost will be at least the revenue loss of a cargo from Yamal, but with additional loss due to an LNG price discount and need for management attention. Finding a terminal and a buyer who is not afraid of U.S. sanctions has also gotten harder. Yet, stranger things have happened, and Vladimir V. Putin may also intervene.

Having with great effort - and an unprecedented amount of gas flared for such a plant - the commissioning and operating organization at Utrenniye is undoubtedly very frustrated, being so close to their finishing line. As the disposition deadline of the November 3 US sanctions on Arctic LNG 2 draws closer, throwing in the towel can be a formality after the succession of Force Majeures over the past month. It would not be the first LNG project in the world to be mothballed, formally or not, after commissioning. From my point of view it seems that most key energy market players have already weighted in and moved on with that realization.

owais.usmani- Posts : 1852

Points : 1848

Join date : 2019-03-27

Age : 38

Oil exports at standstill at key Russian terminal after drone attack

Loadings of Russian and Kazakhstan oil onto marine tankers at Russia’s second key export terminal on the Baltic Sea, Ust-Luga, were at a standstill on Monday after captains ordered vessels to be pulled back to the sea due to security concerns, marine traffic data suggests.

At least two drones have been reported in Russian news outlets as being spotted over the gas condensate facilities operated by Russian producer Novatek before explosions took place, triggering widespread fire. The gas condensate plant is located next to the oil export terminal.

The Novatek facilities, where operations were suspended yesterday, and the terminal share a 2.5-kilometre long berth in Ust-Luga where tankers lifting oil, condensate and products moor.

Tankers were pulled back to sea in the early morning on Sunday, immediately after the first explosions took place.

At the time of publishing, no tankers have been seen moored at this berth, according to marine traffic data.

St.Petersburg-based news outlet Fontanka suggested on Sunday that the attack on the Novatek facilities interrupted the scheduled loading of crude oil into two tankers as the vessels were approaching the terminal, assisted by tugs.

These two tankers, Clearocean Apollon and NS Champion, that have combined capacity of more than 1.6 million barrels of oil, remained moored at sea near Ust-Luga as of Monday morning.

Six more tankers have been seen moored to the north of the oil terminal as of Monday morning. The export terminal in Ust-Luga is the second busiest outlet after the oil port of Primorsk on the Baltic Sea, with exports from the site mainly heading to India and China.

The export facility handles sour and heavy oil from Russia and Kazakhstan, known at the market as the Urals blend, that is delivered to the plant via a dedicated trunkline operated by Russia’s state pipeline monopoly, Transneft.

According to Transneft, Russia exported about 680,000 bpd of Russian and Kazakh oil via the Ust-Luga export terminal, and another 890,000 bpd of Russian oil via the port of Primorsk, to international markets last year.

Transneft did not immediately respond to questions by Upstream on the oil loading operations.

lancelot- Posts : 3190

Points : 3186

Join date : 2020-10-17

Big whoop. Two months of flaring. The gas deposits have over a century of gas reserves in them. The gas is being burned. What do they think the final clients would do to the gas when they get it? They will burn it.owais.usmani wrote:"As I wrote three weeks ago Eikland Energy expected the long-winded commissioning of the GBS1 plant of the heavily sanctioned Arctic LNG 2 project to complete in January. This important milestone seems to have taken place last week as the staggering amount of flaring tailed off. Since mid-November the natural gas equivalent of at least two full cargoes of LNG has been burned. Arctic LNG 2 therefore not only ranks high in terms of media interest, but also as one of the most wasteful LNG plant startups in recent years.

The 'proof of the pudding' of a successful commissioning is in a ship picking up a cargo. There were rumors early this week about the Christophe de Margerie receiving that honor, but it instead sailed off with a Yamal cargo to Zeebrugge. None of the custom-built ships for Arctic LNG 2 are available or near, and sanctions have frozen the Saam and Koryak FSUs. The only solution is a ship/slot-swap with Yamal. But then there is ice in the Northern Shipping Route and Houthi missiles in the Red Sea!

As reported, TotalEnergies this week finally also served notice of Force Majeure as an owner/LNG equity buyer from Arctic LNG 2. Given the US November 3 sanctions on the project and the 31 January deadline for disposition compliance, this was essentially an expected legal technicality (ref. my December analysis). The entire project is now effectively frozen as a Novatek pure-play. It does not make it easier for Novatek, though.

In the complex strategic, logistical and market picture of the day Novatek will have difficulty prioritizing choosing a ship to sail past Yamal LNG to Arctic LNG 2 at Utrenniye. There the ship will be stuck for up to a couple of weeks in commissioning port handling, including ice, loading operations, flow line testing, metering and the like. The opportunity cost will be at least the revenue loss of a cargo from Yamal, but with additional loss due to an LNG price discount and need for management attention. Finding a terminal and a buyer who is not afraid of U.S. sanctions has also gotten harder. Yet, stranger things have happened, and Vladimir V. Putin may also intervene."

The issue with the LNG tankers seems pretty simple to solve really. Make the Gazprom Yamal LNG project use the Novatek FSUs. Then the Sovcomflot ice class LNG tankers would only have to move halfway to the final destination. Enabling them to have enough ships to service the Arctic LNG 2 project.

I don't see how the sanctions would stop the Novatek FSUs from working really. The South Koreans delivered them and Novatek moved them to the final location sites in Russian waters. They wouldn't do that if the ships weren't working. If US sanctions make the other Western countries not use the FSUs then so be it. I am certain the Chinese and Turks won't mind getting that LNG. And the Europeans, Japan, South Korea, etc can just pay Uncle Sam for his inflated "freedom gas". Good luck for the Europeans trying to get LNG from Qatar given the current situation near Yemen.

Both Yamal LNG and Arctic LNG 2 gas terminals are right next to each other.

Given we are in Winter they will have to find export markets to the West. Which could be Turkey. There are other possibilities as well like Israel, Mexico, Brazil, Argentina. If you use the FSUs you could use regular non ice class LNG tankers. Of which there should be a lot more available.

owais.usmani wrote:"Loadings of Russian and Kazakhstan oil onto marine tankers at Russia’s second key export terminal on the Baltic Sea, Ust-Luga, were at a standstill on Monday after captains ordered vessels to be pulled back to the sea due to security concerns, marine traffic data suggests.

At least two drones have been reported in Russian news outlets as being spotted over the gas condensate facilities operated by Russian producer Novatek before explosions took place, triggering widespread fire. The gas condensate plant is located next to the oil export terminal.

The Novatek facilities, where operations were suspended yesterday, and the terminal share a 2.5-kilometre long berth in Ust-Luga where tankers lifting oil, condensate and products moor."

Those Novatek LNG liquefaction facilities at Ust-Luga basically serve the European market and have only tiny capacity. They were made with Russian technology so there should be replacement parts for all of it available. It won't make a noticeable dent on Russian gas exports. Russia is probably exporting more gas to China in a week via pipeline right now than those facilities would do in a whole year.

Making the oil tankers stop operating at the oil export terminal is more serious. But whatever. It will also make oil in Europe more expensive at a time when supplies from the Middle East are constrained already. Sucks to be them.

GarryB, franco and kvs like this post

GarryB- Posts : 41148

Points : 41650

Join date : 2010-03-30

Location : New Zealand

But then there is ice in the Northern Shipping Route and Houthi missiles in the Red Sea!

Russia has ice breakers, and the Houthies are not interested in stopping Russian ships that are not going to Israel to support the genocide of Palestinians...

The entire project is now effectively frozen as a Novatek pure-play.

Till the west actually steals Russias foreign reserves and then they can return the favour and take ownership of different companies and their stakes in various assets and projects...

At least two drones have been reported in Russian news outlets as being spotted over the gas condensate facilities operated by Russian producer Novatek before explosions took place, triggering widespread fire. The gas condensate plant is located next to the oil export terminal.

Another opportunity for Russia, there are gas storage sites in the Ukraine that are earning money storing gas for EU countries that could easily be targeted if Kiev wants to play that game.

If US sanctions make the other Western countries not use the FSUs then so be it. I am certain the Chinese and Turks won't mind getting that LNG.

The main reason the Japs joined the project is because they need that gas... I rather doubt Japan will want to say no to Russian gas even with complications from the US... a bit like the US continuing to buy Uranium from Russia at a time when they are demanding their allies cut energy ties with Russia... it is a bit two faced.

Making the oil tankers stop operating at the oil export terminal is more serious. But whatever. It will also make oil in Europe more expensive at a time when supplies from the Middle East are constrained already. Sucks to be them.

Plus attacks by drone on Russian gas and oil resources could lead to Russia responding in kind with real missiles on the holding gas tanks in the Ukraine and other products they get money from the EU over.

kvs likes this post

Kiko- Posts : 4160

Points : 4244

Join date : 2020-11-11

Age : 76

Location : Brasilia

Shipments of the fuel to the South American nation soared by 6,000% last year as Moscow seeks new outlets for its petroleum products.

Russia has unseated the US as the largest exporter of petroleum products to Brazil, the Financial Times reported on Tuesday, citing official government figures and data from the analytics firm Kpler.

As Russia has been focused on finding new outlets for its petroleum products in light of Western sanctions, one of the new buyers has been Brazil.

In 2023, the fellow BRICS member imported 6.1 million tons of Russian diesel fuel worth $4.5 billion in 2023, according to the report. This is up from just 101,000 tons, worth $95 million, in the previous year, a 6,000% increase in terms of volumes.

Meanwhile, Russian shipments of fuel oil to Brazil in 2023 were worth $5.3 billion, up from only $1.1 billion recorded in 2022, marking year-on-year growth of 400%.

According to data tracked by Kpler, Brazil overtook Türkiye in October to become the largest buyer of Russian diesel, while the massive surge in diesel imports recorded in 2023 means Russia has overtaken the US as Brazil’s largest supplier of the fuel.

Meanwhile, the surge in fuel oil exports pushed Russia’s refined petroleum product shipments in the four weeks to December 31 to the highest level in eight months, data from Vortexa and compiled by Bloomberg earlier this month showed.

Brazil’s trade is “influenced by multiple factors” and the significant increase in fuel imports is “the result of decisions made by private agents and follows the logic of supply and demand,” according to the country’s Industry and Foreign Trade Ministry, as cited by FT.

Government officials also told the outlet that the sharp increase in purchases helped keep consumer prices reined in. Low domestic fuel prices also help the country’s massive agriculture sector.

Russia started diversifying its energy supplies in 2022 after the EU, G7, and allies imposed an embargo on seaborne Russian oil along with a $60-per-barrel price cap for insuring and transporting crude in an effort to curb the country’s energy revenues. Similar restrictions were subsequently introduced for exports of petroleum products. As a result, Russian oil producers have rerouted supplies to Asia and Latin America.

https://www.rt.com/business/591596-russia-brazil-diesel-exports-us/

GarryB, kvs and lancelot like this post

owais.usmani- Posts : 1852

Points : 1848

Join date : 2019-03-27

Age : 38

Russia's Novatek on Track to Complete 2nd Train of Arctic LNG 2 in 2024

The final module for the 2nd production line of Russian gas producer Novatek’s Arctic LNG 2 project, departed from China last week. In February the company will integrate the last three modules ahead of towing the LNG train to the Gydan peninsula this summer. While US sanctions have not yet halted construction, it remains to be seen how much LNG Novatek will be able to sell.

In a major step toward completion of the second train - or liquefaction unit - of Russian gas producer Novatek’s Arctic LNG 2 project, the final prefabricated module left a Chinese construction yard bound for Murmansk in the Russian Arctic last week.

A LNG train consists of various components to process, purify, and convert natural gas to liquefied natural gas (LNG).

The module departed from the Penglai Jutal Offshore Engineering (PJOE) yard in Penglai in the Chinese province of Shandong aboard heavy load carrier Hunter Star on 15 January, shipping data and satellite imagery show. Industry sources confirmed to HNN that this shipment concludes module deliveries from China for Train 2.

Earlier in January two modules shipped from the same yard aboard Red Box’s carriers Audax and Pugnax.

Route of Hunter Star (left) and Audax and Pugnax (right) following their departure from the Penglai Jutal Offshore Engineering (PJOE) yard in the Chinese province of Shandong. (Source: Maritime Optima)

Despite a months-long work stoppage by Chinese builders following Western sanctions in 2022, Novatek ultimately managed to secure all modules, including replacing Western turbines with Chinese imports. The modules will now undergo final assembly at the Belokamenka yard outside Murmansk.

The second train could be ready for sail-away this summer. Novatek aims to tow the gravity based structure (GBS) to the Utrenney terminal in Russia in August, explains Ben Seligman, a project specialist for Arctic oil and gas development.

“The main question in my mind would be the status of the LNG membrane storage system within the GBS, given GTT's departure from Russia a year ago,” Seligman cautions.

Gaztransport & Technigaz, or GTT, is a French multinational naval engineering company specializing in membrane containment systems for the transport and storage of liquefied gas.

Significant uncertainty looms

While the delivery of all twelve modules represents a significant step toward completing Train 2, the project’s overall future has become increasingly uncertain following targeted US sanctions. Novatek’s European, Japanese, and Chinese partners have exited the project under force majeure declarations.

The latest round sanctions bar the purchase and transport of LNG from the project. Thus, questions mount who Novatek will sell its LNG to and aboard which vessels it will deliver it. France’s TotalEnergies announced last week that it will not take receipt of any LNG from the project in 2024.

Novatek may try to sell its LNG at a discount on the spot market to buyers in Asia.

“It is possible that prices for sanctioned Russian LNG would be cheaper than for other supplies, but in this case, Chinese importers would have to resell their cargoes from other suppliers and replace them with Russian supply,” explains Jason Feer, global head of business intelligence at Poten & Partners.

“India would be in a similar situation, though they are more price sensitive so discounts on Russian supply may be more attractive."

The project’s future may in part hinge on the ability of Novatek's partners, including China’s state-owned oil major, the China National Offshore Oil Corporation (CNOOC) and China National Petroleum Corp (CNPC), to secure sanction exemptions.

“But China and India may only be able to take Russian cargoes if they can get waivers of sanctions or if ship owners are willing to breach sanctions, which I doubt most are willing to do,” concludes Feer.

Production of LNG at the facility began about 3 weeks ago and storage tanks will reach capacity by the end of January according to industry reporting.

“It remains to be seen how Seapeak, Mitsui O.S.K. Lines (MOL) and Dynagas [operators of the Arc7 LNG carrier fleet. Journ.note] will react once the first cargo is ready to be loaded,” confirms Mehdy Touil, a LNG Operations Specialist, who in the past worked as a senior operator for Novatek’s Yamal project.

The ongoing expansion of the Russia-Ukraine War to include targeting Russian oil and gas infrastructure, including Novatek’s massive Ust-Luga fuel export complex over the weekend, could also complicate the future of the company’s Yamal LNG and Arctic LNG 2 projects.

A dozen shipments across 15 months

The departure of Hunter Star concludes a 15 months effort to transport a dozen modules to Murmansk in the face of a growing sanction regime. The first modules for Train 2 departed from Bomesc Offshore Engineering in China in October 2022, followed by additional shipments throughout the summer and fall of 2023.

In contrast, the delivery of fourteen modules for Train 1 – all constructed and delivered prior to sanctions in 2022 – took only seven months, from August 2021 until February 2022.

Image showing the twelve heavy load carriers that carried modules for Arctic LNG 2. (Photos by Kees Torn, Berg Knot, and Piet Sinke on Flickr.com under CC BY-SA 2.0 and courtesy of Red Box)

Without ice classification Hunter Star is required to take the long way around to Murmansk, either through the Suez Canal or rounding the Cape of Good Hope, rather than traveling the wintry Northern Sea Route (NSR).

In contrast, their polar ice classes permit Audax and Pugnax to travel through the Arctic, with both ships expected to enter the Northern Sea Route this week.

All three vessels are scheduled to arrive at Belokamenka in February with teams preparing skidding and integration operations for the modules on the gravity based structure, sources at the yard tell HNN.

In total a dozen heavy load carriers participated in the transport of the modules for Train 1 and Train 2, HNN data shows.

Shipments of Modules for Train 1 of Arctic LNG 2 by yard, module number, vessel and date. (Source: Author’s own work)

While several Western shipping companies, including Norwegian GPO and Dutch Boskalis, ceased transporting cargo following sanctions, other operators, such as Chinese COSCO and Dutch-Singaporean Red Box, continue lifting modules.

Shipments of Modules for Train 2 of Arctic LNG 2 by yard, module number, vessel and date. (Source: Author’s own work)

And Novatek will likely continue to rely on their services. This year may see the transport of initial modules for the final production line of Arctic LNG 2. The first four modules for Train 3 are nearing completion, satellite imagery shows.

Originally Novatek had planned to construct all fourteen modules for the final train on site at the Novatek Murmansk Plant, but project documents show that at least four modules will now originate in China.

Modules TMR-001 through TMR-004 for Train 3 of Arctic LNG 2 at the Wison yard on 16 January 2024. (Source: Planet.com)

Modules from five yards across China

The construction of Arctic LNG 2 modules – each the size of half a soccer pitch and weighing up to 14,000 tons – is carried out across five yards in China. Each train, or production line, consists of fourteen modules, a Novatek diagram shows.

Diagram showing the arrangement of the fourteen modules on the GBS. (Source: Novatek pre-commissioning, commissioning & start-up execution plan)

After arriving at Belokamenka modules are skidded onto a gravity-based structure and integrated to form the production line. Satellite images of the construction yard illustrate the final assembly of the fourteen modules into Train 1.

Annotated satellite image of Train 1 of Arctic LNG 2 showing each of the fourteen modules June 2023. (Source: Airbus)

For Train 1 all fourteen modules were constructed across China, for Train 2 two modules are produced locally at Belokamenka, with a dozen modules originating in China.

Novatek documents outline the distribution of modules across five Chinese yards.

Bomesc Offshore Engineering was awarded the largest construction contracts for module design and construction with a total contract value of over 6 billion Yuan (US$840m), across three contracts originating in July and November 2019 and June 2021. In total Bomesc was contracted to construct six modules, three for Train 1 and three for Train 2.

The contract comprises modules TMP-002, TMP-005, and TMR-005.

Penglai Jutal Offshore Engineering was also contracted for a total of six modules for Trains 1 and 2; though the modules are slightly smaller than those by Bomesc. The three PJOE modules are compressor modules TMS-003 and TMS-004 and power generation module TMS-005.

Details on module fabrication in China. (Source: Novatek pre-commissioning, commissioning & start-up execution plan)

Wison Offshore Engineering Module Development was contracted to manufacture eight modules, four for each train. The four pipe rack modules (TMR-001 to TMR-004) represent the core of each train and were thus the first modules to be shipped for Train 1 in August and September 2021.

Qingdao McDermott Wuchuan Module Development was contracted to construct three liquefaction modules for the project, with two modules bound for Train 1 and the third bound for Train 2. It constructed modules TMP-003 and TMP-004 for Train 1 and TMP-003 for Train 2.

Cosco (Qidong) Offshore Company constructed a total of three modules for Train 1 and Train 2. These include modules TMS-001 and TMP-001.

Modules TMS-003 to TMS-005 for Train 1 at the PJOE yard. (Source PJOE)

Redesigning the final module

Following Western sanctions Novatek was forced to redesign module 1-TMS-005, which houses the power supply.

A key challenge was the lack of LM9000 gas turbines by supplier Baker Hughes. The American company delivered four out of seven turbines before sanctions kicked in.

As a result Novatek was forced to modify the configuration of Train 1 and completely redesign Train 2.

Satellite images throughout 2023 and from the loading of Hunter Star indicate that work on the original TMS-005 module for Train 2 was abandoned and instead a new module, likely a modified version of TMS-005 to accommodate the Chinese electric motors, was constructed between May 2023 and January 2024.

The original TMS-005 for Train 2 currently remains at the PJOE yard, while Hunter Star loaded the apparent replacement module.

PJOE yard on 14 January 2024 showing loading of the new TMS-005 module under way. (Source: Planet.com)

“There have been various modifications on TMS-003/4/5 to accommodate the electric motors and remove all the piping accessories related to the canceled LM9000s,” confirms an industry source familiar with developments at the Belokamenka yard.

The startup of Train 1 and the likely completion of Train 2 in 2024 indicate that thus far Novatek has been able to overcome the logistical and engineering challenges created by expanding US sanctions.

However, the question remains at which point the costs associated with repeatedly re-designing and re-engineering different aspects of the project become too great for Novatek to continue pushing ahead.

franco and kvs like this post