"The volume of arms trade has reached the highest level"

To whom Russia sells weapons - and who buys them

Mikhail Khodarenok

RIA Novosti

On October 28, the presentation of the Russian-language edition of the Armament, Disarmament and International Security 2020 Yearbook took place. According to the document, Russia increases defense spending and ranks fourth among countries in the world for this indicator. At the same time, Moscow reduces the supply of weapons to Syria, but sharply increases sales to Iraq and Egypt. Due to quarantine restrictions, the presentation of the yearbook was held in absentia. Gazeta.Ru got acquainted with the text of the document before its publication.

The yearbook was prepared by the Stockholm International Peace Research Institute (SIPRI) and the A. EAT. Primakov (IMEMO) RAS . Its preparation was carried out against the background of the crisis in relations between Russia and the West, the collapse of arms control. This led SIPRI Director Dan Smith to emphasize in the introduction that the latest editions of the yearbook had stated "a constant deterioration in the state of international stability."

The editing of the SIPRI-2020 yearbook in Russian was led by Academician of the Russian Academy of Sciences, head of the Center for International Security of the IMEMO RAS Alexei Arbatov and the head of the sector of military-political analysis and research projects of the IMEMO RAS Sergey Oznobishchev .

The document estimates countries' military spending and the global arms trade as of 2019.

Russia is in the top five in military spending

Military spending in 2019 was estimated at $ 1,917 billion, according to the SIPRI yearbook. This is the highest total global military spending on record since SIPRI began assessing it. They accounted for 2.2% of the world's gross domestic product (GDP), or $ 249 per capita.

Total spending in 2019 was 3.6% higher than in 2018 and 7.2% higher than in 2010. Over the past five years, including 2019, military spending in the world has grown annually, and in 2019 it became the largest in a decade. Compared to 2018, military spending increased by 2.6%.

Military spending increased in at least four of the five key regions of the world: in Europe - by 5.0%, in Asia and Oceania - by 4.8%, in the Americas - by 4.7%, in African countries - by 1. 5%.

The rise in total spending in 2019 was largely driven by the structure of military spending by the United States and China, which together account for more than half of all military spending in the world.

In the United States, defense spending grew for two years in a row and by 2019 amounted to $ 732 billion.This is 2.7 times higher than the expenses of the PRC ($ 261 billion), which is the second largest in the world after the United States for this indicator. In China, military spending increased 5.1% over 2018 and 85% over 2010.

Saudi Arabia, which ranked third in the world in military spending in 2018, dropped to fifth in 2019, spending 16% less than the previous year. India's military expenditures in 2019 amounted to $ 71.1 billion, which allowed it to become the third in the list of countries in this parameter for the first time, and Russia moved from fifth to fourth place, increasing its spending by 4.5%.

Buyers and Sellers

“International trade in major conventional weapons increased by 5.5% between 2010-2014 and 2015-2019, reaching its highest level since the end of the Cold War. This growth is a continuation of the sustained growth trend that began in the early 2000s, ”states the SIPRI document.

However, the cumulative arms trade in 2015-2019 was still 33% lower than in 1980-1984, when the supply of arms peaked.

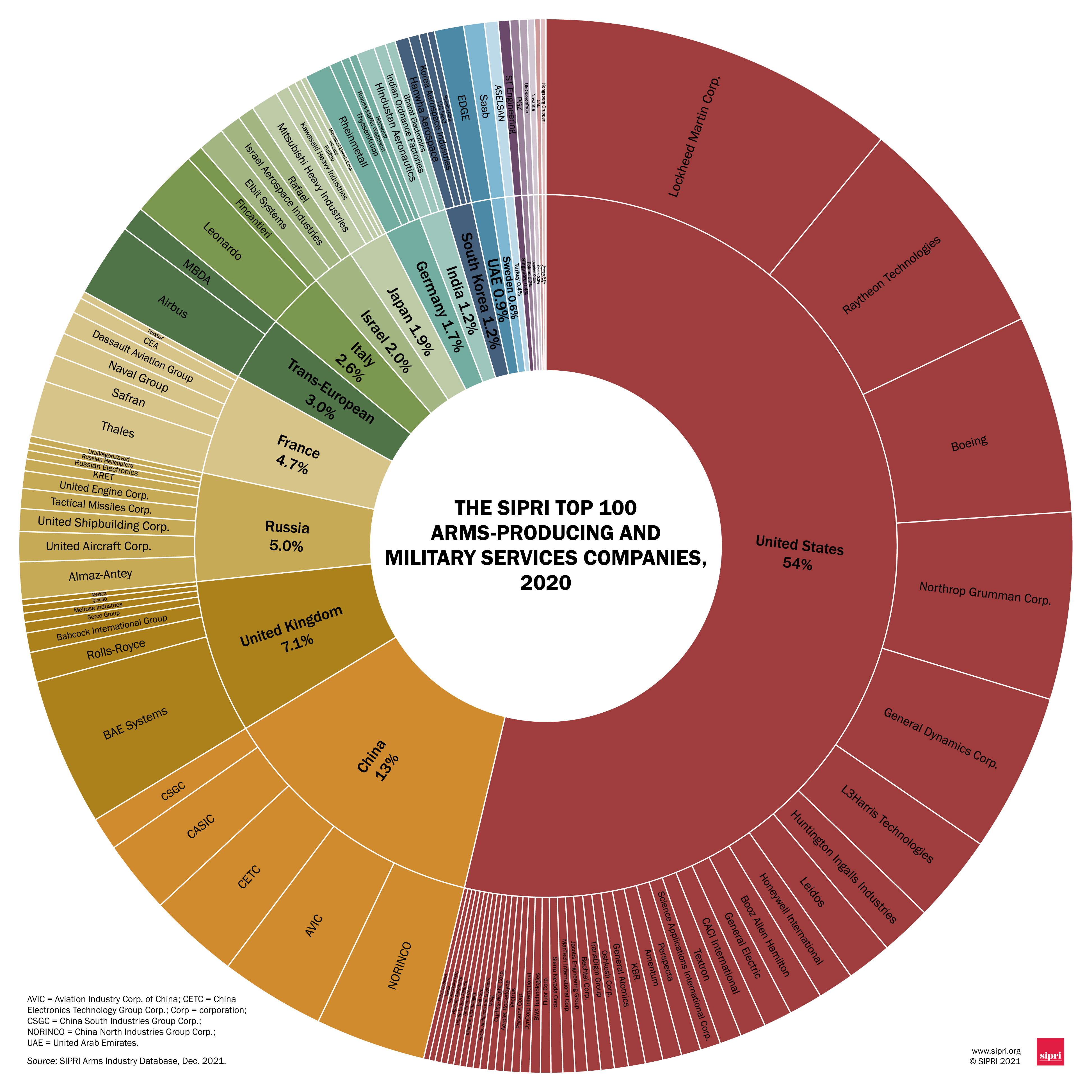

In 2015-2019, the five largest arms suppliers - the United States of America, Russia, France, Germany and China - accounted for 76% of total global exports. Since 1950, the United States and Russia (until 1992 - the Soviet Union) have consistently remained the largest suppliers, far ahead of all others.

In 2015-2019, US arms exports accounted for 36% of total world exports and were 23% higher than in 2010-2014. In turn, Russian arms exports fell by 18%, and their share in the total global volume decreased from 27% in 2010-2014 to 21% in 2015-2019.

The five largest importers, accounting for 36% of total arms imports, were Saudi Arabia, India, Egypt, Australia and China.

Of the regions, the main recipients of weapons in 2015-2019 were the countries of Asia and Oceania, they accounted for 41% of the world's imports of the main types of weapons; followed by the Middle East with 35% of world imports (the highest share of any of the 13 consecutive five-year periods from 1950-1954).

The five largest arms suppliers during this period - the United States, Russia, France, Germany and China - accounted for 76% of all arms exports. The composition of this group of countries did not change in 2015-2019 compared to 2010-2014, but their total exports of major types of conventional weapons were 9.5% higher.

Where does Moscow sell weapons?

In 2015-2019, Russian arms exports accounted for 21% of the total world arms exports. However, its volume was 18% lower than in 2010–2014. In 2015–2019, Russia supplied basic types of weapons to 47 states, with 55% of its arms exports going to three main recipients: India, China and Algeria.

Although India remained the main recipient of Russian arms in 2015-2019, accounting for 25% of total exports, Russian arms exports to India decreased by 47% in 2015-2019 compared to 2010-2014.

At the regional level, most of Russia's arms exports (57%) were in Asia and Oceania, but only China and India accounted for almost three quarters of these exports (41% of total exports).

Similarly, Algeria's significant share of Russian exports (14%) meant that the third largest share of Russian exports (17%) went to African countries.

The countries of the Middle East accumulated the second largest share of Russian exports of major types of weapons (19%). From 2010-2014 to 2015-2019, the volume of Russian exports to this region increased by 30%.

In 2015-2019, Egypt and Iraq were the main recipients of Russian weapons in the Middle East. From 2010-2014 to 2015-2019, supplies to Egypt increased by 191% and accounted for 49% of Russian supplies to the region. Exports to Iraq grew by 212% and accounted for 29% of Russian supplies to the Middle East.

While Russian military forces have operated in Syria since 2015 in support of Bashar al-Assad's government , Russian arms shipments to Syria (including as aid) fell by 87% from 2010-2014 to 2015-2019. Syria accounted for just 3.9% of Russian arms exports to the Middle East and 0.7% of total Russian arms exports in 2015-2019.

In 2015-2019, Russia continued to be the main supplier of weapons to many states of the former Soviet Union. Arms transfers are an important part of military cooperation between Russia and recipient countries from the region, with weapons often provided as aid or on concessional terms.

From 2010-2014 to 2015-2019, the volume of Russian arms exports to some of these states increased significantly. Kazakhstan became the largest recipient of Russian arms among the post-Soviet states, accounting for 5% of all Russian arms exports in 2015-2019 after a fivefold increase. The deliveries included 16 Su-30 combat aircraft and 5 S-300 anti-aircraft missile systems.

In 2015-2019, the volume of Russian arms exports to Belarus was three times higher than in 2010-2014. The S-300 air defense missile systems and the Yak 130 combat training aircraft were exported. Russia was also the main supplier of the main types of weapons to Armenia and the second largest supplier to Azerbaijan; however, the armed conflict between the two countries continued.

NOTE: new release of older numbers

https://www-gazeta-ru.translate.goog/army/2021/10/28/14143879.shtml?_x_tr_sl=ru&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=nui

JohninMK

JohninMK