Yamal LNG produced 100 million tons of LNG

Yamal LNG reports that since the launch of the plant in December 2017, cumulative LNG production has reached 100 million tons.

Yamal LNG became the leading producer in the industry in terms of project implementation and quality of operation: the plant operated 20% above the declared design capacity, while its second and third stages with a capacity of 5.5 million tons per year each were fully commissioned significantly ahead of original schedule. A significant contribution to the successful implementation of the project was the additional fourth stage with a capacity of 0.9 million tons per year based on the proprietary liquefaction technology of the Arctic Cascade, developed by NOVATEK. Yamal LNG's share in global LNG production is 5%.

Yamal LNG operates a natural gas liquefaction plant with a capacity of 17.4 million tons per year, consisting of three LNG lines of 5.5 million tons each and one LNG line with a capacity of 900 thousand tons per year, using the hydrocarbon resources of the Yuzhno-Tambeyskoye field in the Russian Arctic.

Russian hydrocarbon (Oil and Gas and Coal) Industry: News #4

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

GarryB, zardof and Broski like this post

Kiko- Posts : 3871

Points : 3947

Join date : 2020-11-11

Age : 75

Location : Brasilia

Urals blend continues to be the cheapest crude available despite narrowing discounts, the newspaper says.

India will remain a major buyer of Russian oil even as the discount on the country’s flagship Urals blend shrinks, the Kommersant business daily reported on Friday.

Russian oil will maintain its competitive advantages on the Indian market despite the Urals discount to Brent shrinking to $4–5 per barrel, the paper said, citing data from energy analytics company Kpler.

India’s consumption of Russian crude has soared since last year, ousting traditional Middle Eastern suppliers Saudi Arabia and Iraq from the top spots. Discounts offered by Moscow have also enabled India to become a major exporter of oil and petroleum products.

In March, Russia’s largest oil producer, Rosneft, signed an agreement with Indian Oil Corp, the country’s top refiner, to substantially increase supplies and diversify oil grades delivered to the country. Moscow and New Delhi also agreed to use the Asia-focused Dubai oil price benchmark in their latest deal, abandoning the Europe-focused Brent benchmark.

In May, Russia accounted for 46% of India’s total oil imports, compared to less than 2% imported prior to the Ukraine conflict.

Western nations have widely criticized New Delhi for buying cheap Russian fuel. In May, the EU’s chief diplomat Josep Borrell urged the bloc to crack down on India re-exporting refined Russian oil into the EU.

Meanwhile, the executive director of India’s top oil company ONGC believes purchases of Russian crude are good for India and the global economy.

“By importing from Russia, India also has helped the global economy in the sense that [we] freed up some oil on the Gulf for other countries to source, particularly Europe. So it was kind of a win-win situation,” K.C. Ramesh said at the annual APPEC energy conference in Singapore on Wednesday.

Rising global crude prices, driven by Russia and Saudi Arabia’s production and export cuts, have squeezed the discount on Russian crude, prompting some Indian officials to claim that the country would decrease its reliance on barrels from Moscow in favor of Middle Eastern suppliers. However, even the cheapest Saudi Arab Heavy grade costs $7.5 per barrel more than Urals, while Iraqi Basrah Medium oil costs $7 more per barrel. The Saudi standard Arab Light blend, which is similar to Urals, costs $10 more, figures showed.

Russian crude shipments to India have slipped from their record highs in the past few weeks largely due to a seasonal fall in demand and maintenance outages. However, experts are predicting a rebound to follow.

https://www.rt.com/india/582572-india-russian-oil-price-rise/

GarryB, zardof and Broski like this post

caveat emptor- Posts : 2009

Points : 2011

Join date : 2022-02-02

Location : Murrica

Novatek is a great example of a development of company in hydrocarbon sector with competent professional leadership and a vision.owais.usmani wrote:https://pro-arctic.ru/08/09/2023/news/46946#read

Yamal LNG produced 100 million tons of LNG

Yamal LNG reports that since the launch of the plant in December 2017, cumulative LNG production has reached 100 million tons.

Yamal LNG became the leading producer in the industry in terms of project implementation and quality of operation: the plant operated 20% above the declared design capacity, while its second and third stages with a capacity of 5.5 million tons per year each were fully commissioned significantly ahead of original schedule. A significant contribution to the successful implementation of the project was the additional fourth stage with a capacity of 0.9 million tons per year based on the proprietary liquefaction technology of the Arctic Cascade, developed by NOVATEK. Yamal LNG's share in global LNG production is 5%.

Yamal LNG operates a natural gas liquefaction plant with a capacity of 17.4 million tons per year, consisting of three LNG lines of 5.5 million tons each and one LNG line with a capacity of 900 thousand tons per year, using the hydrocarbon resources of the Yuzhno-Tambeyskoye field in the Russian Arctic.

If Russia is really willing to change own economy, as touted, first steps would be a complete change of management in both hydrocarbon giants, Gazprom and Rosneft. Especially Rosneft. There is enough highly qualified people throughout O&G and chemical industries to turn those underperforming giants into real engines of growth and innovation.

owais.usmani likes this post

higurashihougi- Posts : 3401

Points : 3488

Join date : 2014-08-13

Location : A small and cutie S-shaped land.

Spain is increasingly relying on Russian natural gas even though its overall imports are falling, government data showed on Friday.

Spain's imports from Russia soared 65% in July from the same month a year ago, while the country imported 14% less gas during the month, Cores, an arm of the Energy and Environment Ministry, said in a statement.

As a result the share of Russian gas out of the total imports - Spain relies entirely on foreign gas - rose to 28% in July up from 14.5% in the same month in 2022.

GarryB and zardof like this post

GarryB- Posts : 40520

Points : 41020

Join date : 2010-03-30

Location : New Zealand

Another amateurish video. Especially funny is "now we are going to show them" theme that permeates every their video.

Amateurish? More facts than the BBC, ABC, Fox News and any other western news agency combined.

There is a bit of pride there, but why not... the west has been screwing Russia for decades, it is nice to disconnect the leeches from the victim...

flamming_python, kvs, T-47, Hole and Broski like this post

flamming_python- Posts : 9521

Points : 9579

Join date : 2012-01-30

caveat emptor wrote:Another amateurish video. Especially funny is "now we are going to show them" theme that permeates every their video.

But we are going to show them, cavity. And are showing them. And have been showing them

What I can see in my crystal ball is - an endless stream of yet more disappointments and unwelcome surprises coming out of Russia for Western analysts, politicians, economists, journalists and the rest of this rabble.

GarryB, kvs, Hole and Broski like this post

caveat emptor- Posts : 2009

Points : 2011

Join date : 2022-02-02

Location : Murrica

Look at Rosneft. Over 60% of revenues is coming from selling raw oil. Biggest part of refined product is of the lowest kind, fuel oil. Oil refining depth of Rosneft's refineries in Russia is below 75%. For example, Lukoil has over 90% oil depth refining rate. How's that for showing them?

Or, even worse statistics,while sitting on world class hydrocarbon and other assets in the country, petrochemical/chemical industries account for only 1% of GDP. You're showing them all right.

No, let's still talk about the 90's and blame Bill Browder that was kicked out almost 20 years ago.

flamming_python- Posts : 9521

Points : 9579

Join date : 2012-01-30

caveat emptor wrote:Show them what exactly? Best way of showing them was to develop. Making videos like these is just childish. Nothing else. Your government willingly accepted part of Russia being just a supplier raw commodities.

Look at Rosneft. Over 60% of revenues is coming from selling raw oil. Biggest part of refined product is of the lowest kind, fuel oil. Oil refining depth of Rosneft's refineries in Russia is below 75%. For example, Lukoil has over 90% oil depth refining rate. How's that for showing them?

Or, even worse statistics,while sitting on world class hydrocarbon and other assets in the country, petrochemical/chemical industries account for only 1% of GDP. You're showing them all right.

No, let's still talk about the 90's and blame Bill Browder that was kicked out almost 20 years ago.

YouTube is full of videos showing Russians strolling the clean, sparkling and renovated streets of Russian cities in the summer. Vacationing in the Crimea, Moscow with its skyscrapers, St. Petersburg with its restored historical buildings. But even smaller cities such as Rostov on Don, Samara, Krasondar, Vladivostok, Ekaterinburg, Kazan all look fabulous

It was the raw commodities money that paid for that. Also what paid for the financial cushion that has shielded Russia from every economic sanction and attack made against it. Also it was that money which was reinvested into agriculture, shipbuilding, railroads, airports and plenty of other economic sectors and infrastructure in order to give Russia a foundation for economic growth this decade.

I see plenty of progress and development. Long may it continue, and long may it lead to the chagrin of the Kremlin's former 'Western partners'. For we all know that it does, with or without such videos. And if the progress may seem disappointing to you, then that's only because you aren't paying attention. Or indeed, have underestimated the impact of not only the 90s, but the mess in the 80s before that, or admittedly the complacency of Russian elites in the 2000s too. But that's all in the past now.

sepheronx, GarryB, kvs, ALAMO, Hole, lyle6 and Broski like this post

caveat emptor- Posts : 2009

Points : 2011

Join date : 2022-02-02

Location : Murrica

flamming_python wrote:

YouTube is full of videos showing Russians strolling the clean, sparkling and renovated streets of Russian cities in the summer. Vacationing in the Crimea, Moscow with its skyscrapers, St. Petersburg with its restored historical buildings. But even smaller cities such as Rostov on Don, Samara, Krasondar, Vladivostok, Ekaterinburg, Kazan all look fabulous

It was the raw commodities money that paid for that. Also what paid for the financial cushion that has shielded Russia from every economic sanction and attack made against it. Also it was that money which was reinvested into agriculture, shipbuilding, railroads, airports and plenty of other economic sectors and infrastructure in order to give Russia a foundation for economic growth this decade.

I see plenty of progress and development. Long may it continue, and long may it lead to the chagrin of the Kremlin's former 'Western partners'. For we all know that it does, with or without such videos. And if the progress may seem disappointing to you, then that's only because you aren't paying attention. Or indeed, have underestimated the impact of not only the 90s, but the mess in the 80s before that, or admittedly the complacency of Russian elites in the 2000s too. But that's all in the past now.

Russian commodity and material base is so large that these are poor trade offs. You are being sold short. Country is certainly better than in the 90's, but that was not the point of my post. And comparison to the 90's are a low bar indeed. Point is a gross mismanagement of state owned assets. Let's talk numbers, as this is where it is best shown.

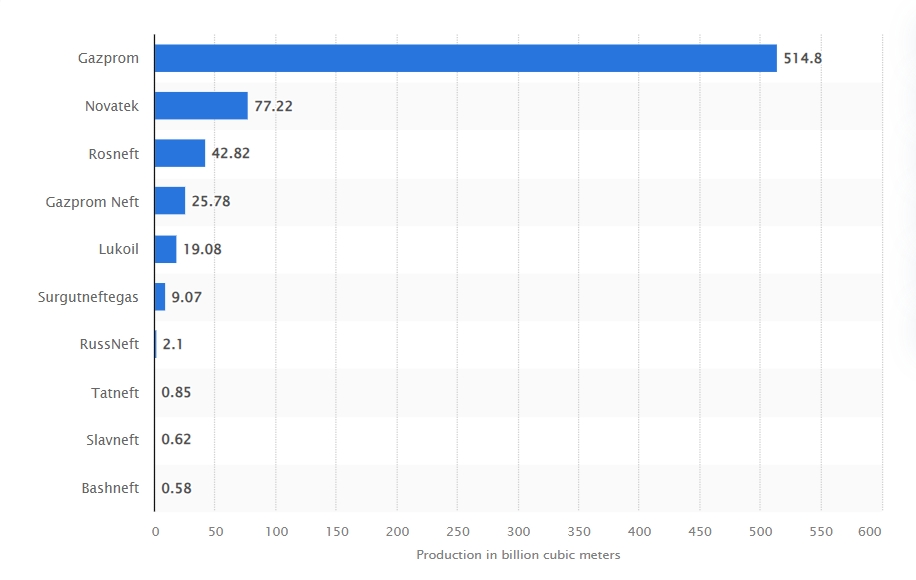

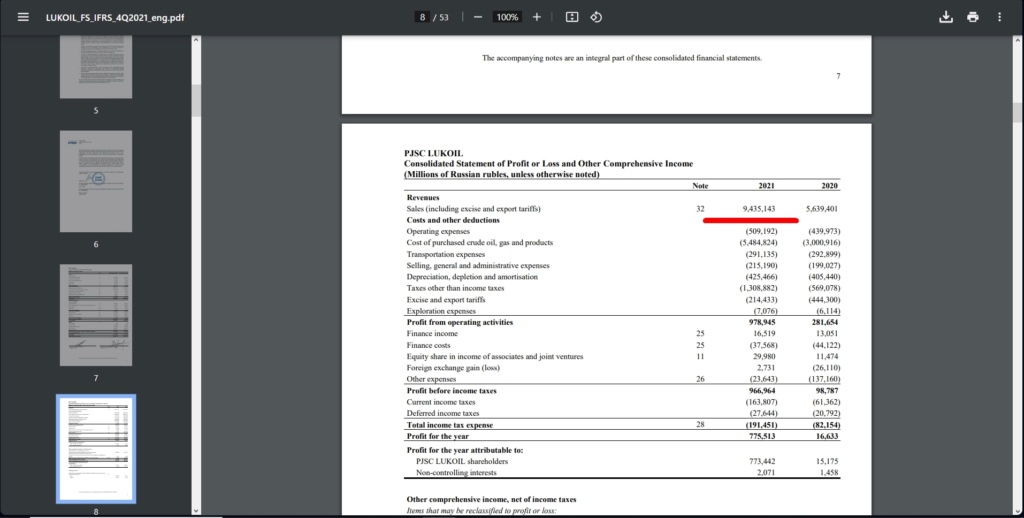

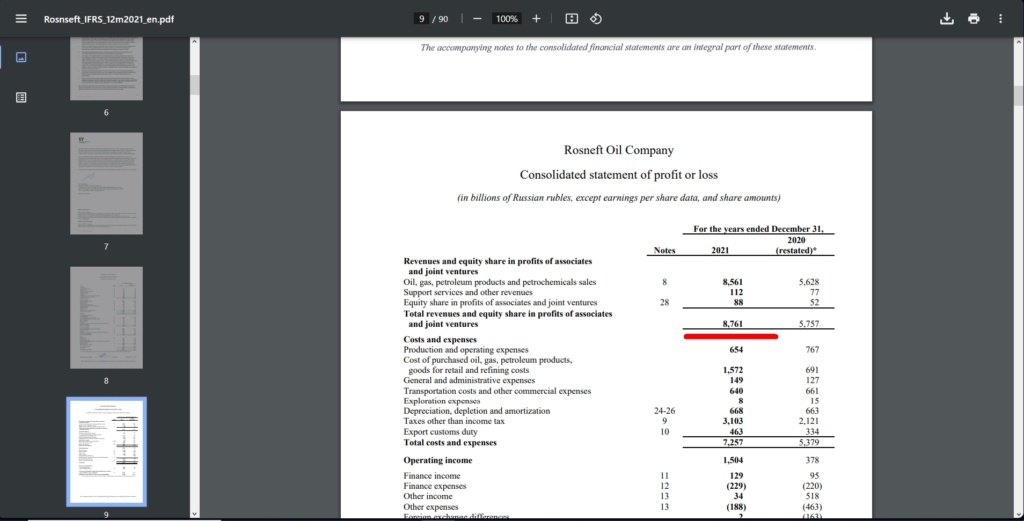

Small example of bad management: Rosneft vs Lukoil production numbers

vs revenues (2021 numbers).

While having best assets in oil producing regions (many legacy production sites from Soviet times with oil extraction cost of under $20), Rosneft manages to get less revenues than Lukoil, thanking to their strategy of selling crude oil and bad oil depth processing. Combination of low capital investment and low extraction cost makes for good profit margin on the first look, but it does huge disservice to the country's overall industrial development. Not to mention that they have one of the worst operational records with most oil spills and accident of all majors working in Russia. One would think that Sechin was siphoning money out of Russia with such levels of mismanagement.

But, this is what you get when you have incompetent leadership, which only quality is prior relationship with Putin. Employ competent professional management and you will get a smaller version of Aramco in 10 years.

owais.usmani likes this post

caveat emptor- Posts : 2009

Points : 2011

Join date : 2022-02-02

Location : Murrica

Employ professionals at the top of the companies and try to keep politics out, as much as possible, and you will get two engines of growth for whole economy.

owais.usmani likes this post

GarryB- Posts : 40520

Points : 41020

Join date : 2010-03-30

Location : New Zealand

Show them what exactly? Best way of showing them was to develop. Making videos like these is just childish. Nothing else. Your government willingly accepted part of Russia being just a supplier raw commodities.

Showing them that the west is wrong and that Russia is more than a gas station with nukes.

It is not enough just to be a 21st century power house... you need to talk about it... right now the west is in its second worst position because Russia is waking up... the only way this could possibly get worse for them if for Russia and Russians to talk about their success without the west or despite all the efforts of the west to damage Russia.

Russia signed a lot of contracts they shouldn't have, but at the time they had no navy and no armed forces and no commercial shipping so the only trade partners they could possibly have was on their borders and the west has encroached to the point that they are Russias borders.

Much of that was corruption and that corruption was encouraged by western backers and no doubt the CIA as well because they benefited enormously from that.

Well now Russia has finally found their feet but still did not want to push away from the west... it was and is the west pushing away from Russia... they thought Russia would collapse when they did this and then they could name their terms which would rob Russia even more of its resources, but they were wrong.

Not only has Russia survived but Russia is actually benefiting from the separation, which is even more reason to celebrate.

If the west had its way no one would know anything about Russia except what they tell them... a dingy old hole of backward drunks who copy western stuff badly.

Videos like this show problems and errors of the past being addressed and corrected and should be posted to the rest of the world because for a start it reveals that information from western sources is propaganda bullshit, and secondly it shows that countries can exist without the west.

Russia has an advantage of resources and natural wealth, but for a smaller country they used to need ties with the west to access everything they needed to grow and develop... the problem of course is that western companies would sweep in and buy up anything that made money and suck the income that generated out of that country to Ireland or Cyprus or Panama or whereever they put their HQ to avoid paying taxes.

Russia can't save these countries on its own, but BRICS has people and resources and money and is an alternative to the west already because China is the wests production sweatshop and Russia used to be their resource cupboard.

So when people in the rest of the world hear from CNN and the BBC that Russia is collapsing and suffering more than western countries and they watch these videos they start to question if western media is telling the truth.

Honestly as a young man I actually believed most of the western point of view of everything... the world wars etc etc, but now as an adult I see all the bullshit about everything I realise what I thought I knew is probably not even nearly true.

Look at Rosneft. Over 60% of revenues is coming from selling raw oil. Biggest part of refined product is of the lowest kind, fuel oil. Oil refining depth of Rosneft's refineries in Russia is below 75%. For example, Lukoil has over 90% oil depth refining rate. How's that for showing them?

You produce what you sell, they have been selling raw materials to customers so that is what they produce. No doubt their European customers would be doing everything in their power to encourage Russian companies to maintain the status quo... simply because that is what benefitted them... remember Russia has no shipping fleet... they didn't even set the price of the damn oil they were selling, but now that things are changing and they are selling around the world to customers who want finished products rather than raw materials then it becomes worth their while to start looking at such things.

Previously it wouldn't make sense because their product was a raw product that was spoken for.

Or, even worse statistics,while sitting on world class hydrocarbon and other assets in the country, petrochemical/chemical industries account for only 1% of GDP. You're showing them all right.

You are looking back at where Russia was and ignoring where they are now and where they are headed... these videos are about all three...

Why have a petrochemical industry if your raw material gets exported for processing... just the same as how can you justify wasting money on domestic food production when you get cheap food from the EU... investments in Russia for food production wont be able to compete and would be a waste of money.

Change of situation in both cases and now the petrochemical industry would be a good place to invest and food production is also a booming industry too for domestic use and export... Russian companies can benefit from Russias cheap raw resources and create finished products they can sell at enormous profits, or moderate profits that destroy western petrochemical industries by undercutting their prices by significant margins.

India complained at the loss of discounts on oil and said they would stop buying Russian oil... but they never bought Russian oil... they bought the cheapest... and when it was discounted they bought it and now it is not discounted... it is still the cheapest so they will continue to buy.

No, let's still talk about the 90's and blame Bill Browder that was kicked out almost 20 years ago.

All the assets and resources and companies were created in the 90s... that is when the Russian industries were infiltrated with foreign and domestic enemies of the state.

It was the raw commodities money that paid for that. Also what paid for the financial cushion that has shielded Russia from every economic sanction and attack made against it. Also it was that money which was reinvested into agriculture, shipbuilding, railroads, airports and plenty of other economic sectors and infrastructure in order to give Russia a foundation for economic growth this decade.

It is great to see the transformation, but still a little sad to know you only got a fraction of what it was all worth with theives fleeing to the west to be called heros with billions of dollars in Russian wealth to be squandered on english soccer teams and other such meaningless BS.

At least things are being sorted out now... and hopefully more Russians get the benefit...

Country is certainly better than in the 90's, but that was not the point of my post. And comparison to the 90's are a low bar indeed.

The 90s is where the current Russia came from, and Russia has been growing and developing solidly ever since.

Despite all the 5th columnists and bastards and of course the west.

Point is a gross mismanagement of state owned assets

Hahahahahaha... that is the standard cry in the west... the government is mismanaging assets... the solution is to privatise of course so some rich foreigner can buy it for peanuts and then milk it for all the money they can which goes to the new owner who hires all the best lawyers and all the best accountants who buy failing companies making huge losses to they can count against the huge profits so they end up not paying any tax at all... yeah... even a badly managed government run company provides jobs and good income for thousands of workers... when you privatise you lose any profit it was making and most of the workers get fired so you lose that income tax too.

Point is a gross mismanagement of state owned assets

Wow... how could a company that was selling cheap raw materials compete with an oil company that was not selling cheap oil to cheap bastards?

How about we give them the benefit of the doubt... Russia has clearly showed it is no longer going to be Mr Nice guy that the west just walks all over... that alone should give a real boost to profitability.

It is a wait and see thing.

kvs, zardof, Hole and Broski like this post

Kiko- Posts : 3871

Points : 3947

Join date : 2020-11-11

Age : 75

Location : Brasilia

MOSCOW (Sputnik) — Brazil increased the import of petroleum products from Russia last August to 920,000 tons, which is three times more than the volumes purchased from the United States, according to the Brazilian customs database.

Calculations indicate that last month, Brazil increased purchases of petroleum products from Russia 2.1 times, at the same time, the cost of imports rose 2.4 times, to $672.8 million. For Moscow, this is an absolute record of shipments to Brasilia both in monetary and absolute terms.

The second largest supplier was the United States, which reduced exports by a third, to 311,300 tons, while its revenues decreased by 25%, to $281.2 million.

The third place was occupied by India, from there, Brazil imported 164,500 tons of petroleum products worth $155.2 million, which is 2.6 times more in absolute terms and 3.1 times more in monetary terms than the previous month.

In addition, more than 100,000 tons of petroleum products were delivered to Brazil by the Netherlands, Peru and Saudi Arabia.

Yandex Translate from Spanish.

https://sputniknews.lat/20230910/rusia-aumenta-exportaciones-de-productos-petroliferos-a-brasil-superando-a-eeuu-1143556135.html

GarryB, kvs, LMFS, owais.usmani and Broski like this post

Kiko- Posts : 3871

Points : 3947

Join date : 2020-11-11

Age : 75

Location : Brasilia

Consumers in Europe are still buying, as well as new partners in Southeast Asia, Nikolay Shulginov says.

Liquefied natural gas (LNG) exports from Russia have been steadily growing since the beginning of the year, with demand on the rise in both Europe and Asia, Energy Minister Nikolay Shulginov has announced. Speaking at the Eastern Economic Forum (EEF) that kicked off in Vladivostok on Sunday, the minister outlined that demand for Russian pipeline natural gas has always been greater than for LNG.

However, the latter may soon catch up due to LNG exports being “more efficient and flexible compared to pipeline supplies,” he added.

“[LNG exports] are already showing positive dynamics. We are talking about a few percent, but nevertheless. There are buyers of Russian LNG all over the world. And it is not only our new partners in Southeast Asia, but also consumers in Europe,” Shulginov stated.

According to Russia’s statistical agency Rosstat, the country’s LNG production rose 8.1% to 32.5 million tons in 2022. Shulginov noted that Russia's current LNG output is not enough to meet the growing demand, suggesting that the country needs new gas liquefaction lines as all existing capacities are loaded.

“We have adopted a program to increase LNG production to 100 million tons per year by 2030. I have high hopes for Arctic LNG 2, where the installation of the first production line is already underway. The line will reach its full capacity – about 6.8 million tons – next year. We are also discussing a new LNG plant in Murmansk, with three liquefaction lines of 6.8 million tons each,” the minister said.

According to a recent report by think-tank Global Witness based on Kpler data, China was the largest buyer of Russian LNG in January-July this year, followed by Spain and Belgium. The EU’s purchases of Russian LNG surged by 40% in the reporting period compared to the same period in 2021 and by 1.7% against last year.

The bloc has so far stopped short of sanctioning Russian gas imports, but introduced a number of measures that limited the inflow of Russian gas supplies and announced plans to scale down imports of Russian energy by 2027. However, based on the current trade flows, Global Witness analysts predict that EU countries will import record volumes of LNG from Russia in 2023.

https://www.rt.com/business/582691-growing-global-demand-russian-lng/

GarryB, flamming_python, kvs, zardof, Hole and Broski like this post

Kiko- Posts : 3871

Points : 3947

Join date : 2020-11-11

Age : 75

Location : Brasilia

Spain's dependence on natural gas of Russian origin grew over the first seven months of 2023, according to a report by the Corporation for Strategic Reserves of petroleum products.

According to the report, in July alone, Spanish imports of natural gas from Russia exceeded 65% compared to the same period in 2022.

In the period between January and July 2023, Spain imported a total of 49,909 GWh of gas from Russia, suggesting an increase of 70% compared to the same period in 2022, when 29,333 GWh were imported.

Thus, Russia has already become the second largest supplier of natural gas to Spain, behind only Algeria, but ahead of the USA and Nigeria.

Yandex Translate from Portuguese

https://sputniknewsbr.com.br/20230911/russia-supera-eua-e-vira-2-maior-fornecedora-de-gas-na-espanha-30254298.html

GarryB likes this post

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

Russia is there to wipe their asses.

Hole- Posts : 11116

Points : 11094

Join date : 2018-03-24

Age : 48

Location : Scholzistan

GarryB, flamming_python, T-47, owais.usmani, lyle6 and Broski like this post

GarryB- Posts : 40520

Points : 41020

Join date : 2010-03-30

Location : New Zealand

Besides.... timing is everything... when the Ukraine army collapses HATO might think of sweeping in and joining the fight... they have spent over 100 billion on this conflict in the last year and a half and probably rather more than that before in bribes and training etc etc all on the sly.

Spending another 100 billion on a mercenary army... Blackwater et all... plus thugs from all over who want to earn good money... they might put together a sizable force... very much an Expendables type force...

It is in the middle of the winter when the west introduces something rather objectionable like say F-16s that they cut off the gas and the Uranium all at once and declare they will only return to selling energy to the EU and US if the EU and US and HATO stop funding and supporting Kiev... that would be a win win situation for Russia... if they stop supporting Kiev it will collapse in a week and have incredibly bitter feelings towards the west with all its promises of forever support... they only promise forever support is because they have a history of leaving such allies high and dry and they run away. If they refuse to stop supporting Kiev then the west will have another cost increase and people are going to suffer for the vanity of their governments... how long will they put up with that... who cares... not a problem for Russia.

Reducing exports increases the price and improves profits.

Broski likes this post

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

Transport of LNG Modules to Russia Continues, Calling Effectiveness of EU Sanctions Into Question

Russia’s natural gas company Novatek continues to receive prefabricated modules from China for its Arctic LNG 2 project. While EU sanctions seemingly prohibit their transport a Dutch shipping company continues to aid in their delivery.

A year and a half into the Western sanctions regime against Russia it is becoming clear that initial expectations regarding their impact on the country’s Arctic LNG 2 project were exaggerated.

In contrast to widespread reporting thoughout 2022 that companies would no longer transport key prefabricated modules for Novatek’s Arctic LNG 2 from China to Russia, their deliveries continue.

Dutch Red Box Group, owner and operator of two ice-capable heavy lift carriers, Audax and Pugnax, has completed several shipments during 2022 and 2023, a HNN analysis of shipping records shows.

Pugnax loaded modules at a construction yard north of Shanghai two weeks ago and entered the Northern Sea Route (NSR) with destination of Novatek’s Belokamenka yard last week. Meanwhile, Audax completed a recent delivery and is returning to Asia via the NSR.

Prohibits supply of LNG technology

The EU’s 5th sanction package passed in April 2022 sets forth broad prohibitions for the transfer of technology for liquefaction of natural gas (LNG), including the “supply, transfer, or export, directly or indirectly, goods and technologies suited for use in the [...] liquefaction of natural gas.”

When sanctions took effect experts highlighted how Russia relied on a fleet of Western heavy-lift carriers to transport its large prefabricated modules from yards across China to the construction yard near Murmansk.

As a result of the sanctions package, industry reporting throughout 2022 indicated that sanctions would impact transport charters for modules as “Western heavy-lift shipping companies start[ed] to terminate contracts to transport modules.”

In-depth studies on the impact of sanctions on Russia’s Arctic energy projects similarly stated that “contracted shipping services by Western countries [would] stop for future projects.”

EU companies remain involved

According to Red Box Energy Services’ website, owner and operator of the two vessels, the company is headquartered in Rotterdam, Netherlands, although it also maintains offices in Singapore.

“The Red Box Energy Services’ website explicitly mentions the company is headquartered in Rotterdam… as such, the company is legally European and thus could be easily targeted by EU sanctions,” confirms Frédéric Lasserre, professor of political geography and geoeconomics at Laval University whose research focuses on strategic issues of water management and law of the sea issues.

Neither Rex Box nor the Dutch government responded to inquiries how a Netherlands-based company may continue transporting LNG modules under the existing sanctions regime.

Shipping records show that Protection & Indemnity (P&I) insurance for the two vessels is provided by The Ship owners' Mutual P&I Association (Luxembourg), a mutual insurance association, further highlighting how European companies continue to, at least indirectly, provide services which aid in the further development of Russian LNG resources.

LNG tankers carrrying Russia gas also received services and exchanged crews in Norwegian waters earlier this year.

Possible loopholes in the sanctions

Red Box may be using its own interpretation of the sanctions, which does not explicitly talk about the ‘transport’ of LNG technology.

“The sanctions [could] merely apply to the producer/reseller of the technology and do not target the transportation service. It could appear that this is Red Box’s interpretation,” elaborates Lasserrre.

The EU may also have elected to not enforce this aspect of sanctions having kept it sufficiently vague.

“One reason for that could be that the EU never wanted to halt Russian gas production. We should recall after all that it was Moscow, not the EU, that turned the taps off for pipeline gas from Russia to the EU, triggering a frenzy of LNG purchases notably from Russia, even more so from Norway, Qatar and the US. Talks of enacting a Russian LNG import ban in Spring 2023 never materialized,” concludes Lasserre.

Red Box Energy Services isn’t the only Western company transporting modules prior to the war, but it is the only one left offering its services to aid in the completion of Arctic LNG 2.

In addition to Red Box, Norwegian GPO Heavylift also provided shipping services to Novatek in the past. Its semi-submersible GPO Grace, one of the most advanced in the world, delivered a 50,000 tons module across the Arctic in 2021.

In contrast to the Dutch operator, the company appears to not have transported modules from China for Novatek since the full-scale invasion of Ukraine.

As with other aspects of the development of Arctic LNG 2, Russia relies on its expanding energy partnership with China. A Chinese-owned heavy lift carrier, Fan Zhou 10, is sailing approximately a week ahead of Pugnax also carrying modules bound for the yard near Murmansk.

GarryB, flamming_python, kvs, zardof and Broski like this post

JohninMK- Posts : 15620

Points : 15761

Join date : 2015-06-16

Location : England

Gazprom Export to stop supplies of gas to households in Bulgaria as of Jan 1 SOFIA, December 30. /TASS/.

Russian company Gazprom Export stops supplies of gas to household customers in Bulgaria as of Friday, January 1, Jacquelin Cohen, the CEO of the Bulgarian Energy Holding EAD said on Wednesday. He said in an interview with the national television that Gazprom Export had no plans to deliver gas to its Bulgarian partner, Overgaz, as of January 1, as followed from an official letter the Bulgarian side received on Thursday. The problem might have a bearing on about 200,000 household customers who consume 1.5 million cubic meters (mcm) of the fuel. Bulgaria’s average consumption stands at 11 mcm to 13 mcm.

The BEH will have an opportunity to make up for this shortage of gas by using fuel from the reserves, Cohen said in a comment on an emergency meeting that Prime Minister Bojko Borisov had earlier on the same day with the heads of the country’s energy companies.

kvs and Broski like this post

GarryB- Posts : 40520

Points : 41020

Join date : 2010-03-30

Location : New Zealand

kvs, Hole and Broski like this post

JohninMK- Posts : 15620

Points : 15761

Join date : 2015-06-16

Location : England

GarryB wrote:The Russians have no choice, the Ukrainians have said they are not going to renegotiate a new deal with the people who invaded their country... so transport of gas and oil across Ukraine territory will cease when the current contract expires.

A disaster for many EU countries this winter. It could finally kill off many industries still dependent on gas in volume.

GarryB and Broski like this post

JohninMK- Posts : 15620

Points : 15761

Join date : 2015-06-16

Location : England

A significant event that could trigger tectonic shifts in global maritime trade occurred in the north of our country. For the first time, it was possible to navigate two non-specialized oil tankers along the Northern Sea Route (NSR), which caused real hysteria in the West. Previously recognized as an undesirable organization in the Russian Federation, Greenpeace is so worried about the risks of an oil spill in the Arctic that it literally cannot eat. True, he previously criticized the use of fortified ice-class vessels in the same way, so perhaps it is not only and not so much a matter of concern for the environment.

The concern of Western lobbyists can be explained very simply: the NSR, which lies entirely in Arctic waters and is controlled by Russia, is a short route to China. The usual route through the Suez Canal takes almost a quarter longer and goes far from Russian shores. Western analysts claim that savings on fuel alone amount to about $500 thousand per flight. And this does not take into account the cost of freight, passage through Suez and other expenses.

It’s funny that in the West they explain the development of the NSR by global warming, but for some reason they ignore the colossal work carried out by Russian scientists and researchers in laying out the route and monitoring ice conditions.

In 2022, only one ice-class tanker, the Vasily Dinkov, transported Russian oil along the Northern Sea Route to China. And in 2023 there will already be ten such tankers! In addition, ice-class LNG tankers began to use the route. According to Rosatom, the main operator of the NSR, the use of non-reinforced vessels on the route has been possible since 2020. Such vessels are allowed to use the route from July to mid-November independently or accompanied by an icebreaker.

The development of the Northern Sea Route is a key priority for Russia. In a world of trade wars and political instability, a short, secure and controlled route to a key trading partner is vital to maintain and develop.

https://t.me/readovkaru/4290

GarryB, flamming_python, Hole, lyle6 and Broski like this post

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

Russia's ESPO Blend crude price flips to premium in Chinese ports

Sept 15 (Reuters) - Рrices for Russia's Far East ESPO Blend crude oil loading from the port of Kozmino in October have firmed to a premium of more than 50 cents against ICE Brent on a delivery basis in Chinese ports, several traders familiar with the matter said.

This means the price has climbed back to levels seen prior to sanctions and a price cap on Russian oil, they added.

ESPO Blend ESPO-DUB crude oil, Russia's flagship grade in Asian market loading from the Kozmino port, used to trade at a premium to both the Brent and Dubai benchmarks as its quality and close loading point made it very popular among refiners in China.

However, in Spring 2022 prices for ESPO Blend collapsed as many companies started to abandon Russian oil amid its military actions in Ukraine, which Moscow calls a special military operation, while a price cap and EU embargo on Russian oil imports sent discounts for ESPO Blend even wider.

Nevertheless, ESPO Blend has been trading above the $60 per barrel price cap for most of 2023, Reuters calculations show.

High demand for fuel in Asia has been driving China’s intake of crude oil, including ESPO Blend, which is much cheaper than Middle Eastern and West African alternatives, despite the firming of the price.

At least three deals for October-loading cargoes of ESPO Blend were done at a premium to ICE Brent of 30 to 60 cents per barrel, compared with a discount of $1-2 per barrel for cargoes loading early in September and August, the traders said.

Prior to 2022, the ESPO Blend crude oil price was traditionally set at the port of loading, Kozmino, and against the Dubai benchmark. Current prices in Chinese ports mean the discount on free on board (FOB) Kozmino basis to Dubai is just a couple of dollars per barrel, which is close to prices achieved during pre-sanction times, traders said.

"Now ESPO price is close to what it was when the market was weak, but still it is an old market," one of the traders said.

China remains the main buyer of ESPO Blend oil cargoes loaded from the sea port, while India has also been taking some four-six cargoes per month recently, the traders said.

One added that China's state oil refiners' demand for October-loading ESPO Blend was high and their share may account for more than a half of the market.

Russia’s pipeline monopoly Transneft said this week that ESPO Blend crude oil loadings from Kozmino are expected to rise in 2023, compared to last year, without disclosing details.

ESPO Blend oil exports are very profitable for Russian oil companies that benefit from Transneft's discounted tariff for eastern exports and higher market prices compared to Urals.

The U.S. Treasury published a warning to U.S. companies in April of possible evasion of the Russian petroleum price cap of crude oil exported through Russia's Eastern Siberia Pacific Ocean (ESPO) pipeline and ports in eastern Russia.

GarryB, flamming_python, kvs, lyle6, lancelot and Broski like this post

GarryB- Posts : 40520

Points : 41020

Join date : 2010-03-30

Location : New Zealand

A disaster for many EU countries this winter. It could finally kill off many industries still dependent on gas in volume.

But wasn't it Bulgaria that screwed the Russians around with South Stream that led to them eventually sending all their gas to Turkey?

Weren't they already refusing to buy Russian gas anyway and were getting gas from Azerbaijan through Greece via Turkstream?

EU agreements means they are supposed to share gas supplies so having near full storage in Germany wont help them much if they have to supply all their neighbours with gas too.

kvs, Hole and Broski like this post

lancelot- Posts : 3147

Points : 3143

Join date : 2020-10-18

China is the major buyer and countries in the G7 like Japan are not sanctioning Russian crude oil. Unlike in Europe.

G7 "oil price cap" totally blown. Even Urals has not traded at 60 USD for quite some time.

kvs, owais.usmani and Broski like this post

owais.usmani

owais.usmani