Russia and economic war by the west

ali.a.r- Posts : 117

Points : 118

Join date : 2011-11-04

- Post n°76

Re: Russia and economic war by the west

Re: Russia and economic war by the west

andalusia likes this post

andalusia- Posts : 771

Points : 835

Join date : 2013-10-01

- Post n°77

Re: Russia and economic war by the west

Re: Russia and economic war by the west

I think a UN currency would be good or the IMF Special Drawing Rights:

https://www.lietaer.com/2021/12/can-swiss-frac-replace-dollar-as-reserve-currency/

https://www.clevelandfed.org/en/newsroom-and-events/publications/economic-commentary/economic-commentary-archives/2009-economic-commentaries/ec-20090309-replacing-the-dollar-with-special-drawing-rights-will-it-work-this-time.aspx

https://www.investopedia.com/terms/s/sdr.asp

lancelot- Posts : 3147

Points : 3143

Join date : 2020-10-18

- Post n°78

Re: Russia and economic war by the west

Re: Russia and economic war by the west

I expected that. Switzerland abandoned its bank secrecy laws years ago. All banking information of US citizens is forwarded to the US for taxation purposes.

The Swiss also cancelled a deal to buy the Gripen and switched it to the F-35. They claimed the F-35 would be cheaper than the Gripen.

The Swiss are also buying the Patriot missile system. God knows why.

https://edition.cnn.com/2021/06/30/europe/switzerland-f-35-fighters-intl-hnk/index.html

GarryB and Hole like this post

GarryB- Posts : 40515

Points : 41015

Join date : 2010-03-30

Location : New Zealand

- Post n°79

Re: Russia and economic war by the west

Re: Russia and economic war by the west

Would avoid the situation of maybe the Yuan simply replacing the Dollar and giving China the power the US has had (and currently still has, although diminishing).

Pretty sure the lesson is clear... the power is nice but when you use it as a weapon against other countries that power is likely to be taken away.

A power you can't use or it will be taken away is not really a power any more.

For people who are more informed on this topic; What are the pros and cons of using the Swiss Franc as a reserve currency or in trade as an alternative to the Dollar, Euro, or Chinese Yuan?

In terms of economics I am probably not much better informed than you, but the dollar and the euro have already been used as weapons against Russia, and the swiss are tools of the west already.

Selling things paid for in Yuan makes sense for Russia because it will be buying Chinese products in return, though for some customers they should insist on payment in Rubles... especially western countries they don't need or want to buy anything from in return.

Rubles will create demand for their own currency, which is not bad, but Yuan means they can buy from China without conversions or having to buy currency which saves money.

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°80

Re: Russia and economic war by the west

Re: Russia and economic war by the west

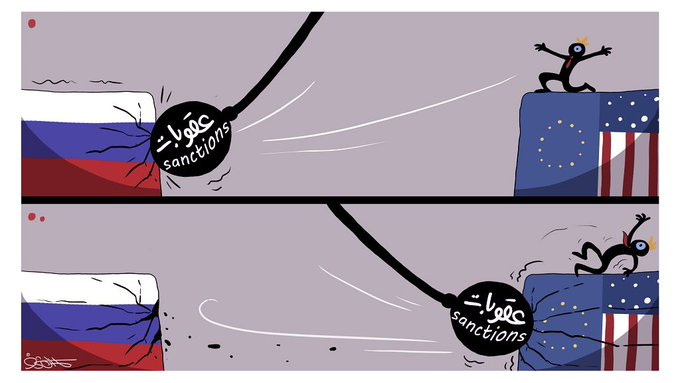

1. Undoubtedly, the collective "West" is not kidding. They're actually waging a shock-and-awe economic war against Russia in the likes of the yanqui military bombings of Yugoslavia, Irak and Libya.

2. Given the speed & scale of the global sanctions offensive, the attack was mostly premeditated in its scope by the top-level government levels in the US and Europe. There's been no consultations of their main economic structures (the Fed and ECB were not consulted as to the global financial consequences of the arrest of the RCB assets and the cutting-off Russia from SWIFT).

3. Given the anti-Russian hysteria that started in Yanquiland sometime ago and spread over the entire globe by Western wreckless and corrupted media, other countries joined in the offensive (UNGA resolution obtained through blackmail and unprecedented diplomatic & economic pressure).

4. Therefore, Russia should react accordingly by setting up a list of enemy countries and establish a tough economic sanctions as well as diplomatic policy against them (by banning some critical commodity exports, making them pay only in rubles, stopping imports through the opening of alternative markets).

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

- Post n°81

Re: Russia and economic war by the west

Re: Russia and economic war by the west

And everyone wants Russian energy.

India and China are going to be massive gainers on this through Russia. Maybe Vietnam as well.

GarryB and mnrck like this post

Airbornewolf- Posts : 1523

Points : 1589

Join date : 2014-02-05

Location : https://odysee.com/@airbornewolf:8

- Post n°82

Re: Russia and economic war by the west

Re: Russia and economic war by the west

It is pretty much denying water to someone in regards to technology consumption.

Add that that the U.S/Australia wants to turn Taiwan into the next "asia-nato fortress" and you can bet the "invasion-meter" is steadily rising in regards to Taiwan.

play stupid games, win stupid prizes in my opinion.

GarryB, Hole and lancelot like this post

mr_hd- Posts : 136

Points : 138

Join date : 2020-12-13

- Post n°83

Re: Russia and economic war by the west

Re: Russia and economic war by the west

bitch_killer dislikes this post

magnumcromagnon- Posts : 8138

Points : 8273

Join date : 2013-12-05

Location : Pindos ave., Pindosville, Pindosylvania, Pindostan

- Post n°84

Re: Russia and economic war by the west

Re: Russia and economic war by the west

mr_hd wrote:So it is just few days after Putin's adventure into Ukraine and Russian economy lost 50% of its value. On top country will be kicked out as serious energy provider globally. There is 0 chance that Russia will recover if this is not stopped fast and actually country will be worse than it was during Jelcin times...

BitTurdBurgler is that you?

JohninMK, miketheterrible and bitch_killer like this post

lancelot- Posts : 3147

Points : 3143

Join date : 2020-10-18

- Post n°85

Re: Russia and economic war by the west

Re: Russia and economic war by the west

And these idiots want to use Bitcoin as world currency. 145 million people will have to pay their taxes with rubles this year.

The value of a currency vs USD is a lot about perception and you can bet there are loads of speculative attacks on the ruble right now.

Just look at what Soros did to HK and UK in the past.

GarryB and bitch_killer like this post

JohninMK- Posts : 15617

Points : 15758

Join date : 2015-06-16

Location : England

- Post n°86

Re: Russia and economic war by the west

Re: Russia and economic war by the west

I'm sure that the US etc pays for Russian patents

This article at Global Times explains some of Russia's counter moves to date.

https://www.globaltimes.cn/page/202203/1254369.shtml

....In another countermeasure, the Russian government has also reportedly revised its rules concerning compensation paid to patent rights holders, with the new regulation stipulating that patent holders from unfriendly countries and regions would be entitled to zero percent of the actual proceeds from the manufacture and sale of goods and the offering of services, if their inventions or industrial design are used without authorization....

...What matters more, as experts pointed out, is that the regulation actually facilitates Russian firms to use foreign patents for free, a countermeasure against the West's technology embargo on Russia.

What's more, the Russian authorities are purportedly working on the possibility of waiving criminal and administrative liability for the use of pirated software, according to media reports.

GarryB, andalusia, kvs, mnrck and lancelot like this post

kvs- Posts : 15849

Points : 15984

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°87

Re: Russia and economic war by the west

Re: Russia and economic war by the west

The Russian government must ban all such transactions. If the retards in Washington think they can have their

cake and eat it too, then they should learn to love the taste of shit.

magnumcromagnon and lancelot like this post

magnumcromagnon- Posts : 8138

Points : 8273

Join date : 2013-12-05

Location : Pindos ave., Pindosville, Pindosylvania, Pindostan

- Post n°88

Re: Russia and economic war by the west

Re: Russia and economic war by the west

Sanctions and sovereignty

Sergey Glazyev

academician of the Russian Academy of Sciences

February 25, 2022, 11:47

It would be childish to proceed from the fact that "when we are beaten, we grow stronger." Although we have indeed strengthened national sovereignty in the economic sphere under the influence of US sanctions, but not to such an extent that we do not pay attention to them at all. Of course, there is damage from sanctions, and it is significantly enhanced by the passive policy of the monetary authorities.

The permanent intimidation of Russia with new “hellish” sanctions has long ceased to excite Russian public opinion. I remember how in 2014 I, like other first US-sanctioned individuals, was interviewed and we all assured journalists that we were proud of such recognition of our services to Russia. Since then, the number of individuals and legal entities subjected to sanctions by the United States and its satellites has increased many times over and has not had any noticeable impact on our country. On the contrary, the retaliatory measures introduced by our government in terms of restricting food imports from these countries significantly contributed to the growth of domestic agricultural production, which almost completely replaced the import of poultry and meat. The defense and energy industries have learned how to circumvent these sanctions, abandoning the use of the dollar, and at the same time American banks in favor of national currencies and banks of partner countries. Next in line is the development of digital currency instruments that can be used without resorting to the services of banks that are afraid of falling under sanctions. The people are watching with interest the return to the country of the capital exported by the oligarchs and themselves, who fear confiscations and arrests in NATO countries.

American sanctions have affected not so much Russia as third countries that have come under pressure from Washington. First of all, on our European neighbors, who curtailed most of the cooperation projects in the scientific, technical and energy fields. They also influenced Chinese commercial banks operating in the dollar zone, which preferred to stop serving Russian clients. Russia's trade turnover with the EU and the US has naturally declined, while with China it has grown. In the period 2014-2020 in monetary terms, Russia's trade with China increased by 17.8% from $88.4 billion to $104.1 billion. 4% and from 16.3% to 24.1% respectively. The share of the EU in the external trade turnover of the EAEU, on the contrary, decreased from 46.2% in 2015 to 36.7% in 2020.

In fact, with the help of sanctions, the United States is trying to force Russian goods out of the markets of their satellites, replacing them with their own. This was most clearly manifested in the European natural gas market, where the share of the United States has risen sharply, although so far it has not been possible to squeeze Russia out of the European natural gas market.

The main result of the US-European sanctions was the change in the geographical structure of Russian foreign economic relations in favor of China, the expansion of cooperation with which fully compensates for the curtailment of trade and economic relations with the EU. European consumers have to switch to more expensive American energy sources, and producers are simply losing the Russian market. The total losses of the EU from anti-Russian sanctions are estimated at 250 billion dollars.

Another important result of US sanctions was the fall in the share of the dollar in international settlements. For Russia, as for other countries subject to US sanctions, the dollar has become a toxic currency. By tracking all dollar transactions, US punitive authorities can block payments, freeze, or even confiscate assets at any time. For 8 years after the introduction of sanctions, the share of the dollar in international settlements decreased by 13.5 percentage points. (from 60.2% in 2014 to 46.7% in 2020).

Sanctions have become a powerful incentive for the transition to settlements in national currencies and the development of national payment systems. Thus, in the mutual trade of the EAEU states, the share of the dollar decreased by more than 6 p.p. (from 26.3% in 2014 to 20.0% at the end of 2020).

I remember how, ten years ago, when considering the issue of risks for the Russian banking system at the National Banking Council, I asked the then head of the Central Bank: “Is the risk of disconnecting Russian banks from the SWIFT international banking messaging system, as Western partners did with respect to Iran, being considered? ? To which he received the answer: "We cannot consider the risk of an atomic bomb hitting the Bank of Russia." However, the Central Bank took measures - today Russia has its own system for transmitting electronic messages between banks - the Financial Message Transfer System of the Bank of Russia (SPFS), as well as its own payment system for Mir bank cards, which is interfaced with the Chinese Union Pay system and can be used for cross-border payments and transfers. Both of them are open to foreign partners and are already widely used not only in domestic, but also in international settlements. Disabling SWIFT is no longer seen as a large-scale threat - it will benefit the development of our payment and financial information systems.

However, it would be childish to assume that "when we are beaten, we grow stronger." Although we have indeed strengthened national sovereignty in the economic sphere under the influence of US sanctions, but not to such an extent that we do not pay attention to them at all. Of course, there is damage from sanctions, and it is significantly enhanced by the passive policy of the monetary authorities. Since 2014, when, with the connivance of the regulator, currency speculators brought down the ruble exchange rate through market manipulation, the latter has been used by sanctioners as a fail-safe fuse for macroeconomic stability. At the same time, it was in 2014, on the eve of the already announced US sanctions, that the Bank of Russia switched to a free-floating exchange rate regime. And only after that the United States introduced them, being sure that speculators would multiply their negative effect. When the ruble nearly halved, Obama said with satisfaction that "the Russian economy has been torn to shreds." As a result of this manipulation of the Russian foreign exchange market, ruble income and savings depreciated, and speculators received more than $35 billion in profits. But this happened not because of the sanctions, but because of the connivance of the Bank of Russia, which left the exchange rate at the mercy of international speculators on the recommendation of Washington financial institutions.

Only completely naive people can believe in the formation of an equilibrium exchange rate of the ruble in a free floating mode. Self-withdrawal of the Bank of Russia from the regulation of the ruble exchange rate means that this is done by international currency speculators. On the swinging of the ruble, which has become one of the most unstable currencies in the world with a 3-fold supply of foreign exchange reserves, international speculators receive multibillion-dollar profits, and Russians depreciate their ruble savings and incomes along with bursts of inflation. At the same time, the investment climate is hopelessly deteriorating - the instability of the ruble exchange rate gives rise to uncertainty in the main parameters of investment projects using imported equipment and export-oriented products.

Thus, the damage from the US financial sanctions is inextricably linked with the ideal foreign exchange policy of the Bank of Russia. Its essence boils down to a rigid binding of the ruble issue to export earnings, and the ruble exchange rate to the dollar. In fact, an artificial shortage of money is being created in the economy, and the strict policy of the Central Bank leads to an increase in the cost of lending, which kills business activity and hinders the development of infrastructure in the country.

Sanctions restrictions have led to extremely high demand for corporate financing in the domestic market. Against the backdrop of a relatively low key rate and access to cheaper funding, large banks consistently maintain a net interest margin above the market average of 5.4-6%, while for the largest banks in China, the USA, Germany, France, the UK and Japan, the net interest margin is from 0.8% to 2.3%. However, these windfall profits are not used to finance infrastructure projects, but to acquire disparate non-core businesses that are combined into ecosystems. Most of these businesses remain unprofitable even at the level of EBITDA. Despite this, billions of rubles are still spent on their development. These figures are quite comparable with the volume of investments in a large infrastructure project in the real sector of the economy, capable of bringing both job growth and a contribution to the development of the economy. But such projects (as well as filling the budget) still remain with the commodity companies, while the largest financial corporations prefer to channel their income into the creation of chimeras.

In fact, it was precisely the connivance of the Central Bank that led to the fact that Russia, its industry, were drained of blood and unable to develop.

If the Central Bank fulfilled its constitutional obligation to ensure the stability of the ruble - and it has every opportunity to do this due to the 3-fold excess of foreign exchange reserves of the monetary base - then financial sanctions would be nothing to us. They could even be turned around, as in other sectors of the economy, for the benefit of the banking sector, if the Central Bank replaced the loans withdrawn by Western partners with its own special refinancing instruments. This would increase the capacity of the Russian credit and banking system by more than 10 trillion. rub. and would fully compensate for the outflow of foreign investment financing, preventing a drop in investment and economic activity without any inflationary consequences. Thus, it would be possible to avoid a long period of decline in real incomes of the population,

Assessing the consequences of anti-Russian sanctions, one cannot ignore the consequences of breaking economic ties with Ukraine. The mutual abolition of the free trade regime and the imposition of an embargo on a wide range of goods led to the rupture of cooperation ties that ensured the reproduction of many types of high-tech products. Blocking the work of Russian banks led to the depreciation of multibillion-dollar Russian investments. The refusal of the Ukrainian authorities to service their debt to Russia led to several billion more dollars in losses. In total, their volume is estimated at about 100 billion dollars. for each side. This is indeed a significant and in many respects irreparable real damage, which we ourselves have exacerbated by retaliatory sanctions.

To date, the result of the economic consequences of anti-Russian sanctions is as follows. The largest losses in relation to GDP were suffered by Ukraine, in absolute terms - by the European Union. Russian losses of potential GDP since 2014 amount to about 50 trillion rubles. But only 10% of them can be explained by sanctions, while 80% of them were the result of the ongoing monetary policy. The United States, which replaces the export of Russian hydrocarbons to the EU, as well as China, which replaces the import of European goods by Russia, benefit from anti-Russian sanctions. We could completely neutralize the negative consequences of financial sanctions if the Bank of Russia fulfilled its constitutional obligation to ensure a stable ruble exchange rate, and not the recommendations of Washington financial institutions.

Consider the threats of American and European Russophobes regarding new “hellish” sanctions. It has already been said above that the threat of disconnection of Russian banks from the SWIFT system, which is widely exaggerated today in the media, although it will interfere with international settlements at first, will benefit the Russian banking and payment system in the medium term.

The threat to ban transactions with Russian bonds will also benefit us, since their issue in a budget surplus is nothing but a source of profit for foreign speculators. And their profitability is overestimated three times in relation to the market assessment of their riskiness. The termination of the Samoyed policy of the monetary authorities, borrowing money that is objectively unnecessary for the budget at exorbitant prices, will allow us to save billions of dollars. If the sanctioners try to prohibit the purchase of foreign currency bonds of Russian corporations, then it will be possible to compensate for the missing financing for the purchase of imported equipment by buying them out at the expense of a part of excess foreign exchange reserves. If foreign loans are cut off for them, then the risk of their default will fall on the European and American banks themselves.

There is also the potential risk of seizure of Russian state assets. But we can respond symmetrically to this by imposing an embargo on servicing debt obligations to Western creditors and also freezing their assets. The losses of the parties will be approximately equal.

There remains, in fact, one threat - to take away foreign assets from Russian oligarchs. For all its popularity among the common people, it stimulates the return of capital exported from the country, which will also have a positive effect on the Russian economy.

At the same time, we need to protect ourselves as much as possible from the expected escalation of US-European sanctions. The most vulnerable spot for our economy is its excessive offshorization. Up to half of the assets of Russian industry are owned by non-residents. There is more than a trillion dollars of capital exported from the country abroad, half of which is involved in the reproduction of the Russian economy. A one-time freeze of these assets can really drastically worsen the position of a number of strategically important enterprises dependent on the foreign market. The Americans showed how this is done using the example of Rusal, establishing their control over it under the threat of stopping foreign trade activities. We could respond to this by nationalizing at least the gigantic hydroelectric power plants transferred to this corporation for nothing and on dubious grounds, on which the lion's share of its profits is based. But for some reason, they did not begin to protect this one of the structural sectors of our economy from a raider takeover by the US Treasury.

From the above it follows the need for effective measures for real deoffshorization of the economy, as well as bringing the policy of the Bank of Russia in line with its constitutional obligations. Also, measures to tighten foreign exchange regulation in order to stop the export of capital and expand targeted lending to investments and working capital of enterprises in need of financing will not interfere. It is advisable to introduce taxation of currency speculations and transactions in dollars and euros in the domestic market. We need serious investments in R&D in order to accelerate the development of our own technological base in the areas affected by sanctions - primarily the defense industry, energy, transport and communications. It is necessary to complete the de-dollarization of our foreign exchange reserves by replacing the dollar, euro and pound with gold. In the current conditions of the expected explosive growth in the price of gold, its massive export abroad is akin to high treason and it is high time for the regulator to stop it. It is necessary to quickly introduce a digital ruble, which could be used for cross-border payment and settlement transactions bypassing the banking system subject to sanctions pressure. We should hurry up with the creation of our own exchange space and ruble pricing mechanisms for the commodities we produce in abundance. Propose to partners in Asia to introduce a global payment and settlement currency based on the index of national currencies and commodities. It is possible to unilaterally remove sanctions from Ukrainian enterprises, at the same time easing the position of the Russian population employed in them. Maybe come out again with the initiative of a single economic space from Lisbon to Vladivostok, encouraging a healthy part of the European business and political elite. Try to create a broad international coalition for the restoration of the norms of international law, including the norms of the WTO and the IMF, which Western sanctions shamelessly violate with their sanctions and trade wars.

In general, much remains to be done to strengthen national sovereignty in the economy. American sanctions are the agony of the outgoing imperial world economy based on the use of force. To minimize the dangers associated with it, it is necessary to accelerate the formation of a new - integral - world economic order, restoring international law, national sovereignty, equality of countries, a variety of national business models, the principles of mutual benefit and voluntariness in international economic cooperation.

https://expert.ru/2022/02/25/sanktsii-i-suverenitet-column/

AlfaT8 and lancelot like this post

GarryB- Posts : 40515

Points : 41015

Join date : 2010-03-30

Location : New Zealand

- Post n°89

Re: Russia and economic war by the west

Re: Russia and economic war by the west

TSMC/Taiwan being responsible for 90 percent of the world chip production and deciding an full ban on Russia and Belarus is going to bite them in the ass somewhere.

Something so critical sounds like something they should be making for themselves anyway... rather than biting them in the ass, this is more of a wakeup call... all that excess money could be investing in making their own chips... wasn't there a post sometime ago that the US buys neon from the Ukraine for the purposes of making computer chips... you see sanctions can swing in many directions... does TSMC import anything from Russia that is critical to make those chips?

Improving Chinese submarine technology might be a good step and perhaps also their sub hunting technology could be given a real boost as well...

So it is just few days after Putin's adventure into Ukraine and Russian economy lost 50% of its value. On top country will be kicked out as serious energy provider globally. There is 0 chance that Russia will recover if this is not stopped fast and actually country will be worse than it was during Jelcin times...

Russia isn't being kicked out of anywhere as being an energy supplier... the US is talking to Iran and Venezuela regarding gas and oil, which shows how desperate they are, but really just reducing supply by Russia to any of their western customers will jack up the price to the point where the stuff they do sell will be very very profitable... at one point they were talking about 20$ a barrel... now probably ten times that...

...What matters more, as experts pointed out, is that the regulation actually facilitates Russian firms to use foreign patents for free, a countermeasure against the West's technology embargo on Russia.

Which would be huge because not only would they be able to make what they are no longer allowed to buy from the west, you can bet they can make it cheaper and probably better so it will be competition in other countries markets too.

So for Apple, not only can they not make money selling in the Russian market, but Russian companies can take your ideas and create their own products and sell them on the Russian market and also the international market.

At the end of WWII the British had two excellent jet engines... the Nene and the Derwent... they sold them to the Soviets, who also had jet engines in works in progress but the Nene and Derwent were huge leaps forward in axial and centrifugal engine designs and pretty soon they had improved those engines and made them rather more powerful with things like afterburners and other redesigns, which led to the MiG-15 and MiG-17 and other very very capable modern types for the time. Can you remember a British fighter from the period?

The Hunter maybe?

The point is that the Russians are quite smart and can take a design and make it better and make it theirs... and these BS sanctions from the west are allowing them to do that...

Uncle Swineshit is trying to use 3rd countries to bypass its own embargo on Russian oil.

The Russian government must ban all such transactions. If the retards in Washington think they can have their

cake and eat it too, then they should learn to love the taste of shit.

Or triple the price...

Maybe come out again with the initiative of a single economic space from Lisbon to Vladivostok, encouraging a healthy part of the European business and political elite. Try to create a broad international coalition for the restoration of the norms of international law, including the norms of the WTO and the IMF, which Western sanctions shamelessly violate with their sanctions and trade wars.

Putin has been trying to interest Europe in the single economic space and they have rejected him every time... why continue with such nonsense.

The west is broken... let it go.

magnumcromagnon, kvs, Hole and rigoletto like this post

TMA1- Posts : 1193

Points : 1191

Join date : 2020-11-30

- Post n°90

Re: Russia and economic war by the west

Re: Russia and economic war by the west

miketheterrible, Kiko and rigoletto like this post

mr_hd- Posts : 136

Points : 138

Join date : 2020-12-13

- Post n°91

Re: Russia and economic war by the west

Re: Russia and economic war by the west

The point is Russia is each day more isolated. Russian assets are now toxic. Even if their energy is needed for global economy risk is just too big so international companies are hesitating to do business as usual. West is shocked how big idiot is Putin so they are ready to go extra mile if needed, even if sanctions on Russian energy will trigger recession and hurt economy etc... So far the hard truth is adventure in Ukraine proved to be way too costly for Russia and if nothing changes soon Russia will become new giant North Korea. We are just in second week in conflict and Russia lost ground internationally on epic proportions.GarryB wrote:

So it is just few days after Putin's adventure into Ukraine and Russian economy lost 50% of its value. On top country will be kicked out as serious energy provider globally. There is 0 chance that Russia will recover if this is not stopped fast and actually country will be worse than it was during Jelcin times...

Russia isn't being kicked out of anywhere as being an energy supplier... the US is talking to Iran and Venezuela regarding gas and oil, which shows how desperate they are, but really just reducing supply by Russia to any of their western customers will jack up the price to the point where the stuff they do sell will be very very profitable... at one point they were talking about 20$ a barrel... now probably ten times that...

andalusia- Posts : 771

Points : 835

Join date : 2013-10-01

- Post n°92

Re: Russia and economic war by the west

Re: Russia and economic war by the west

https://www.unz.com/mhudson/the-american-empire-self-destructs/

JohninMK- Posts : 15617

Points : 15758

Join date : 2015-06-16

Location : England

- Post n°93

Re: Russia and economic war by the west

Re: Russia and economic war by the west

GarryB, magnumcromagnon and kvs like this post

flamming_python- Posts : 9517

Points : 9575

Join date : 2012-01-30

- Post n°94

Re: Russia and economic war by the west

Re: Russia and economic war by the west

mr_hd wrote:The point is Russia is each day more isolated. Russian assets are now toxic. Even if their energy is needed for global economy risk is just too big so international companies are hesitating to do business as usual. West is shocked how big idiot is Putin so they are ready to go extra mile if needed, even if sanctions on Russian energy will trigger recession and hurt economy etc... So far the hard truth is adventure in Ukraine proved to be way too costly for Russia and if nothing changes soon Russia will become new giant North Korea. We are just in second week in conflict and Russia lost ground internationally on epic proportions.GarryB wrote:

So it is just few days after Putin's adventure into Ukraine and Russian economy lost 50% of its value. On top country will be kicked out as serious energy provider globally. There is 0 chance that Russia will recover if this is not stopped fast and actually country will be worse than it was during Jelcin times...

Russia isn't being kicked out of anywhere as being an energy supplier... the US is talking to Iran and Venezuela regarding gas and oil, which shows how desperate they are, but really just reducing supply by Russia to any of their western customers will jack up the price to the point where the stuff they do sell will be very very profitable... at one point they were talking about 20$ a barrel... now probably ten times that...

North Korea isolates itself on its own accord

Russia will survive.

And everyone will start switching to China's payment system. Including the Europeans, to keep trading with Russia.

Then China will invade Taiwan

kvs- Posts : 15849

Points : 15984

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°95

Re: Russia and economic war by the west

Re: Russia and economic war by the west

NATzO terrorists.

GarryB, magnumcromagnon, miketheterrible, Hole and rigoletto like this post

Regular- Posts : 3894

Points : 3868

Join date : 2013-03-10

Location : Ukrolovestan

- Post n°96

Re: Russia and economic war by the west

Re: Russia and economic war by the west

https://mobile.twitter.com/wargonzoo/status/1501554927465910277

Regular- Posts : 3894

Points : 3868

Join date : 2013-03-10

Location : Ukrolovestan

- Post n°97

Re: Russia and economic war by the west

Re: Russia and economic war by the west

kvs wrote:The owners of KFC are making a big show by closing down in Russia. Meanwhile they are operating in Idlib in Syria.

NATzO terrorists.

Companies only suspend their business, they are not closing permanently, hence why they are not selling their premises or equipment.

They fear backlash from not following the unwritten guidelines, look what happened to companies who were slow to react.

miketheterrible- Posts : 7383

Points : 7341

Join date : 2016-11-06

- Post n°98

Re: Russia and economic war by the west

Re: Russia and economic war by the west

GarryB, Hole and lancelot like this post

Regular- Posts : 3894

Points : 3868

Join date : 2013-03-10

Location : Ukrolovestan

- Post n°99

Re: Russia and economic war by the west

Re: Russia and economic war by the west

miketheterrible wrote:Wonder if Rusburger will replace McDonalds like in Crimea. As for KFC, I do recall seeing domestic fried chicken places. I mean, shit isn't rocket science.

I live in UK in a rural town where we have no McD or KFC, but plenty of local takeaways. Closest KFC is 35 miles away. Not rocket science also, it's bad for your health. Russian politicians were crying about how it was affecting young people and etc.

GarryB and miketheterrible like this post

ALAMO- Posts : 7470

Points : 7560

Join date : 2014-11-25

- Post n°100

Re: Russia and economic war by the west

Re: Russia and economic war by the west

miketheterrible wrote:Wonder if Rusburger will replace McDonalds like in Crimea. As for KFC, I do recall seeing domestic fried chicken places. I mean, shit isn't rocket science.

How it goes?

If all McDonalds, Coca&Cola, Pornhub etc will get out of Russia, they might became the most physically&mentally fit society in the whole world!

GarryB, flamming_python, Regular, magnumcromagnon, kvs, miketheterrible and Hole like this post

lancelot

lancelot