Sales of heavy trucks in Russia will grow by 50-65% this year.

The sale and registration of heavy trucks is taking off on a scale that Russia has not seen in years. This phenomenon came as a surprise to many Western analysts who predicted Russia would collapse due to sanctions. Various versions of what is happening are put forward, but the most correct of them is the simplest: the Russian economy is rapidly changing. And for the better.

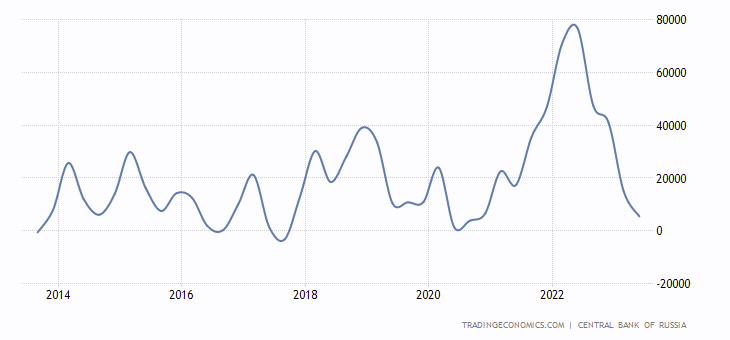

From January to May of this year, sales of heavy trucks exceeded 10,000 vehicles monthly. According to the Autoreview publication, citing the National Industrial Information Agency (NAPI), 44,188 new heavy trucks were sold in the first five months of 2023. In the remaining seven months, it is expected that another 70-80 thousand new cars of this class will be sold. The total annual sales in this case will reach 115-125 thousand trucks. What is the reason for such rapid growth?

Deferred demand or deferred deliveries?

In 2021, sales of new heavy trucks in Russia amounted to 79,091 units. In 2022, they decreased by 5.2% (to 75,013 units). Therefore, at first glance, it would be logical to explain the increase in sales by pent-up demand. Like, in 2022, against the backdrop of unfolding sanctions, business was afraid that the economy would sag, and was in no hurry to implement plans to purchase new vehicles. At the end of 2022, it turned out that the economy survived, and growth is expected in 2023. And the purchases that were suspended last year were made, and the current ones were continued. The superimposition of one and the other gave such high growth.

There is another explanation for the decline in sales in 2022 and their growth in 2023. Last year, during the period of super-strengthening of the ruble, a Chinese 25-ton truck crane, which cost 2 million rubles in 2019. more expensive than the similar Russian "Ivanovets", suddenly turned out to be 2 million rubles. cheaper. A similar situation developed with heavy truck tractors, and with commercial vehicles in general. The changed situation in this logic led to an increase in orders, some of which suppliers did not manage to fulfill in 2022. From this perspective, much of the 2023 growth is deferred 2022 deliveries.

But then the question arises, why did demand increase during the period of ruble overstrengthening?

Engine War Logistics

Another version of the growth in demand for road transport is the needs of a special military operation in Ukraine. But a significant part of the vehicles that replenished the parts of the Russian army and the National Guard was taken from long-term storage warehouses. And replenishment with new cars takes place under government contracts concluded directly with manufacturing plants. Therefore, trucks purchased for law enforcement agencies are not included in the above statistics.

But this does not mean that the war did not cause an increase in the need for commercial transportation. Firstly, the supply of everything necessary to the Armed Forces of the Russian Federation, from various property to fuel and lubricants and ammunition, has increased. Deliveries from manufacturing plants and supplier companies to storage warehouses are carried out mainly by civil transport. The same supply bases in the Crimea and in the liberated territories are replenished with the help of rail transport (where possible) and road trains.

We should not forget about humanitarian convoys to the liberated territories. The same restoration of Mariupol required the delivery of a huge amount of building materials there. One can argue whether this growth in freight traffic (and hence the growth in the need for trucks) is attributed to the result of military operations or to the growth of the needs of the economy. Military builders built something, but most of the new houses were built by civilian construction companies, delighted with these orders in the conditions of the emerging housing market saturation.

The need to replace European cars due to lack of spare parts

Another version linked the growth in sales of heavy trucks with the sanctions imposed against Russia. They say that transport companies have begun to decommission European tracks due to the lack of spare parts or their high price.

The departure from Russia of a number of Western brands (both the cars themselves and the manufacturers of spare parts) really caused certain problems with the repair of European heavy trucks. Service centers closed. But temporary problems were largely covered by the import of spare parts into the country through parallel imports and the replacement of individual items with analogues.

Analogues can be obtained from China or from Iran. They already know about the Chinese auto industry in Russia. As for Iran, the auto industry is the third most important industry after oil and gas. At one time, due to anti-Iranian sanctions, the country had to achieve 100% localization of produced models (full copies or local versions of European automakers). This meant the creation of our own production of components and spare parts, which may well work for the needs of the Russian automotive industry.

Thus, some temporary problems with repairs arose, but it is unlikely to serve as a reason for the mass replacement of European heavy trucks in transport companies with new ones from other manufacturers.

New foreign trade routes

With the reorientation of Russian exports, everything is clear. Europe has closed its borders for it, and the main shipment goes through the Far Eastern and Black Sea ports. Increased attention to the multimodal North-South corridor. In the absence of a through railway connection, cargo arriving on the northern coast of the Caspian Sea has to be reloaded onto road transport, bypassing along the eastern or western coast or by sea to the Caspian ports of Iran (where it is again reloaded onto road or rail transport). In this direction, an additional need arose for cargo transportation (and, consequently, for an increase in the vehicles occupied by these transportations). This also contributed to some of the growth in truck sales.

But to a greater extent, the automotive industry has been affected by the EU-imposed bans on Russian carriers and retaliatory measures that prohibit the transportation of goods in Russia (and transit through Russian territory) to European companies.

The European ban on Russian carriers has freed up a certain number of trucks for domestic transportation. But they were not enough to cover the newly formed needs.

Thus, deliveries to Kazakhstan and other countries of Central Asia of goods prohibited for export to Russia have increased. At the same time, some of these goods are then returned to Russia through parallel imports. Parallel imports through Turkey also created a need for road transport (although some of the cargo goes by sea and rail.

Industrialization processes

But the main demand for cargo transportation arose within the country due to the restructuring of the economy in favor of the real sector. The expansion of the production of demanded industrial products, the implementation of the import substitution policy necessitate the creation of new industries, the construction of new workshops. These are the transportation of building materials, equipment to be installed, and as new production facilities are launched, the need for regular delivery of raw materials and components.

Theoretically, after the completion of the import substitution process, the transport component of costs in the final price of products should decrease (the finished product will not be transported from Europe, but delivered from this enterprise to consumers in Russia). But the process of launching new production is still in full swing. The demand for cargo transportation is only growing.

All this means that the Russian economy is being restructured from the European model of the "service economy", in which the provision of necessary transport services falls more on small-tonnage commercial vehicles, to the "producing economy" model, in which large-tonnage transportation becomes important. Therefore, heavy trucks are becoming more and more in demand.

https://vz.ru/economy/2023/7/4/1219397.html

Kiko

Kiko