Turdope "wins" again.

Russia and economic war by the west #3

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

Turdope "wins" again.

GarryB, par far, Sprut-B and Hole like this post

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

Russia exploits billion-dollar oil cap loophole

Inflated shipping costs are enabling Russian companies to earn far more from crude oil sales to India than previously recognised, according to a Financial Times analysis which suggests that the charges may have raised more than $1bn in a single quarter.

Russia has, until recently, appeared to comply on this route with western measures designed to curb its revenues which were introduced after its full-scale invasion of Ukraine last year. Its oil producers have been selling crude to India for below the $60-per-barrel price cap.

But when freight costs are included, they and the traders with whom they work have charged much higher sums.

An FT analysis of ships running directly from Russia’s Baltic ports to India suggests that this overcharging, combined with fees earned from shipping the oil on Russia-linked vessels, may have been worth $1.2bn in the three months to July.

Benjamin Hilgenstock, an academic at the Kyiv School of Economics, which has been studying evasion of the price cap, said: “Inflated shipping costs are a major concern as they effectively create a leak in the price cap regime through which someone, somewhere can siphon off billions of dollars.”

James Cleverly, the UK’s foreign secretary, said: “It comes as no surprise that Putin is becoming increasingly desperate and dishonest in his attempts to mitigate the price cap’s impact — something that has been severely restricting Russian revenues since its introduction. Those aiding Russia’s attempts to fund this illegal war should know, the UK will continue to act alongside our partners to enforce this measure.”

The price cap imposed by the G7 is intended to keep Russian oil flowing while squeezing revenues that could be used to fund the war. But the cap — which places requirements on buyers, shipowners and insurers from participating countries — does not impose any limit on freight costs.

Customs records issued in Russia from December until the end of June indicate that the average price of crude oil shipped to India was around $50 per barrel in Russia’s Baltic ports. This kept the sales in line with the cap, which applies to the so-called “free on board” (FOB) price, or the cost of the oil at the port of loading.

But Indian customs data shows that the prices actually being paid in India after delivery — the so-called “cost, insurance and freight” (CIF) price — over the same period had amounted to $68. This was a marked discount on world oil prices, which averaged around $79 per barrel over the period, but implies an $18 per barrel rise in prices between the Baltic and India.

Figures from Argus, a pricing agency, also point to a large spread. Argus estimates that the average price of Urals crude has been $14.90 per barrel higher in India than in the Baltic since data started to be collected in February. This is in excess of Argus’s estimates of the actual price of shipping, which has averaged around $9 per barrel.

An official at an Indian state-owned oil company which bought some of this oil told the FT that Indian buyers were buying inclusive of shipping costs. The official said that no negotiation was allowed over freight arrangements or costs.

The excess charges are therefore likely to have been captured by the sellers of the oil. According to Kpler, the data analytics company, the oil producers Lukoil and Rosneft have made direct sales to Indian refineries. In other cases, the sale is managed by trading companies that have emerged in the past year with close links to several Russian oil companies.

Kpler estimates that Russia shipped 108mn barrels from the Baltic to India from May to July in 134 vessels, a time when the spread between Argus prices averaged $17 per barrel, after taking account of the lag between departure and delivery. At that time, Argus estimates that commercial shipping rates averaged $9 per barrel, suggesting that the overcharging may be worth around $800mn.

Hilgenstock said: “If Russian oil companies and traders agree to these kind of contractual conditions, we have to assume that a portion of the spread is being captured by Russia — whether or not Russia owns the tankers moving the oil.”

Russia does have a hand in the tanker fleet. Of the 134 vessels identified by Kpler as moving Russian oil to India from May to July, the FT has been able to directly link 23 of them to Russian entities via insurance, ownership or management documentation.

Most of these are run by Sun Ship Management, which has been placed under sanctions by the UK and EU for being connected to Sovcomflot, the giant Russian state tanker fleet.

The FT has identified a further 26 “ghost” vessels which were bought by their current owners since the start of the war. Their owners are secret, hidden via shell companies largely in the Marshall Islands and Liberia, but all have dramatically diverted on to the Russian oil routes since being bought — and some have previously been linked to Russia.

In the three months to July, around 40 per cent of the oil shipped from the Baltic was carried by the Russia-connected fleet. The freight cost estimates calculated by Argus imply that this fleet may have earned more than $350mn in revenue on the route over the quarter.

Adding the $800mn by which fees were inflated, this means that Russian entities may have covertly made a billion dollars more in revenue over that period than previously recognised.

India now accounts for around a quarter of Russia’s crude and refined oil exports. Russia’s global oil exports amounted to $39bn in total over these three months, according to the International Energy Agency.

Keeping the price in its Baltic ports below the price cap had allowed Russia to also use ships with western insurance. More than half of the vessels on the route during that quarter were G7-insured, with 46 of them run by Greek ship managers.

The number of western vessels is dropping, however — a consequence of international crude prices rallying 15 per cent in the past month to near $85 a barrel. This has dragged Russian prices higher and closer to the cap. Argus has assessed that average quoted prices in Primorsk, a major Baltic port, rose above $60 last month.

This makes it more difficult for western-linked companies to shift the oil while still obeying the cap. As a result, Greek-domiciled ship managers suddenly started to leave the Russian crude market in July.

The International Energy Agency said on Friday that Russia’s oil export revenues in July reached their highest level since the cap was introduced, even without including inflated freight costs.

The higher prices may also deter buyers, however. An Indian oil official told the FT that the discount was now just $2 to $10 a barrel.

“Indian imports may now decline, as the discounts aren’t as generous,” said Amrita Sen at Energy Aspects. “Their banks are also getting anxious now there are signs that most cargoes are trading above the price cap.”

GarryB likes this post

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

For the rest of the world this just makes Russian products cheaper to buy because the Ruble has less value.

It also means imported stuff is more expensive for Russians so the tossers who think they are cool because they drive around in expensive European cars can pay more to buy the damn things and pay more for parts and support.

But for ordinary Russians I don't really see the problem.

It is not like you import all your food or other essentials... the west has put a stop to that.

For Germany a strong Euro was good because it reduced the relative cost of energy and raw materials, and they make expensive stuff so it is going to be expensive to buy anyway... that was their niche of the market, but for Russia their market is affordable and a weak ruble means their customers get a better deal without Russia having to offer a discount.

Right now you can't easily get US dollars and Euros so why would the conversion rate matter?

sepheronx, kvs, Sprut-B and owais.usmani like this post

sepheronx- Posts : 8838

Points : 9098

Join date : 2009-08-06

Age : 35

Location : Canada

GarryB, kvs, zardof, Sprut-B and owais.usmani like this post

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

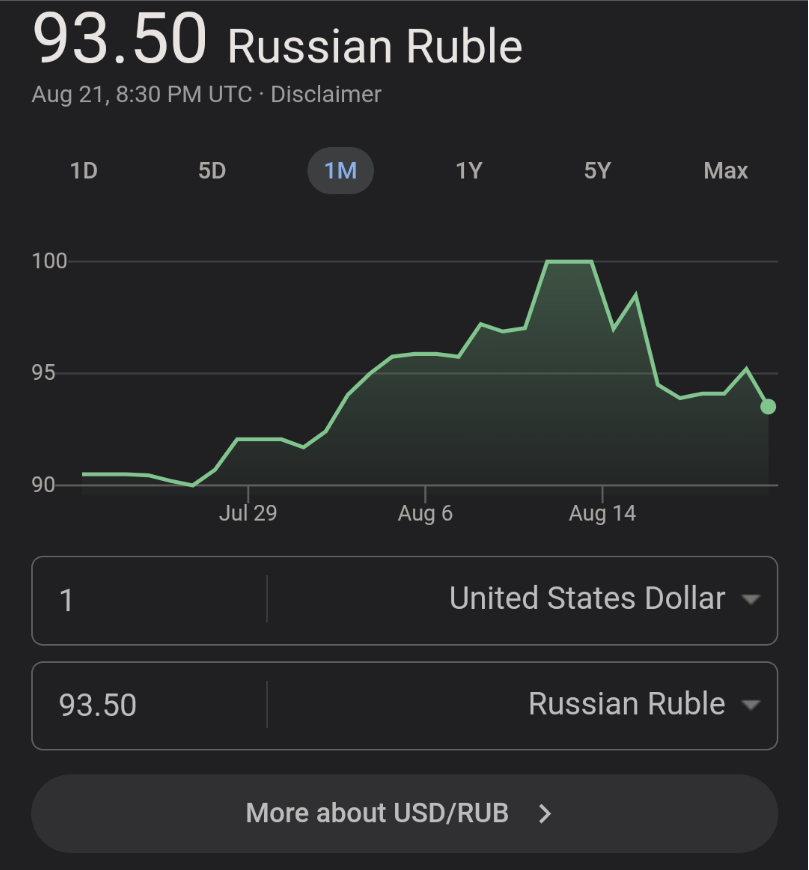

First of all sudden moves as this one are not good for financial stability. Ruble made a year worth of move in a matter of few weeks. Second, as imports are increasing, there's a chance that sudden ruble devaluation will spark inflation.GarryB wrote:I don't understand why this matters.

For the rest of the world this just makes Russian products cheaper to buy because the Ruble has less value.

It also means imported stuff is more expensive for Russians so the tossers who think they are cool because they drive around in expensive European cars can pay more to buy the damn things and pay more for parts and support.

Right now you can't easily get US dollars and Euros so why would the conversion rate matter?

Russia is not completely self sufficient and still need to import a lot of stuff. Especially, when they're doing many things in parallel. As their export income declined YoY, expensive items such as machinery and electronics will weigh heavily on current account balance.

Let's not forget that decent parts of exports is made of parallel or gray exports, which by definition are more expensive and bear extra cost.

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

https://t.me/multipolarmarket/6204

Ruble turnes back

MM admins: decide to post news about Russian economy.

Russian economy a few minutes later: hold my vodka, tovarish'.

Russia's central bank announced an emergency meeting on a key rate tomorrow amid falling Ruble.

And, it's like the almighty Elvira Nabiullina, the CB's head, in just a few words forced the currency to reverse it's course.

If European and US news sometimes are clown, then Russians are tumblers. The whole world is a circus.

flamming_python likes this post

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

How the "market" really works. Treachery and colonial domination.

GarryB, zardof and Sprut-B like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

As their export income declined YoY, expensive items such as machinery and electronics will weigh heavily on current account balance.

Sounds like they need to set up companies and businesses to produce in Russia the things they have to import from unreliable countries, a weaker currency would make Russian products more attractive for export which should balance out the few things they still have to import.

Added to that the fact that Russia produces machinery and electronics too so expanding their range to include the stuff some companies are importing would be a good thing.

Also the fact that investments in countries within US reach will lead to the loss of assets and funds there should be a lot more investment in domestic projects leading to growth and development of the Russian economy further.

Cutting foreign owners out of the Russian economy is also a good thing too, especially if those new owners start investing some of the profits they make back into the companies that generate the money, which foreign investors never seemed to do.

kvs and Sprut-B like this post

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

if Russia was a banana republic that had no internal resource for research, development and production. The NATzO west made an epic

mistake with its assumption that Russia was a banana republic.

GarryB, zardof, Sprut-B and Hole like this post

Belisarius- Posts : 860

Points : 860

Join date : 2022-01-04

The Swiss bank's annual Global Wealth Report for 2022 revealed that Russia's total wealth grew by $600 billion. Additionally, the count of Russian millionaires surged by approximately 56,000, reaching 408,000, and the number of individuals with an ultra-high net worth (over $50 million) surged by nearly 4,500.

https://t.me/DDGeopolitics/77566

GarryB, franco, flamming_python, Werewolf, xeno, par far, kvs and like this post

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

Here we see capitalism's critical need for cheap resource inputs. The capitalist cult would have you believe that it is the bestest system

ever but it can't handle fair pricing for resources and is intrinsically colonialist. The west has to rob the developing world of resources

to maintain tolerable prices for its consumers. In other words, the capitalist elite is a mega parasite that cannot share its filthy lucre with

the proles. If it does not have access to high enough profit margins (near zero costs, arbitrary prices for its goods and services) the whole

system is in crisis. Trickle down shuts down.

Maybe small companies have sufficient constraints to operate in a balanced way, but the economy is not governed by small companies but

controlled by oligarchs and their large oligopolistic/monopolistic corporations.

GarryB, flamming_python, zardof, Sprut-B, Hole and Broski like this post

Sprut-B- Posts : 428

Points : 432

Join date : 2017-07-29

Age : 31

GarryB, flamming_python, kvs, zepia, zardof, Hole, Broski and Belisarius like this post

par far- Posts : 3496

Points : 3741

Join date : 2014-06-26

Belisarius wrote:

Amidst the ongoing Ukraine conflict, Russians experienced increased wealth last year, in stark contrast to the trillions of dollars lost by the US and Europe, according to UBS. - Newsweek

The Swiss bank's annual Global Wealth Report for 2022 revealed that Russia's total wealth grew by $600 billion. Additionally, the count of Russian millionaires surged by approximately 56,000, reaching 408,000, and the number of individuals with an ultra-high net worth (over $50 million) surged by nearly 4,500.

In stark contrast, the United States faced the largest wealth decline, losing $5.9 trillion. UBS reported that the combined wealth of North America and Europe decreased by a staggering $10.9 trillion during the same period.

https://t.me/DDGeopolitics/77566

I read and I wondered, where the $10.9 trillion from the west went?

owais.usmani and Broski like this post

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

The wealth loss is price related which involves import costs and internal costs.

The Saudis used to invest all of their oil revenue money back into the NATzO west so the NATzO west was essentially getting Saudi oil for free

and it was only consumers getting reamed at the pump (i.e. an internal wealth transfer). Maybe the Saudis have dialed down this cycling of

money and invest in China or elsewhere to a greater extent. But this cannot explain the wealth loss number.

GarryB, par far, Sprut-B and Broski like this post

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

par far wrote:

I read and I wondered, where the $10.9 trillion from the west went?

Higher interest rates lead to some correction in asset prices, as well as bonds. Considering level of financialization of western economies, they are very interest rate sensitive.

on the other hand, ruble was very strong against the US dollar last year and when you combine that with high export revenues (mostly due to high price of carbohydrates), Russia looked very good when nominated in USD. This year that metric will look weaker. Not that it makes much difference.

Btw, emergency interest rate hike, combined with other measures stabilized ruble and negated most of the rise that happened in the last month. Apparently, some exporters didn't repatriate their earnings back to the country and that, combined with heightened credit activity and swift rise in M2, produced mini collapse in RUB value.

par far and Broski like this post

Sprut-B- Posts : 428

Points : 432

Join date : 2017-07-29

Age : 31

flamming_python, xeno and kvs like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

Danish company Carlsberg not happy either:

Should Russia remain a member of WHO:

Grift in Siberia over electricity prices should be improved with this sort of activity by the Russian government:

xeno, kvs and Sprut-B like this post

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

GarryB wrote:

Grift in Siberia over electricity prices should be improved with this sort of activity by the Russian government:

Even worse is that grift was organized by minister in the government and right hand of another "great liberal hope" Chubais. And he was minister until fairly recently, 4-5 years ago.

Scorpius- Posts : 1569

Points : 1569

Join date : 2020-11-06

Age : 37

flamming_python, kvs and Sprut-B like this post

caveat emptor- Posts : 2008

Points : 2010

Join date : 2022-02-02

Location : Murrica

Situation with ruble was so benign in month of August, that RCB called emergency meeting overnight in which they had to introduce partial capital controls and raise interest rate for 3.5 % in one go and next day Putin and the members of financial part of the government met with exporters to discuss repatriation of export revenues back to the country. You read from that what you want.

P.S. it's ok not to comment something you don't understand.

owais.usmani likes this post

franco- Posts : 7047

Points : 7073

Join date : 2010-08-18

https://twitter.com/MyLordBebo/status/1693906149609742556/photo/1

Not shown here but apparently the total EU, UK and other European losses were $5 trillion.

kvs likes this post

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

anti-Russian agendas. I think that Russia's economy has gained much more over the last year and half as western parasites are

in the process of being shed and western imports are replaced. Even the Russian official numbers are not showing the full picture.

The record low unemployment (really full employment) in Russia is a good indicator of the reality. The GDP counts reduction of loans from

foreign sources as economic decline, but the physical state of Russia's economy says the opposite.

franco, flamming_python and Sprut-B like this post

flamming_python- Posts : 9519

Points : 9577

Join date : 2012-01-30

- Post n°100

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

kvs wrote:The graphics are nice but I would take them with a grain of salt. All western based estimates of Russia's economy are tainted with

anti-Russian agendas. I think that Russia's economy has gained much more over the last year and half as western parasites are

in the process of being shed and western imports are replaced. Even the Russian official numbers are not showing the full picture.

The record low unemployment (really full employment) in Russia is a good indicator of the reality. The GDP counts reduction of loans from

foreign sources as economic decline, but the physical state of Russia's economy says the opposite.

The record low unemployment is an indicator of overheating and a shortage of work force too. The Russian economy has expanded faster than its ability to attract workforce to the country

Which sounds like a nice problem to have, and yeah it's better than record unemployment and stagnation. But still, we see the negative effects this situation leads to too, with the rouble's fall and necessitation of interest rate hikes.

kvs

kvs