Russia and economic war by the west #3

ALAMO- Posts : 7470

Points : 7560

Join date : 2014-11-25

- Post n°226

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

JohninMK likes this post

JohninMK- Posts : 15617

Points : 15758

Join date : 2015-06-16

Location : England

- Post n°227

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

301 Military

@301military

.

6h

A shipment of military vehicle engines worth 25 million rubles was stopped from leaving Russia for Kazakhstan.

The engines, intended for armored vehicles, lacked proper permits. Border patrol intercepted a truck carrying 15 unauthorized diesel engines meant for BMP-1 and BMP-2 models.

GarryB, kvs and lancelot like this post

lancelot- Posts : 3147

Points : 3143

Join date : 2020-10-18

- Post n°228

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

sepheronx, GarryB, kvs, JohninMK and Hole like this post

JohninMK- Posts : 15617

Points : 15758

Join date : 2015-06-16

Location : England

- Post n°229

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

@dana916

Ports of Belgium, Spain and France are “making money” from transit of Russian gas.

Until 2023, the Kingdom burned “dictatorially aggressive and dirty gas from Russia,” but from this year they switched to American... and it’s a shame to watch from the sidelines at inexpensive gas floating by.

R_Diplomat

GarryB, zardof, Hole and owais.usmani like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

- Post n°230

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

The guy is a genius.

Average Intelligence but surrounded by morons who keep pushing the sanction button because it flashes bright colours and makes sounds when you push it... like a zombie playing slot machines in a post apocalypse Vegas.

There was some info about relocating some big business from Germany to the US, because of enormous difference in energy prices.

General mood was about how cheap Russkie gas fueled German economic power, and how powerless it became without that.

The Americans actually have announced large subsidy packages for any company that wants to shift production to the US... officially it is about moving western production from China to the US but it does not actually specify where the industry should come from... they were probably hoping for western production in Russia to move to the US as well and if western production in Europe moved to the US then that was fine too.

Micron complained at one stage I seem to remember, but nothing changed.

franco- Posts : 7047

Points : 7073

Join date : 2010-08-18

- Post n°231

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

“Of course, we don’t expect an exchange until the end of the year. There is no scheme yet, and then there will be a long period, as soon as it appears, of combining the will of all parties - first the owners of securities, then the owners of type “C” accounts, and so on,” RIA Novosti quotes the words of a representative of the Central Bank .

At the same time, Chistyukhin indicated that discussions on the scheme are currently ongoing.

On November 8, Russian President Vladimir Putin signed a decree allowing the exchange of assets frozen in the Russian Federation and abroad . According to the document, interested foreign investors will be able to purchase foreign securities from Russians using funds from type C accounts.

At the same time, the Ministry of Finance of the Russian Federation announced that brokers and other participants in the securities market would participate in the exchange of funds of foreign investors blocked in Russia for frozen assets of Russians . At the same time, the state will not participate in organizing the exchange itself. The mechanism will be completely voluntary.

According to Pavel Sokol, a financial analyst at the Finmir marketplace, such a step shows that the Russian authorities want to help citizens who have had their assets blocked as a result of sanctions.

On August 22, Finance Minister Anton Siluanov said that the assets of more than 3.5 million Russian citizens were blocked abroad . The total amount of funds is 1.5 trillion rubles.

https://iz-ru.translate.goog/1615202/2023-12-04/v-tcb-prokommentirovali-sroki-obmena-zablokirovannykh-aktivov?main_click&_x_tr_sl=ru&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=wapp

GarryB, kvs, zardof, Hole, lancelot and Kiko like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

- Post n°232

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°233

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Mikhail Mishustin drew attention to the fact that even opponents who "openly admit that sanctions do not work" talk about Russia’s successes.

MOSCOW, December 6. /TASS/. The Russian economy will grow by 3% by the end of the year, Prime Minister Mikhail Mishustin said during a lecture he gave as part of the Knowledge. Lecture-Hall project.

"The growth of the gross domestic product in October was about 5% in annual terms. Based on the results of ten months it was 3.2%. And at the end of the year we expect [the growth of] about 3%," he said, noting that good dynamics are also observed in real disposable income.

Mishustin drew attention to the fact that even opponents who "openly admit that sanctions do not work" talk about Russia’s successes.

"In general, our industry responded well to external pressure. It is gradually recovering. The growth of manufacturing production in October continued to increase at a good pace - 9.5% year on year," the Prime Minister said.

Another key indicator of stability in the economy is employment.

"Our unemployment has reached an all-time low. If we compare, in the eurozone as a whole this figure this year is more than twice as high as in Russia, and in some countries it is even higher. For example, in Spain, it is 12-13%," the head of the government said.

https://tass.com/economy/1716731

GarryB, franco, kvs, zardof, owais.usmani and lancelot like this post

Hole- Posts : 11115

Points : 11093

Join date : 2018-03-24

Age : 48

Location : Scholzistan

- Post n°234

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

This is like saying that Federer was a decent tennis player.It is gradually recovering.

GarryB likes this post

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°235

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Russia’s GDP “is already higher than it was before the Western sanctions attack,” Putin said. He emphasized that 3.5% at the end of the year is a good result.

In the first ten months of 2023, Russia’s GDP increased by 3.2%; by the end of the year, growth could be 3.5%, President Vladimir Putin said at the VTB “Russia Calling!” forum.

“So, over the ten months of this year, Russia’s GDP grew by 3.2%. Today it is already higher than it was before the Western sanctions attack. It is expected that by the end of the year - at least we all really count on it - GDP will increase by at least 3.5%. Agree, all the people here are literate, this is a good indicator for the Russian economy,” the president said.

“Russia is the largest economy in Europe and in terms of growth rates it is now ahead of all the leading countries of the European Union,” the head of state said.

https://www.rbc.ru/economics/07/12/2023/6571b5689a7947794ac97133

GarryB, franco, kvs, zardof, Hole and lancelot like this post

ALAMO- Posts : 7470

Points : 7560

Join date : 2014-11-25

- Post n°236

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

sepheronx, GarryB, kvs, Hole, owais.usmani and lancelot like this post

sepheronx- Posts : 8839

Points : 9099

Join date : 2009-08-06

Age : 35

Location : Canada

- Post n°237

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

GarryB likes this post

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°238

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

The country has not closed its doors in the wake of Western pressure, according to the president.

The Russian market will remain open and competitive despite Western attempts to isolate the country, President Vladimir Putin stated on Thursday.

Addressing the VTB Investment Forum in Moscow, Putin stressed that Russia is not expelling anyone from its market and is not closing itself off.

He noted that many foreign enterprises and organizations have expressed willingness to continue working in the country in the face of growing pressure from their respective governments.

The number of foreign companies operating in Russia has “surprisingly" risen by 1,500 since March 2022, to a total of over 25,000 firms as of November 2023, Putin said, adding that “we only welcome this.”

He emphasized the benefits of working with and in Russia, insisting that “it was, is, and will be advantageous.”

Putin also noted that the West’s expectations of a Russian collapse after the departure of its businesses had not materialized. Instead, Russian entrepreneurs have managed to adapt and seize new opportunities, according to the president.

https://www.rt.com/business/588676-russia-foreign-business-putin/

GarryB, franco, kvs, zardof and Hole like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

- Post n°239

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

This is about ports in the Baltic and their rail transport network...

But ultimately about doing Americas bidding in trying to hurt Russia economically.

Don't worry guys... the west will have your back...

franco and kvs like this post

owais.usmani- Posts : 1825

Points : 1821

Join date : 2019-03-27

Age : 38

- Post n°240

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Oil Sanctions Never Had A Chance

The recent slump in oil prices pushed Russia’s flagship Urals below the $60 price cap imposed on international shipments by the G7 last year. Perhaps this is a reason to celebrate in the G7. Or perhaps it is a good time to take a moment and consider where Urals fell from to reach the cap level.

For much of the time since the cap was imposed, Russia’s oil—which does not only include Urals—has been trading above $60. Despite assurances from some of the architects of the cap that it is working and depriving Russia of vital revenues, this has not been the case. Because oil is too essential a commodity, and as the Russia case has demonstrated, there is always a way to bring it from seller to buyer, even if the seller is heavily sanctioned.

FT columnist and former trade editor Alan Beattie noted in a recent column on sanctions that “Governments cannot muster enough control over global demand to choke off trade, supply chains are agile, sometimes illicitly so, and end users have found alternatives.”

Indeed, as the questionable success of U.S. sanctions on Iran and Venezuela, and now broader Western sanctions on Russia have shown, sanctions rarely achieve the goals they were imposed to achieve. There has been no regime change in either Venezuela or Iran, Russia has not stopped fighting the Ukraine, and oil has continued flowing from all three countries.

In fairness, oil flows from Venezuela and Iran suffered a substantial decline since the imposition of U.S. sanctions, but both countries have recently seen an uptick in shipments abroad in evidence of the indispensability of all oil, even as U.S. exports themselves increased substantially.

The case of Russia, however, is particularly pertinent because of the sheer scale of the sanction push from the EU and the U.S. Indeed, the push stopped short of targeting its oil exports with a view to decimating them, but even the price cap has not been effective in achieving the stated goal. That was to keep Russian oil flowing abroad but curb revenues.

Bloomberg reported this week that Russia is currently making more money from exporting its oil than it did before the invasion of Ukraine. Another report, from November, cited central bank figures showing this has been going on for months. It was not always this way, however.

The Finland-based NGO Centre for Research on Energy and Clean Air, which tracks Russian energy exports, reported recently that the EU oil embargo and the price cap have cost Russia 34 billion euros ($37 billion) in lost revenue. The figure, substantial as it looks, only represents a 14% decline in revenues, which the CREA duly laments, saying, “That impact though is far short of what could have been achieved.”

Not only are revenues not hurt enough, but the overall economy has managed to shrug off most of the adverse effects of the sanctions. Bloomberg again reported that GDP growth in Russia booked an increase of 5.5% in the third quarter of the year, which was a further increase on an already pretty impressive 4.9% in growth recorded for the second quarter. Meanwhile, the eurozone was struggling to stay in positive GDP growth territory, and Germany was entering recession.

This is certainly a situation that begs the question of who is getting hurt more by the sanctions: the target or the enforcers. The answer, at least when it comes to the EU, appears to be quite unpalatable, which makes the topic a sort of taboo. Much has been made of Russia’s loss of its biggest gas market but, like with oil, it simply redirected most of the flows from the west to the east and China. Europe, meanwhile, replaced pipeline gas with LNG. Neither move has been perfect for the move maker. As to which has fared worse as a result of it, this can be seen in GDP reports.

Oil and gas—but especially oil—are a favorite target for sanction authors. On the face of it, sanctioning the oil industry of a country dependent on this industry is a no-brainer. It only later emerges that sanctioning this commodity has repercussions for the sanction authors themselves. U.S. refiners felt it when the flow of heavy Venezuelan crude stopped with the imposition of the oil sanctions. The whole world felt it when President Trump reimposed sanctions on Iran and prices rose, albeit temporarily.

“Export controls contain the seeds of their own destruction just like producer cartels and attempts to interdict narcotics,” The FT’s Alan Beattie wrote after noting that “The G7 and EU simply aren’t big enough parts of the global economy to strangle Russia’s oil sales.” And they don’t have the clout they probably wish they did on countries such as India, looking for a bargain on oil imports.

Not only this, but the EU, finding itself in a bit of a bind in the diesel department, ended up importing Indian diesel quite likely made from Russian oil, embargoed by that same EU, not to mention the record-high intake of Russian LNG this year.

This is why sanctions on oil and gas never work. Because oil and gas mean energy and energy means security. No country dependent on imports, regardless of the degree, can really afford to sanction its suppliers—at least not without some adverse consequences for its own economy.

GarryB, franco, kvs, zardof and lancelot like this post

lancelot- Posts : 3147

Points : 3143

Join date : 2020-10-18

- Post n°241

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

I read reports that they paid as much for gas in two years as they did in the last eight before that. And that is without getting nearly as much gas per year as they used to.

That is not taking into account loss of revenue from having to shut down production in heavy industry in the EU due to energy shortages. Or loss of income from sales of finished goods to Russia.

GarryB, franco, kvs, zardof, owais.usmani and lyle6 like this post

ALAMO- Posts : 7470

Points : 7560

Join date : 2014-11-25

- Post n°242

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Before winter.

GarryB, franco and kvs like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

- Post n°243

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Essentially EU rules that state the supplier can't also make money on delivery means Russian oil being shipped to Europe can't be shipped or insured by Russian companies, so Europe made money with shipping and insurance. No other customer has such rules so it actually means that Russia can make money shipping and insuring their oil deliveries... and I suspect that Finnish organisation working out costs for Russia probably didn't take into account shipping and insurance costs that used to go to Europe but now could go to Russia or a third party.

Over the period that could eat up a lot of the reduced income they received and also pays for a fleet that can deliver resources anywhere in the world which would be rather useful to Russia too.

The point is that the west thought they were the biggest customer and they owned the ships and they controlled the insurance coverage so if they sanctioned Russian oil they wouldn't have the shipping or insurance capacity to continue to make a profit.

The irony is that they are making a good profit and selling to other customers, initially at a discount while new routes and new shipping and insurance contracts were sorted out, but as that discount was scaled back they were still getting oil cheaper than they ever got before from other sources like the Middle East or US etc.

Without the discounts their oil is still cheaper than alternative sources so they will continue to buy it in bulk because they know no other source can supply what the west needs in terms of oil and processed fuels based on that oil. That means they can buy double or triple what they need and sell the extra to the west for a nice profit.

The west has been trying to "contain" Russia so cheaper energy is one way to limit their growth and development, but when buying what they need from India they can pay more for the moment but eventually they will decide to sanction everyone in BRICS+.

kvs and Rodion_Romanovic like this post

kvs- Posts : 15850

Points : 15985

Join date : 2014-09-11

Location : Turdope's Kanada

- Post n°244

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

it line at least since 2010. Its weakness during the 1990s and running into the early 2000s prevented any hard line options but that

changed. Anyway, the west overplayed its hand and now Russia can tell it to go and f*ck itself. Oil and gas are not critical exports for

Russia. Russia is not an export dependent economy and also is not import dependent as well. Cheaper imports suppressed domestic

production of machine tools, etc. NATzO sanctions have blown away the economics argument and domestic capacity increase should

proceed.

If Russia fails to capitalize on the current trade restrictions, then it will be a clear sign of political problems. This is why I support Putin

for another term in office. He has been doing a good job restoring Russia's economy even though he has coddled monetarist trash.

Some replacement could be a variant of Yeltsin who will sabotage the progress and put Russia back for decades to come.

GarryB, franco, Rodion_Romanovic and zardof like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

- Post n°245

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Russia was way too generous in its dealings with the EU and the rest of the NATzO west. It should have been driving a take it or leave

it line at least since 2010.

I suspect that was part of the problem... Russia seemed happy to put up with western bullshit well beyond anything the west would take so perhaps the west started believing its own propaganda and thought they had no other customer but the west which put them in a position of power.

One of the reasons bullies bully is because their victims are either too weak to fight back or they don't fight back hard enough to make them regret it for whatever reason.

He has been doing a good job restoring Russia's economy even though he has coddled monetarist trash.

Some replacement could be a variant of Yeltsin who will sabotage the progress and put Russia back for decades to come.

Western tentacles are many and long, especially in the economics sector where most of what they are taught is western propaganda bullshit. People dealing with other peoples money every day must wonder why these people get so much and others like themselves don't get so much... and how their lives would be much better if they had more.

Humans are fickle of course and just always want more because they think that might make them happy and when they appear to have everything they realise sometimes it is the simple things they miss like free time to themselves or with family... which you can't have if you are making big money. Cats in the cradle is a great song that illustrates the point.

As the west declines the rest of the world will start to have more of a voice... western containment of Russia and China is just a continuation of western containment of everyone in the rest of the world.

kvs, zardof and Rasisuki Nebia like this post

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°246

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Russia sharply increased seaborne oil exports in December. According to Bloomberg, supplies rose to 3.76 million barrels per day (b/d), up 0.9 million b/d from the last week of November. Against this background, it seems strange that the twelfth package of EU sanctions will not include a ban on the sale of oil tankers to Russia.

When this measure was first announced, it was presented almost as the main one in the next package of sanctions. And as a result, even the struggle to include this item in the new package of sanctions turned out to be somewhat sluggish, without a spark.

The point is not at all that the EU is tired of sanctions and has decided to change the vector of relations with our country. Market conditions have simply changed, and the times when Europe thoughtlessly introduced restrictions against Russia, sometimes greatly to the detriment of its own interests, are over. Since the end of November, barrel prices have decreased by 15%, falling below $73 per barrel for the first time since June of this year. Taking into account the discount on our oil, its price as a result approached the price cap level (price ceiling) - $60 per barrel. The discount situation was aggravated by targeted US sanctions against several ships and companies that did not comply with price ceiling requirements. Discounts on our Urals oil shipped from the ports of the Baltic and Black Sea have increased, in November they increased relative to the minimum in October (just under $10 per barrel).

An increase in oil exports reduces the negative effect on our budget from lower oil prices

In fact, the current situation is ideal for the initiators of the sanctions - the EU and the USA; the volume of oil on the market is not decreasing, but its price is falling. “Along with the fall in world oil prices, Russia’s export revenues from oil sales are declining, which, in principle, is the main purpose of the restrictions and price ceilings being introduced,” says Freedom Finance Global analyst Vladimir Chernov.

At the same time, the growth in Russian oil exports should now offset the negative effect on our budget from lower oil prices. It is unlikely that the EU does not understand this, but here they have to choose the “lesser evil”.

As Valery Andrianov, associate professor at the Financial University under the Government of the Russian Federation, notes, the decision to ban the sale of tankers could reverse the trend that is beneficial for Europe. It is unlikely that it would lead to a real reduction in supplies from Russia, but it would give stock speculators a reason to “play bullish.” Now it is important for Europe not to make sudden movements that could lead to a new round of price growth.

In addition, as Chernov notes, a number of Mediterranean countries, in whose territories large maritime transport companies operate, voted against the ban on the sale of tankers to Russia, as they are afraid of losing their competitiveness.

At the same time, many shipowners played it safe and simply removed tankers “from their balance sheets” and transferred them to the shadow fleet, clarifies Evgenia Popova, a consultant for the Implementa company.

Experts believe that this favorable situation for the EU and the US with oil prices will not last long. According to Chernov, starting from January 1, 2024, OPEC+ countries will reduce production levels of “black gold” by an additional 900 thousand bpd, which will lead to a decrease in supply on the world oil market. Therefore, at the beginning of 2024, we can expect an increase in world oil prices.

From Andrianov’s point of view, in the future, the restoration of demand for oil will lead to the fact that production outside OPEC+ will be unable to satisfy growing appetites, and therefore the regulatory role of the alliance will be fully restored, which will lead to the next stage of rising prices, to their return to corridor 90-100 dollars per barrel.

The current decline reflects only temporary market concerns caused by forecasts for an increase in average daily production in the United States and risks associated with disagreements within OPEC+, Popova says. Locally there can be both downward and upward jumps. If the agreements within OPEC+ are maintained for 2024, prices will remain at the current level, the expert believes.

https://rg.ru/2023/12/13/pobochki-bochek.html

GarryB, franco and zardof like this post

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°247

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Their Achilles's heel is their agricultural industry, most specifically their sugar production based on sugar beets, driving away Global South's exports of tropical sugarcane sugar.

Russia could well set up a global sugarcane hub in its territory with increased massive imports of tropical sugarcane, thereby controlling the global sugar market, exerting political and economic pressure over the European authorities to open up their respective sugar markets with a sound and solid international price mechanism.

Activate a WTA aggressive offensive and an OPEC for tropical Global South sugar exporters.

GarryB, zardof and lyle6 like this post

JohninMK- Posts : 15617

Points : 15758

Join date : 2015-06-16

Location : England

- Post n°248

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

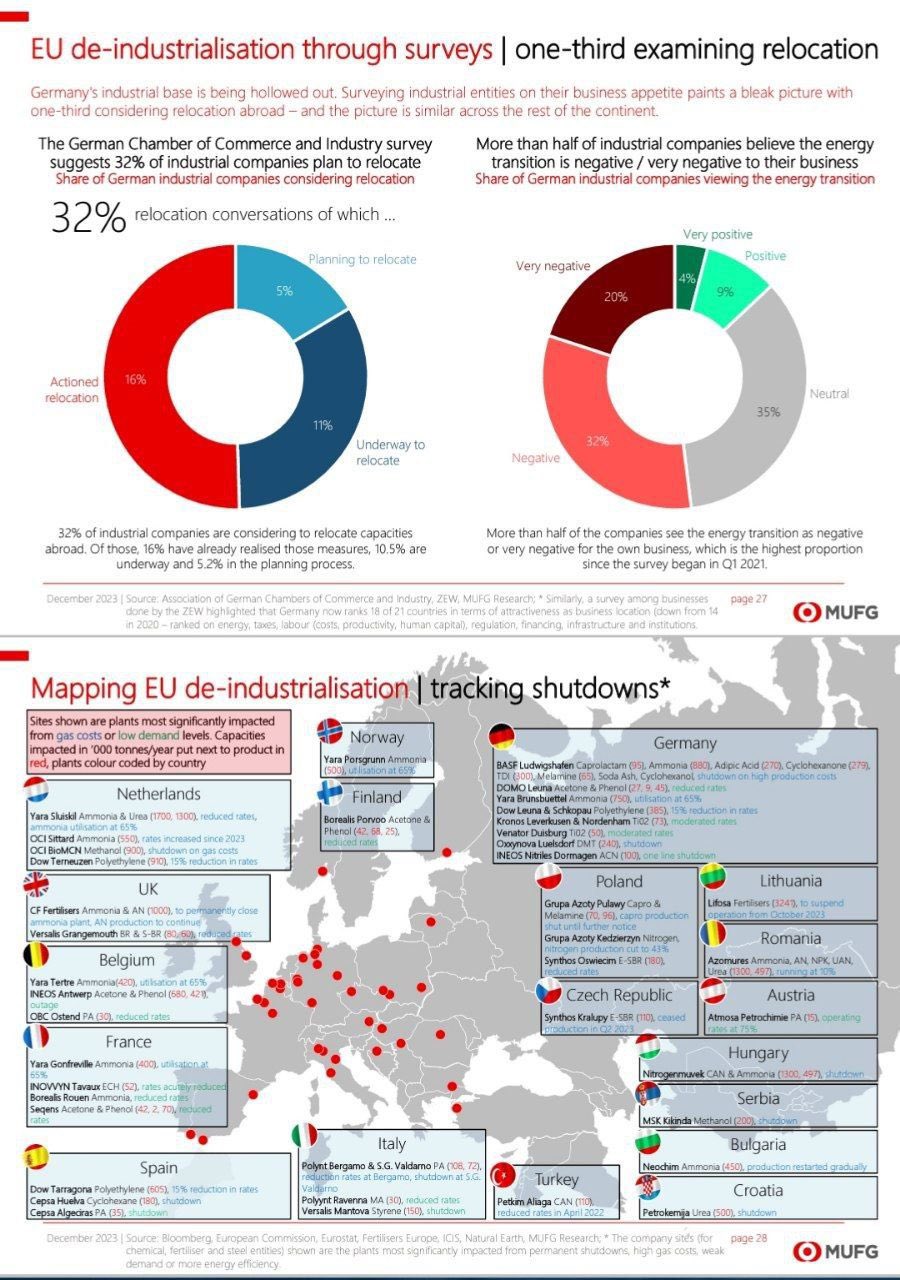

It seems that the chart is mainly chemicals, the building blocks of industry. No mention of the other high NG users suffering like steel, glass insulation etc.

If before such images were called propaganda, now the largest Japanese conglomerate Mitsubishi UFJ Financial Group writes about the extensive deindustrialization of Europe and Germany.

German companies are not making any statements anymore; instead, they are actively relocating from Germany.

The number of closed fertilizer productions that depended on Russian gas is approaching 50.

Therefore, it should not be surprising if in ten years, Germany becomes a tourist state rather than an industrial one.

@ukraine_watch

GarryB, franco, zardof and lyle6 like this post

GarryB- Posts : 40516

Points : 41016

Join date : 2010-03-30

Location : New Zealand

- Post n°249

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

Kiko- Posts : 3870

Points : 3946

Join date : 2020-11-11

Age : 75

Location : Brasilia

- Post n°250

Re: Russia and economic war by the west #3

Re: Russia and economic war by the west #3

The Russian lobby was able to prevail on the issue of excluding the steel industry from anti-Russian sanctions, Der Spiegel reports. Now imports of steel from Russia will be allowed until 2028. European manufacturers do not want to give up this “gold mine” - otherwise their entire business model becomes meaningless, since it is based on cheap imports of raw materials.

European steel producers speak harshly of the latest package of measures against Russia adopted in Brussels, writes the German magazine Der Spiegel. “Member states are helping to fill Moscow’s war chest at the expense of their national companies,” Axel Eggert, CEO of the European steel association Eurofer, said in an interview with the publication. “It is unacceptable that, at the initiative of several member countries and steel importers, the European Union is reducing its own sanctions system to absurdity.”

The reason for criticism was an inconspicuous paragraph on page five of the 12th package of sanctions against Russia, which the European Council of Member States adopted this week, explains Der Spiegel. According to it, some types of steel products from Russia can be imported into the EU for at least another four years, unlike what was previously planned.

According to Eurofer, Russian producers will receive up to €2 billion per year for 3 million tons of steel, which will be allowed to be supplied to Europe annually only until 2026. “This is enough to keep an average Russian steel mill running, ” warns Eurofer director Eggert. “ Thus, Europe indirectly supports Russian military production.”

Originally, the exemption for steel ingots, known in the industry as “slabs,” was set to expire next fall. However, several companies from EU countries, which, for example, produce thick sheets for wind turbines or heavy engineering using cheap Russian primary products, have put pressure on their governments. One of these importers is the Belgian-Russian steel group NLMK with subsidiaries in Belgium and Italy.

As a result, steel regulation has become one of the most controversial issues in the new sanctions package. Brussels representatives from Belgium, Italy and the Czech Republic pushed for an extension of the exemption during weeks of consultations, EU diplomats said. Other states, including Germany, were against it. However, since sanctions require unanimity, the Russian lobby was able to prevail. Now imports will be allowed until 2028, although in a slightly smaller volume than originally planned.

In addition, ingots are often produced in outdated Russian factories that emit large amounts of greenhouse gases into the atmosphere and produce products that are 25% cheaper than similar factories in other countries. This gives importers a significant competitive advantage, which the industry believes is reflected accordingly.

According to a study by the German Steel Federation, the share of Russian slabs in imports has risen to approximately 56% in recent months. This is higher than the level of pre-sanction years, when it was about 53%. “It is understandable why individual steel companies are keen to preserve this gold mine, ” says Eurofer director Eggert. “Otherwise, their business model makes no sense, since it is based on the cheapest imports.”

The responsible regional government of the Belgian province of Wallonia, on the other hand, is insisting on an appropriate transition period to give the affected companies enough time to decouple from Russia. “European sanctions should not harm member states more than Russia,” Prime Minister Elio di Rupo told Der Spiegel. In Belgium alone, 4 thousand jobs are at stake. Therefore, according to the head of government, “a transition period was necessary to prevent a social catastrophe.”

However, these are difficult times for those steel companies that cannot rely on cheap imports from Russia. Therefore, the Eurofer association, which includes industry giants such as Thyssenkrupp and ArcelorMittal, wants the regulation to be changed quickly. “The EU must lift this opportunistic and counterproductive measure as soon as possible, ” demands Eurofer expert Eggert, “together with the next round of sanctions at the latest.”

This is a heroic demand, as anyone who has followed the history of punitive measures against Russia in recent months knows, notes the German magazine Der Spiegel. Once sanctions decisions come into force, they rarely change.

https://russian.rt.com/inotv/2023-12-21/Spiegel-Evrope-tak-nuzhna-deshyovaya

GarryB and Hole like this post

sepheronx

sepheronx